This Report is a New 2024 Definitive Resource for Evaluating Startups in the Smart Building & PropTech Space.

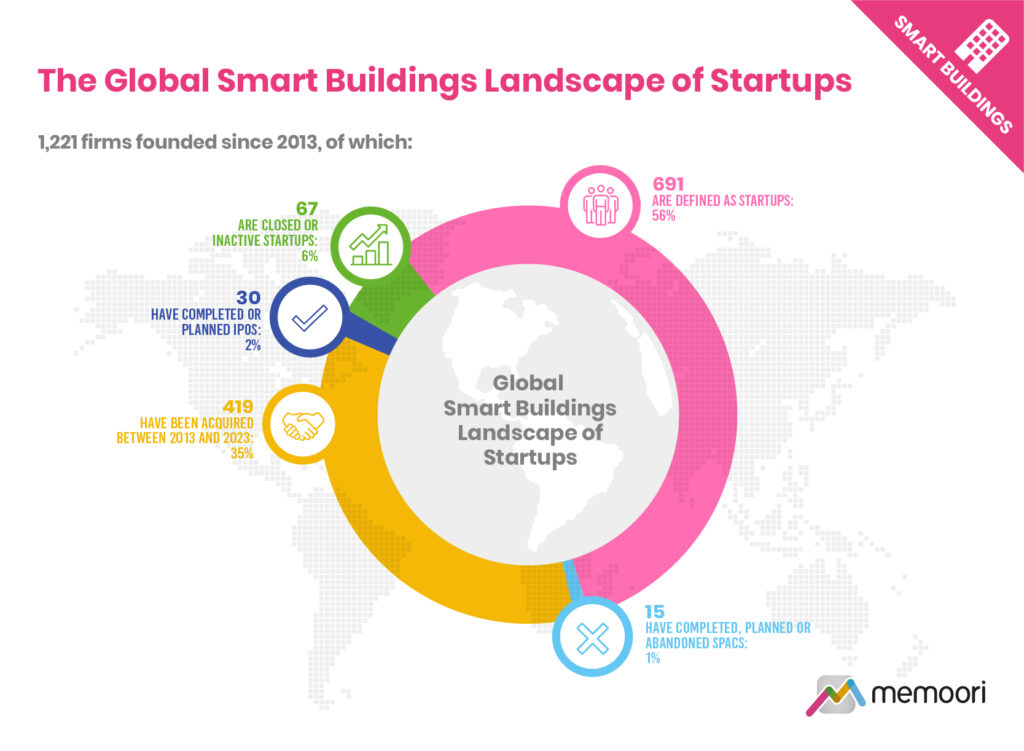

Around 1,221 startups are active in the management and operations phase of the global smart commercial buildings space. This is just a 3% decrease compared with our analysis last year. In total 419 startups have been acquired since 2013, 35% of the total landscape. 67 are closed or inactive startups, 6% of the total.

Our definition of a Startup is “a private company formed for no more than 10 years, that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is often financed by venture capital or private equity funding.”

The report INCLUDES at no extra cost, 2 spreadsheets that list all Startup acquisitions and investments in 2023 & 2024 (to date) AND a presentation file with high-resolution charts from the report. This report is also included in our 2024 Premium Subscription Service.

What does this Startups Report tell You?

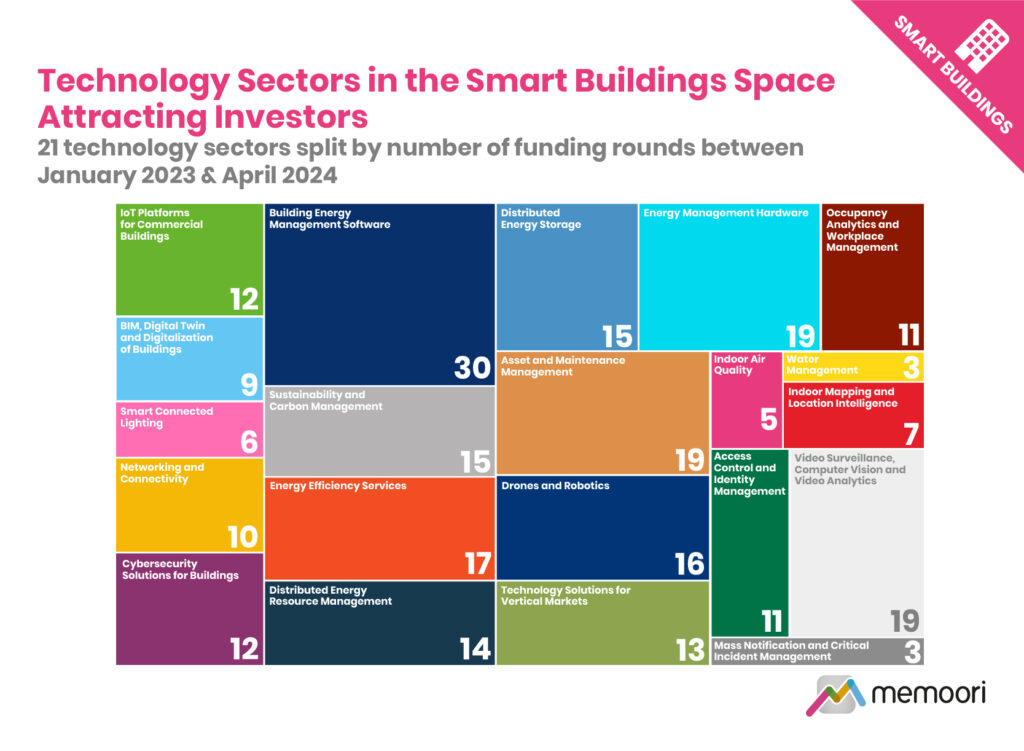

- Memoori has identified 284 funding rounds for startup companies, amounting to around $5.5 billion across the smart buildings sector in the 16 months since January 2023.

- 2023 marked a turning point, with 44% less investment and 33% fewer funding rounds than 2022.

- Memoori also identified a lower level of M&A activity in 2023 with 48 disclosed acquisitions, a decrease of 38% on 2022.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into artificial intelligence, occupancy analytics, workplace experience apps, the Internet of Things, video surveillance, and access control.

It demonstrates that technology investment remains a key driver for the digital transformation of commercial real estate, as innovation continues to enable smarter buildings, aligned with global sustainability goals and the increasing demand for flexible user-centric property solutions.

Within its 215 Pages and 46 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand how StartUp Companies are Shaping the Future of PropTech.

The report identifies recent partnerships with established players including building systems vendors, IoT and IT vendors, lighting suppliers, facilities management service firms, and security systems vendors. There is also a detailed assessment of the ecosystems of 14 incumbent players ABB, Alarm.com, Allegion, Belimo, Carrier, CBRE, Cushman & Wakefield, Honeywell, JLL, Johnson Controls, Panasonic, Scheider Electric, Siemens, Trane Technologies.

For only USD $3,000 this report provides valuable information into how startup companies are developing their businesses through Acquisitions, Partnerships, and Alliances.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startups will find it particularly useful. Want to know more? Download the Brochure.

Table of Contents

- Preface

- Research Scope and Methodology

- Executive Summary

- 1. The Global Smart Buildings Landscape of Startups

- 2. Venture Capital and Private Equity Funding

- 2.1 Development of VC & PE Funding for Startups 2015 – 2023

- 2.2 Top 20 Startups by Total Disclosed Funding

- 2.3 Which Sectors and Startups Have Attracted Investors?

- 2.3.1 IoT Platforms for Commercial Buildings

- 2.3.2 Smart Connected Lighting

- 2.3.3 BIM, Digital Twin & Digitization Solutions for Buildings

- 2.3.4 Networking and Connectivity

- 2.3.5 Cybersecurity Solutions

- 2.3.6 Building Energy Management Software

- 2.3.7 Sustainability and Carbon Management

- 2.3.8 Energy Efficiency Services

- 2.3.9 Distributed Energy Resource Management

- 2.3.10 Distributed Energy Storage

- 2.3.11 Building Energy Management Hardware

- 2.3.12 Occupancy Analytics and Workplace Management

- 2.3.13 Asset & Maintenance Management

- 2.3.14 Drones and Robotics

- 2.3.15 Technology Solutions for Vertical Markets

- 2.3.16 Indoor Air Quality

- 2.3.17 Water Management

- 2.3.18 Indoor Mapping and Location Services

- 2.3.19 Access Control and Identity Management

- 2.3.20 Video Surveillance, Computer Vision and Video Analytics

- 2.3.21 Mass Notification and Critical Incident Management

- 3. Mergers and Acquisitions of Emerging Players

- 3.1 Startup Acquisitions in the Smart Buildings Space

- 3.2 Which Startups Have Been Acquired in 2023?

- 3.2.1 Building IoT Platforms

- 3.2.2 Building Energy Management Software and Services

- 3.2.3 Solar Energy Management, Storage and EV Charging in Buildings

- 3.2.4 Workplace Management and Workplace Experience

- 3.2.5 Resource Scheduling and Visitor Management

- 3.2.6 Video Analytics and Physical Security Information Management (PSIM)

- 3.2.7 Access Control and Identity Management

- 4. SPACs and IPOs of Emerging Players

- 4.1 Special Purpose Acquisition Companies (SPAC) Transactions with Startups

- 4.1.1 CXAI

- 4.1.2 learnd

- 4.1.3 Veea

- 4.1.4 Quanergy

- 4.1.5 Electriq Power

- 4.1.6 Conclusions

- 4.2 Initial Public Offerings (IPOs)

- 4.2.1 CloudMinds

- 4.2.2 Simpple

- 4.2.3 Thinxtra

- 4.1 Special Purpose Acquisition Companies (SPAC) Transactions with Startups

- 5. Corporate VC, M&A and Partnerships with Established Players

- 5.1 Building Automation Firms

- 5.1.1 ABB

- 5.1.2 Belimo

- 5.1.3 Honeywell

- 5.1.4 Johnson Controls

- 5.1.5 Schneider Electric

- 5.1.6 Siemens

- 5.2 Real Estate Service Firms

- 5.2.1 CBRE

- 5.2.2 Cushman & Wakefield

- 5.2.3 JLL

- 5.3 HVAC Equipment Companies

- 5.3.1 Carrier

- 5.3.2 Trane Technologies

- 5.3.3 Panasonic

- 5.4 Physical Security Companies

- 5.4.1 Alarm.com

- 5.4.2 Allegion

- 5.1 Building Automation Firms

- 6. Investment Outlook for Startups in 2024

Appendix

- A1 VC and PE Funding for Smart Building Startups Jan 2023 to April 2024

- A2 Smart Building Startups M&A Jan 2023 to April 2024

List of Charts and Figures

- The Global Smart Building Landscape of Startups

- Development of Startups VC and PE Funding 2015 – 2023

- Highest Funded Startups January 2023 – April 2024

- Technology Sectors in the Smart Buildings Space Attracting Investors

- Investments in IoT Platforms for Buildings Startups January 2023 – April 2024

- IoT Platforms for Smart Buildings

- Investments in Connected Lighting Startups January 2023 – April 2024

- Smart Connected Lighting

- Investments in BIM, Digital Twin, and Digitization Startups January 2023 – April 2024

- BIM, Digital Twin, and Digitization Solutions

- Investments in Networking and Connectivity Startups January 2023 – April 2024

- Networking and Connectivity for Buildings

- Investments in Cybersecurity Startups January 2023 – April 2024

- Cybersecurity Solutions for Buildings

- Investments in Building Energy Management Software Startups January 2023 – April 2024

- Building Energy Management Software

- Investments in Sustainability and Carbon Management Startups January 2023 – April 2024

- Sustainability and Carbon Management in Buildings

- Investments in Energy Efficiency Services Startups January 2023 – April 2024

- Energy Efficiency Services

- Investments in DERMS, DR, and VPP Startups January 2023 – April 2024

- Distributed Energy Resource Management

- Investments in Distributed Energy Storage Startups January 2023 – April 2024

- Distributed Energy Storage

- Investments in Energy Management Hardware Startups January 2023 – April 2024

- Building Energy Management Hardware

- Investments in Occupancy Analytics and Workplace Management Startups January 2023 – April 2024

- Occupancy Analytics and Workplace Management

- Investments in Asset & Maintenance Management Software Startups January 2023 – April 2024

- Asset & Maintenance Management

- Investments in Drones and Robotics Startups January 2023 – April 2024

- Investments in Vertical Market Startups January 2023 – April 2024

- Investments in Indoor Air Quality Startups January 2023 – April 2024

- Investments in Water Management Startups January 2023 – April 2024

- Investments in Indoor Location and Mapping Startups January 2023 – April 2024

- Investments in Access Control & Identity Management Startups January 2023 – April 2024

- Access Control

- Investments in Video Surveillance and Computer Vision Startups January 2023 – April 2024

- Video Surveillance & Video Analytics

- Investments in Emergency Response Startups January 2023 – April 2024

- Startup Acquisitions in the Smart Building Space 2013 – 2024

- IoT Platforms for Buildings

- Energy Management Software and Services

- Solar Energy Management, Storage and EV Charging in Buildings

- Workplace Management & Workplace Experience

- Resource Scheduling & Visitor Management

- Video Analytics & PSIM

- Access Control & Identity Management

- ABB Partnerships with Startups

- Belimo Partnerships with Startups

- Honeywell Partnerships with Startups

- Johnson Controls Partnerships with Startups

- Schneider Electric Partnerships with Startups

- Siemens Partnerships with Startups

- CBRE Partnerships with Startups

- Cushman & Wakefield Partnerships with Startups

- JLL Partnerships with Startups

- Carrier Partnerships with Startups

- Trane Technologies Partnerships with Startups

- Panasonic Partnerships with Startups

- Alarm.com Partnerships with Startups

- Allegion Partnerships with Startups

Companies Mentioned Include (BUT NOT LIMITED TO);

120Water | 1X | ABB | Accacia | Accenta | Accessy | Acreto Security | Adaptis | aedifion | Aeria | Aetos Imaging | Airvine | Akia | Alarm.com | Allegion | Alpinov X | Ambient.ai | Ampeers Energy | Amperon | Andorix | Antrum | Apaleo | Arcadia | Ariadne Maps | Artisight | Ascento | Assert AI | Asylon Robotics | Autarc | Axiom Cloud | Axle Energy | Banyan Infrastructure | Bedrock Energy | Belimo | BetterSpace | BIMSense | Binamod | Bisly | Bitpool | Bitwards | Blackpoint Cyber | BlocPower | Blue Frontier | Bluewave-ai | Bob W | Brainbox AI | Bright Spaces | BuildOps | Butlr Technologies | Cactos | Cambio | Carbyne | Carrier | Cartesian | CBRE | Clairco | Claroty | ClearTrace | ClimateView | CloudMinds | Cohesion | Conservation Labs | Coram AI | Crezes | Cushman & Wakefield | Dayta AI | Debos | Deep Sentinel | Deepki | Defigo | Demand Logic | Desana | Deskbird | Digital Spine | Direct Energy PartnersvDoongji | Ecotrak | Elyos Energy | Emitwise | Encentive | Enerdrape | Energiency | Enersee | Enlite Research | Enteligent | Enviria | Epishine | Equium | Fever Energy | Finite State | Flyability | Freesi | Fuergy | Fyma | Green Fusion | Greenly | GreenWaves Technologies | Greyparrot | GridCog | Guesty | Hakimo | HeatTransformers | Helixintel | Hive Power | Honeywell | HqO | HT Materials Science | Igor | Inbalance grid | Incident IQ | Infogrid | Infrared City | Infraspeak | InnerSpace | Inspace | IntelliSee | Intenseye | IonicBlue | IOTech | Ivy Energy | Izix | JetCool Technologie | JLL | Johnson Controls | Kestrix | Kibsi | KODE Labs | kontakt.io | KoolLogix | Korelock | Kumux | Landways | Latchel | Leap | learnd | LEDCity | Limble | Lumana | Lumen Energy | Lumoview Building Analytics | lun | LuxWall | MaintainX | MapMortar | Mapped | Mapxus | Maxem | Mclimate | Measurabl | Measurable.Energy | Meterz | Metrikus | Metris Energy | Modern Hydrogen | Mojave Energy Systems | Monaire | Montana Technologies | Munjz | Myrspoven | nami | Navenio | neoom | Next Sense | NineID | Novacene | Nozomi Networks | nZero | Occuspace | OfficeRnD | On.Energy | OneTrust | Openvolt | Operto Guest Technologies | Opt-E | Optimise AI | Optiml | Origin AI | Panasonic | Paraspot AI | Parity | Peak Power | PearlX | Percepto | Phaidra | Phosphorus Cybersecurity | Pluxity | Pratexo | Predium | Preflet | Prengi | Preoptima | promiseQ | Propify | Proprli | ProptechOS | ProSentry | Pudu Robotics | qbiq | QEA Tech | Qio Technologies | Quandify | R-Zero | R8 Technologies | Redaptive | RENEW Energy Partners | Responsibly | Rhombus Systems | Rice Robotics | Satellite Vu | Schneider Electric | SecurityGate | Secury360 | SeeChange Technologies | SenArch | Sensorfact | Sentry Interactive | Shifted Energy | Shuwei | Siemens | Site Technologies | Skedda | Skydio | Skyline Robotics | Smart Joules | Soly fka Enie | SparkMeter | Specifx Data | Spectral | Spintly | Spotr.ai | Stabl Energy | Strategic Thermal labs | Stuf | Suena | SwiftConnect | Swiftlane | Swtch Energy | TablePointer | Tallarna | Terion | Terminus Technologies | Thinxtra | tibo energy | Torus | Trane Technologies | Treon | Upciti | Uplight | UrbanVolt | Utopi | Veckta | Venturous Group | Verity | Viboo | Wavelynx | Waymap | WeMaintain | Wevo Energy | Woltair | Xage Security | XNRGY Climate Systems | xWatts | Yotta Energy | Zeitview | ZeroEyes