Rumors circulated this week after a Bloomberg article and comments by Johnson Controls CEO, George Oliver, suggested we may see a potential sale of their residential and light commercial HVAC equipment business.

Johnson Controls has described the situation as “early stages” but in this research note, we look at recent activities and trends to consider the potential shape of such a deal.

“The management team continues to simplify and transform the company into a comprehensive solutions provider for commercial buildings,” Oliver was quoted in Johnson Controls Q1 2024 earnings release. “As part of the continuous evaluation of our portfolio, we are in the early stages of pursuing strategic alternatives of our non-commercial businesses, in line with our objective to maximize value to our shareholders.”

Questioned later, during the associated earnings call with Wall Street analysts, Oliver said the potential asset sale would represent less than 25% of Johnson Controls business portfolio, which Memoori estimates at around $6.7 billion. He added:

“If a sale happens, we'll continue to be able to do bolt-ons and support the technology and our go-to-market as we strengthen that across the globe. And our intent would be to make it accretive as far as whether it'd be through bolt-ons and/or deployment back to our shareholders to offset the dilution that any divestiture might have.”

Global Products divisional revenues by product type (HVAC, Fire & Security, Refrigeration) in the latest 10K filing report that HVAC product revenues were $6,820 million in FY 2023. Residential HVAC equipment accounted for around 10% of FY 2023 total sales, around $2,679 million. This excludes light commercial equipment.

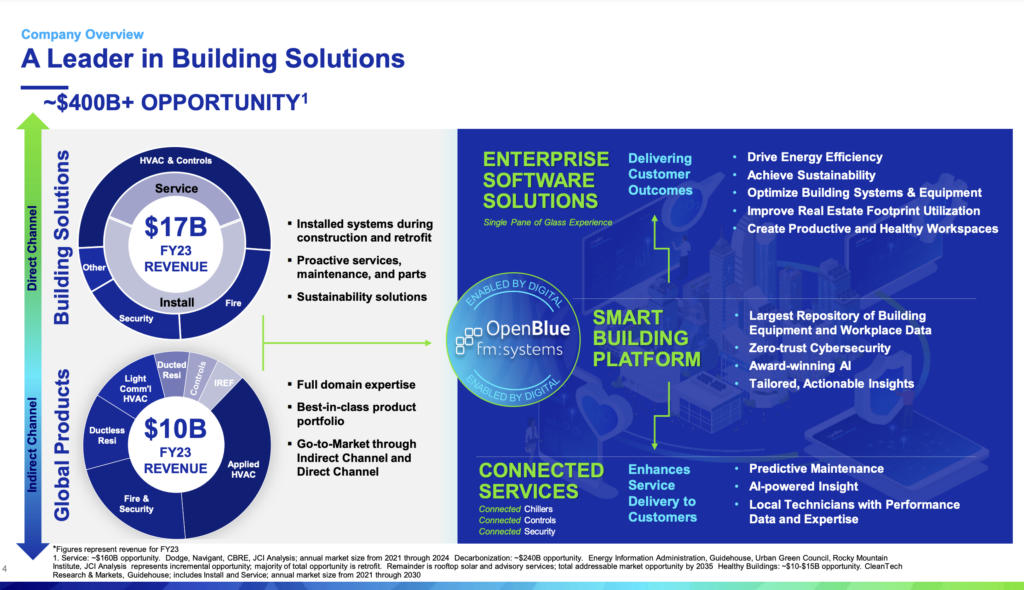

In July 2023, they acquired FM:Systems, a North Carolina-based digital workplace management and Internet of Things (IoT) solutions provider, which has now become part of their OpenBlue ecosystem. And, during fiscal 2023, the company concluded that its Global Retail business, which was previously presented as a divestment candidate in 2022, no longer met the criteria to be classified as held for sale and sales efforts were discontinued.

“Memoori believes that Johnson Controls is at the beginning of a long journey to transform its large service business (around 24% of FY23 revenues) through digital technology,” we said in a December 2023 research note. “Like many of their competitors, the company is trying to accelerate the development of high-growth Software-as-a-Service business via their OpenBlue platform.”

Also in December 2023, on an earnings call with Wall Street analysts, Oliver explained how the company was betting its business on smart building technologies that align with customers' energy efficiency, sustainability and decarbonization goals. Explaining that the strategy leans heavily on AI, IoT, and cloud computing services that save energy and reduce emissions, while improving the overall building occupant experience.

Johnson Controls Potential HVAC Divestiture

According to a Bloomberg article, 26th January 2024, JCI is working with advisors to gauge interest in the businesses which could be worth around $5bn.

The assets it is considering selling, dubbed the residential light commercial businesses, are rumoured to include most of the York International operations that Johnson acquired in 2005, for $3.2 billion, including the assumption of $800 million debt. At the time York was recognised as the world’s largest independent manufacturer of air conditioning, heating, and refrigeration equipment.

They may also include a 60% stake in an air conditioning joint venture launched with a subsidiary of Japan’s Hitachi Ltd. in 2015, (excluding Japan), which presented sales of $2.6 billion at the time of the deal.

Separately to the residential light commercial assets, JCI is thought to be working on a possible disposal of the majority of the Air Distribution Technologies business it bought for $1.6 billion in 2014.

Bloomberg reported that deliberations are ongoing and there was no certainty they would lead to any transactions. Representatives for Johnson and Hitachi declined to comment.

Johnson Controls Pure-Play Intentions

JCI’s proposed divestment is part of a wider trend in the industry. Earlier this month, established HVAC player Carrier sold its commercial refrigeration business to Chinese manufacturer, Haier. This transaction is part of a series of divestments by Carrier, brought about by the acquisition of Viessmann Climate Solutions, as discussed in our recent article on the topic.

In 2023, Fujitsu attempted to sell off its air-conditioning manufacturing unit, representing 42% of Fujitsu General Ltd, in order to “simplify its operations” according to a company statement. However, the $1.1 billion deal appears to have stalled for the foreseeable future.

In 2022, Emerson announced a definitive agreement to sell a majority stake in its Climate Technologies business to private equity funds managed by Blackstone in a transaction valued at $14.0 billion. Citing “cohesiveness and operating agility of a pure-play company” as the key reason.

The confirmed move by Johnson Controls to explore the divestment of non-commercial HVAC businesses aligns with their strategy to transform itself from an equipment supplier to accelerate the development of high-growth Software-as-a-Service business via their OpenBlue smart commercial buildings platform.