Did you miss our live stream last week? We explored the complex ecosystem of IoT platforms reshaping how commercial buildings operate, from traditional office spaces to data centers.

We examined the five technology tiers, analyzed the competitive landscape of unified versus specialized platforms, and investigated how artificial intelligence is fundamentally disrupting traditional software-as-a-service business models in favor of outcome-based solutions. Watch the recording now.

IoT Platforms in Commercial Buildings Summary

Market Scope and Methodology

Our research focuses on commercial real estate applications, including office buildings, retail spaces, hotels, warehouses, and data centers, deliberately excluding residential and industrial sectors. The analysis draws from over a decade of market research, vendor interviews, financial performance data, and regulatory analysis to provide forecasting insights.

5 Tiers of the IoT Market in Commercial Buildings

- Traditional Building Automation Systems – Legacy HVAC, lighting control, and basic building management systems that have operated for decades but fall outside the modern IoT scope.

- Enablement Hardware – “Frontline” devices, including sensors monitoring temperature, occupancy, and air quality, plus smart meters tracking energy consumption – the data collection foundation.

- Connectivity Services – Gateways, routers, and networking equipment that transport data throughout buildings and to cloud platforms.

- IoT Platforms & Data Analytics – The critical layer encompassing data integration, analytics, and application interfaces that transform raw sensor data into actionable insights – the focus of this live stream.

- Professional Services – Consultants, managed service providers, and cybersecurity specialists who implement and maintain these systems in real-world applications.

Market Projections and Growth Scenarios

Our baseline forecast projects growth from $64 billion (2024) to over $100 billion (2030), with three scenarios developed to account for global trade uncertainties and supply chain disruptions. The most significant insight reveals a fundamental market transformation from hardware-driven to software and services-driven value creation, with Tiers 4 and 5 representing the fastest-growing segments.

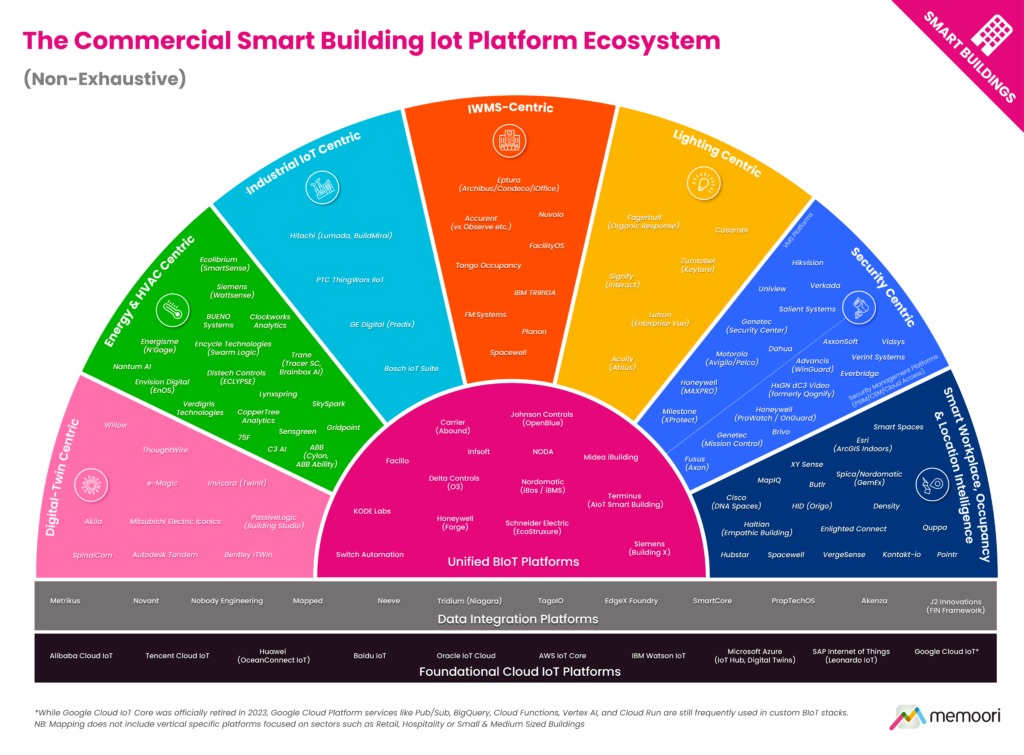

IoT Platform Categories and Ecosystem Mapping

- Foundational Cloud Platforms: General-purpose infrastructure services like Microsoft Azure IoT and AWS IoT Core that provide the underlying technology foundation.

- Data Integration Platforms: Solutions focused on connecting disparate building systems and extracting data from previously siloed operations.

- Purpose-Built IoT Platforms: Specialized applications designed for specific commercial building functions, featuring AI/machine learning processing capabilities and user interface layers.

The ecosystem mapping reveals significant market fragmentation with building automation giants (Siemens, Schneider Electric, Honeywell, Johnson Controls) developing unified platforms, while agile newcomers create cloud-native, retrofit-friendly applications delivering rapid deployment and results.

Market convergence is driven by customer demand to reduce multiple platform subscriptions and achieve unified building operations visibility. This has resulted in increased cross-domain integration, with energy management companies expanding into occupancy analytics, security firms adding environmental monitoring, and workplace experience platforms integrating with HVAC systems.

Success factors include delivering both depth in core specialties and breadth across building operations while maintaining ease of deployment and integration with existing infrastructure.

AI’s Disruption of IoT Platform Business Models

Artificial intelligence is poised to commoditize software functionality, challenging the traditional Software-as-a-Service (SaaS) subscription model. Key implications include:

- Customer Subscription Fatigue: Building owners express frustration with multiple monthly IoT platform fees that aren’t directly tied to measurable outcomes or value delivery.

- Return to Perpetual Licensing: Some market demand is emerging for traditional software ownership models rather than ongoing subscription commitments.

- Shift to Outcome-Based Services: AI enables a transition toward “outcomes as a service” where providers are compensated for results rather than software access, similar to energy service company models that take percentage shares of achieved energy savings.

The evolution could trend towards embedding software within broader managed service delivery representing a significant business model transformation. Examples could include:

- Facilities Management Integration: CAFM systems becoming invisible components within comprehensive service packages where clients pay for specific operational outcomes

- Workplace Experience Services: Meeting room management combining booking systems, visitor management, and audiovisual support into single managed service contracts with maintenance and equipment replacement included.

Key Insights

- Software and services (Tiers 4-5) determine actual value realization from IoT investments.

- Market fragmentation creates opportunities for both unified and specialized platform approaches.

- Customer preferences are shifting toward outcome-based compensation models.

- AI commoditization of software functionality will reshape competitive advantages.

- Integration capabilities across building systems represent critical differentiators.

- Subscription fatigue is driving demand for alternative licensing and service models.

Our analysis of IoT platforms reveals a market in fundamental transition, where SaaS approaches face disruption from AI-enabled automation and evolving customer expectations for outcome-based service delivery.