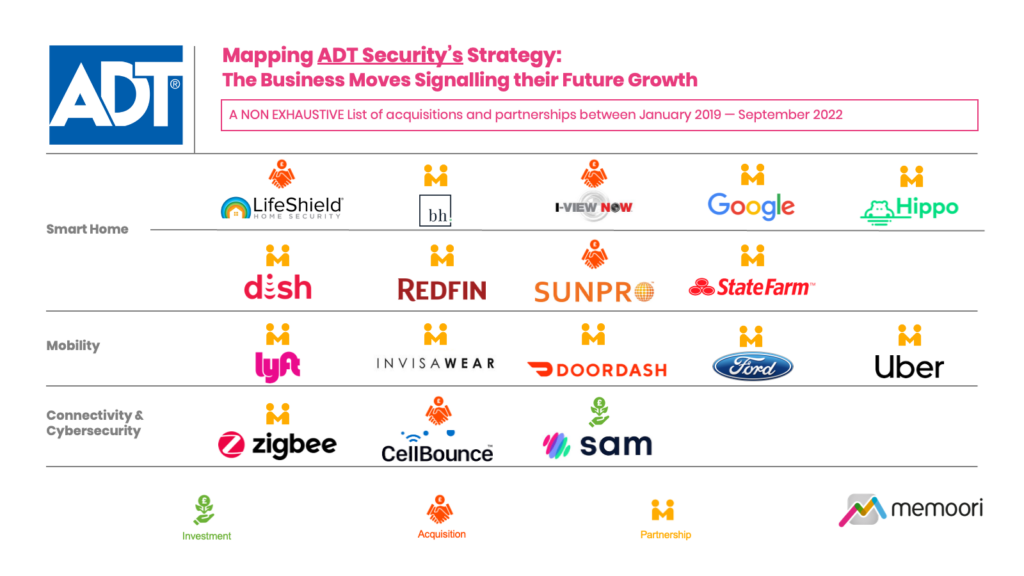

In this research note, we map the strategic direction of US security alarms and monitoring services provider ADT. This analysis focuses on the acquisition, investment and partnership moves they have made in Smart Home, Mobility and Connectivity / Cyber Security.

ADT Reported revenues of $5.3 billion in 2021, They met or exceeded guidance from the previous year, with total revenue and adjusted EBITDA above the high end of ranges provided. This performance was driven by an increase in installation revenue due to the impact from COVID-19 during the prior year as well as an increase in monitoring and services revenue due to higher recurring revenue, improved customer retention, and acquisitions.

“Our fourth quarter caps off a strong year for ADT as we further set the foundation for long-term growth – increasing our subscriber and recurring revenue base, achieving important milestones in our Google partnership, growing our Commercial business, and entering the fast-growing residential solar market,” said ADT President and CEO, Jim DeVries.

The US market in which ADT Commercial operates is highly fragmented with a limited number of national competitors, although Convergint currently outpaces ADT with a $1.8 billion systems integration business.

ADT is fighting back with a string of acquisitions and calculated partnerships that is driving them into the smart homes market. Deliberate partnerships with big names in the mobility sector are also positioning ADT on a new path, while their growing commercial sector reveals a comprehensive smart city security player lurking in the future.

Here we map ADT’s acquisition, partnership, and investment strategy over recent years in order to identify patterns that are shaping the future of the company and reflecting the direction of the market.

Smart Home

In a March 2022 strategy announcement, ADT’s President and Chief Executive Officer Jim DeVries said “With the right mission and a clear strategy and plan in place, ADT is the only scaled player positioned to capture the next wave of growth in the security, smart home and residential solar markets.”

ADT is clearly making a big push on the smart home market with acquisitions of LifeShield for home security, I-View Now for video surveillance, and Sunpro residential solar energy. As well as active partnerships with major names including DISH Networks, State Farm, and Google.

The intriguing Google partnership began with discussions in 2019 that highlighted a mutually beneficial relationship on smart homes. Like many tech giants, Google spent much of the past decade angling to dominate household automation, symbolized by big acquisitions of Nest for $3.2 billion and Dropcam for $555 million.

“ADT’s primary expertise today is in logistics. An army of more than 4,000 residential technicians blueprint security plans and handle snaking cords through ceilings and cramped attics,” reads a Bloomberg article. “The company assists with permits that municipalities typically mandate for professionally supervised systems and trains call-centre dispatchers to coordinate with local police and other first responders if a panic button or infrared camera is triggered.”

These are skills that Google needs to achieve its smart home ambitions and when the vague partnership was announced it sparked a spike in ADT’s otherwise stagnant share price as rumours of their acquisition by Google circulated. No official announcements were made and Google remains a preferred partner in ADT’s sales channels, but rumours of a future acquisition persist.

Mobility

Four key partnerships have revealed a strong intention by ADT to provide solutions for smart mobility. The partnerships with rideshare giants Lyft and Uber focus on ADT providing users and drivers of those platforms a discrete communication channel to ADT’s owned and operated monitoring centres, while a partnership with Doordash will offer a similar service for users of the last-mile logistics platform.

The partnership between Ford and ADT established a new joint venture called Canopy that combines ADT’s professional security monitoring and Ford’s AI-driven video camera technology to help customers strengthen security of new and existing vehicles across automotive brands.

Smart wearable company invisaWear and ADT are collaborating to introduce more advanced mobile safety and monitoring features into invisaWear’s line of wearable personal safety accessories.

Connectivity & Cyber Security

ADT’s focus on connectivity and cyber security will provide the glue that securely brings all their smart home, mobility, commercial real estate, and smart city ambitions.

ADT joined the Zigbee Alliance in August 2020, with the announcement stating that their “participation in Project CHIP will provide customers with more seamless and secure ways to curate their smart home.” And later was a key investor in a $20 million series B round of SAM Seamless Network, a network security company for consumers and small to medium-sized businesses.

In December 2020, ADT acquired CellBounce and its proprietary 3G-to-4G radio conversion technology, which is expected to reduce the need for technicians to perform the required upgrade in many customer homes before the 3G network goes obsolete. The device has also been made commercially available to third parties in the wider security industry.