This Research Note examines the emerging strategic priorities of Patrizia within the buildings and infrastructure space.

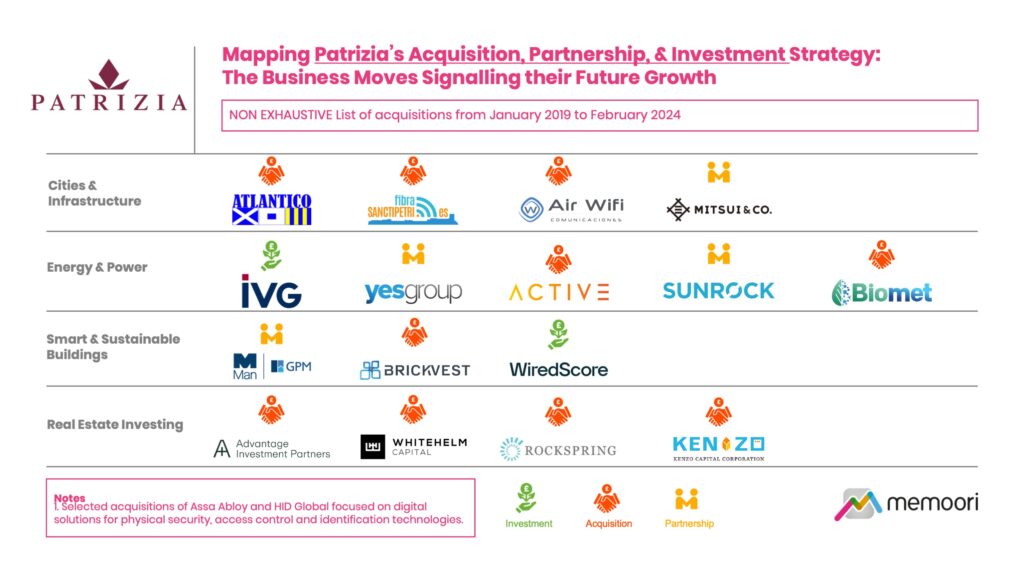

We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the company, by categorizing the various business relationships by technology and investment type over 5 years.

Patrizia is a globally renowned investment group focused on “real assets” (real estate and infrastructure) with a €60 billion portfolio of assets under their management. Since its foundation in Augsburg, Southern Germany, in 1984, the firm has grown into a major player in Europe and a growing influence around the world.

Patrizia became a listed company in 2006, launched a private investor business in 2016, set up Patrizia Japan in 2019, and continues to evolve.

In its last annual report, Patrizia presented revenues of €346 million, EBITDA of €78.9 million, and consolidated net profit of €7.3 million. The firm was early to incorporate social and environmental values into its investment strategy, which has led it into the fast-growing smart and sustainable development space.

Of the €60 billion in real assets under management, infrastructure represents just 4%, while real estate covers the remaining 96%. Office buildings make up 34% of all assets, residential 27% retail 17%, logistics 12%, and 6% other real estate.

Our strategy mapping exercise highlights three investments, four partnerships, and 10 acquisitions within various buildings and infrastructure sectors over the last five years.

Patrizia Cities & Infrastructure

Just last week, on February 7th 2024, Patrizia signed a deal to acquire an 85% stake in Atlantico, Italy’s third-largest independent smart street lighting operator. Although still pending regulatory approval, the transaction would be the third Italian smart street lighting acquisition by Patrizia’s Smart City Infrastructure Fund, its single LP strategy with Dutch pension giant APG, and completes its EUR 750 million smart cities investment programme across the US and Europe.

Almost a year earlier, on March 20th 2023, Patrizia made a double acquisition of Wifi Sancti Petri and Airwifi, two mid-market Cadiz, Spain-based, broadband and fiber network operators with a combined 25,000+ existing customers. From the acquisitions, Patrizia launched a new `Fiber-to-the-Home’ (FTTH) platform aiming to deliver high-speed broadband across rural Spain. Patrizia also leverages its experience managing SiFi Networks, an operator in the US.

On January 18th 2023, Patrizia announced a partnership with Japan-based Mitsui, one of the world’s largest trading and investment companies. The pair launched a new flagship discretionary sustainable infrastructure strategy in Asia-Pacific, which eventually aims to manage $1 billion in assets —making it one of the largest strategies dedicated to investing in sustainable mid-market infrastructure in the region.

Energy & Power

On December 12th 2023, Patrizia announced a €210 million refinancing for its fund that owns Germany’s largest independent supplier of cavern facilities for energy storage. Patrizia acquired six new financing partners and significantly increased commitment from existing lenders for the Etzel storage facility which stores essential liquid and gas energy sources, such as hydrogen.

Two months earlier, on October 9th 2023, committed to a joint venture with existing infrastructure partner Mitsui. The pair committed to invest up to AUD $70 million (USD $46 million) in a major solar and battery development programme in Australia, through the co-owned APAC Sustainable Infrastructure Fund (A-SIF) and in collaboration with YesGroup. The investment could deliver total generation capacity of over 150 MW once fully developed.

Also in Australia, on September 20th 2023, Patrizia acquired a 100% interest in Active Utilities, an Australian embedded network provider, on behalf of Australian superannuation fund client, Prime Super. By bringing together Active Utilities with its previous acquisition, Savant Energy, Patrizia creates Australia’s largest independent embedded network platform.

On July 7th 2023, Patricia partnered with Sunrock to bring one of Europe’s largest solar power installations onstream. The new 120,000 sqm photovoltaic (PV) system on the roof of Patricia’s Rotterdam logistics development has a capacity of 25 MWp a year and the partners intend to expand their relationship with new logistics facilities in the pipeline and other building types under consideration.

Showing the diversity of their energy portfolio, on June 20th 2022 Patrizia announced the acquisition of Italian bio-LNG producer Biomet, marking the first investment for PATRIZIA’s recently created infrastructure business. Biomet will eventually be Europe’s largest plant producing biomethane LNG from natural waste and will be the first facility in Italy that is directly connected to the SNAM national transport gas grids, with an onsite filling station.

Smart & Sustainable Buildings

On November 28th 2023, Patrizia announced a partnership with Man GPM to develop new-build environmentally and socially sustainable residential real estate across England. The £100 million ($126 million) joint venture brings together PATRIZIA's impact fund, PATRIZIA Sustainable Communities, and Man GPM, the private markets investment business of Man Group plc., all committed to sustainable buildings and a zero operational carbon footprint.

On February 3rd 2020, Patrizia announced the acquisition of BrickVest, an open digital investment platform provider for real asset investments. London-based BrickVest, founded in 2014, was a hot-shot in the proptech scene, raising more than €12m in various financing rounds before running out of money and filing for insolvency in November 2019. Patrizia swooped in to “secure independence of BrickVest as global and open industry platform for real asset investing” the company said.

On October 15th 2019, Patrizia made a strategic investment in WiredScore, a global rating scheme for digital connectivity across commercial and residential real estate. As part of Patrizia’s technological ecosystem, WiredScore will actively develop products that meet the needs of the market and to grow its European footprint while expanding into other asset classes.

Patrizia has been a critical partner for WiredScore’s entrance into the European market. A total 15 office assets across Patricia’s portfolio were already Wired Certified before the 2019 investment, and the firm committed a further 23 office properties in Germany to be certified as part of the initial roll-out.

Real Asset Investment Funds

Patrizia is a seasoned acquirer of real estate and investment funds that, in turn, invest in and acquire a wide range of businesses within the buildings and infrastructure sectors.

On July 6th 2022, Patrizia announced the acquisition of Advantage Investment Partners, a Copenhagen-based international multi-manager expanding PATRIZIA’s real asset product shelf with broad access to multi-manager products including global infrastructure and private equity. Advantage Investment Partners have developed a nimble approach to raising new products leading to a lower “time to market” for new products vs. traditional investment managers.

On September 13th 2021, Patrizia announced the acquisition of Whitehelm Capital, an independently owned international infrastructure manager managing €3.2 billion assets within a fund of €22 billion.

The acquisition tripled Patrizia’s infrastructure assets under management (AUM) to over €5 billion, while Whitehelm’s portfolio of investment solutions took Patrizia deeper into smart cities & digital infrastructure, de‑carbonisation & energy transition, in addition to social infrastructure and environmental services.

On December 19th 2019, Patrizia acquired Rockspring Property Investment Managers, a London-based real estate fund management hub with a focus on discretionary capital for global clients. The transaction built on the acquisitions of TRIUVA Kapitalverwaltungsgesellschaft and Sparinvest Property Investors in Q4 2017 and increased Patrizia’s AUM to approximately €40 billion and further strengthened the company’s position in Europe.

At the beginning of our investigation period, on January 10th 2019, Patrizia acquired the business of Kenzo Capital Corporation, a Tokyo-based real estate advisory and asset management firm, as well as the fund management and placement activities of Kenzo Japan Real Estate GmbH. This proved an important step for Patrizia’s expansion into Japan and general growth in its international network.