This article was written by Daphne Tomlinson of Tomlinson Business Research

Real estate firms are joining the race to own the intelligent buildings sector as they seek to differentiate their third party services to building owners and operators worldwide.

CBRE Group, Inc. is the world’s largest commercial real estate services and investment firm with 2016 revenues of $13.1 billion and over 5 billion square feet of commercial real estate while JLL had 2016 revenue of $6.8 billion and managed 4.4 billion square feet.

These two leading service providers in the global Commercial Real Estate (CRE) market have been augmenting their capabilities in smart building technologies, as major real estate clients demand a “one-stop shop” with more integrated services and global multi-site capability.

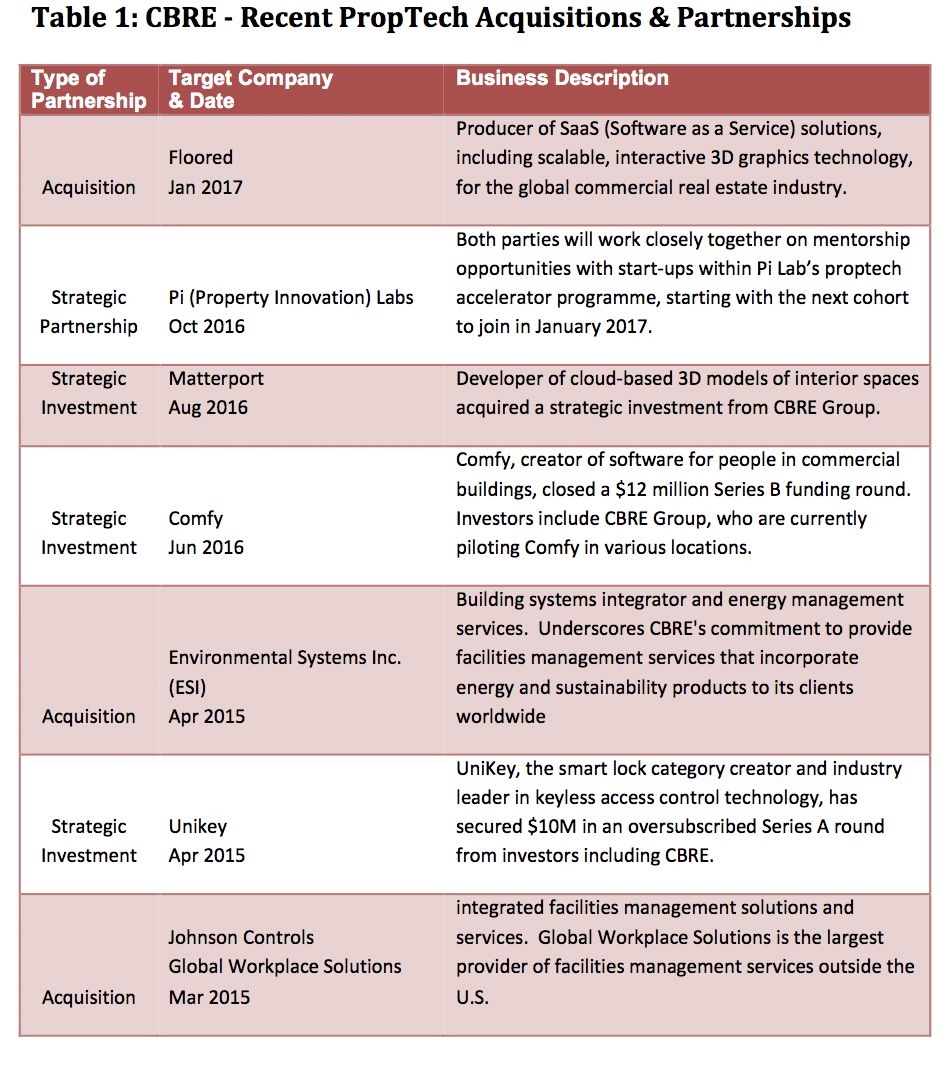

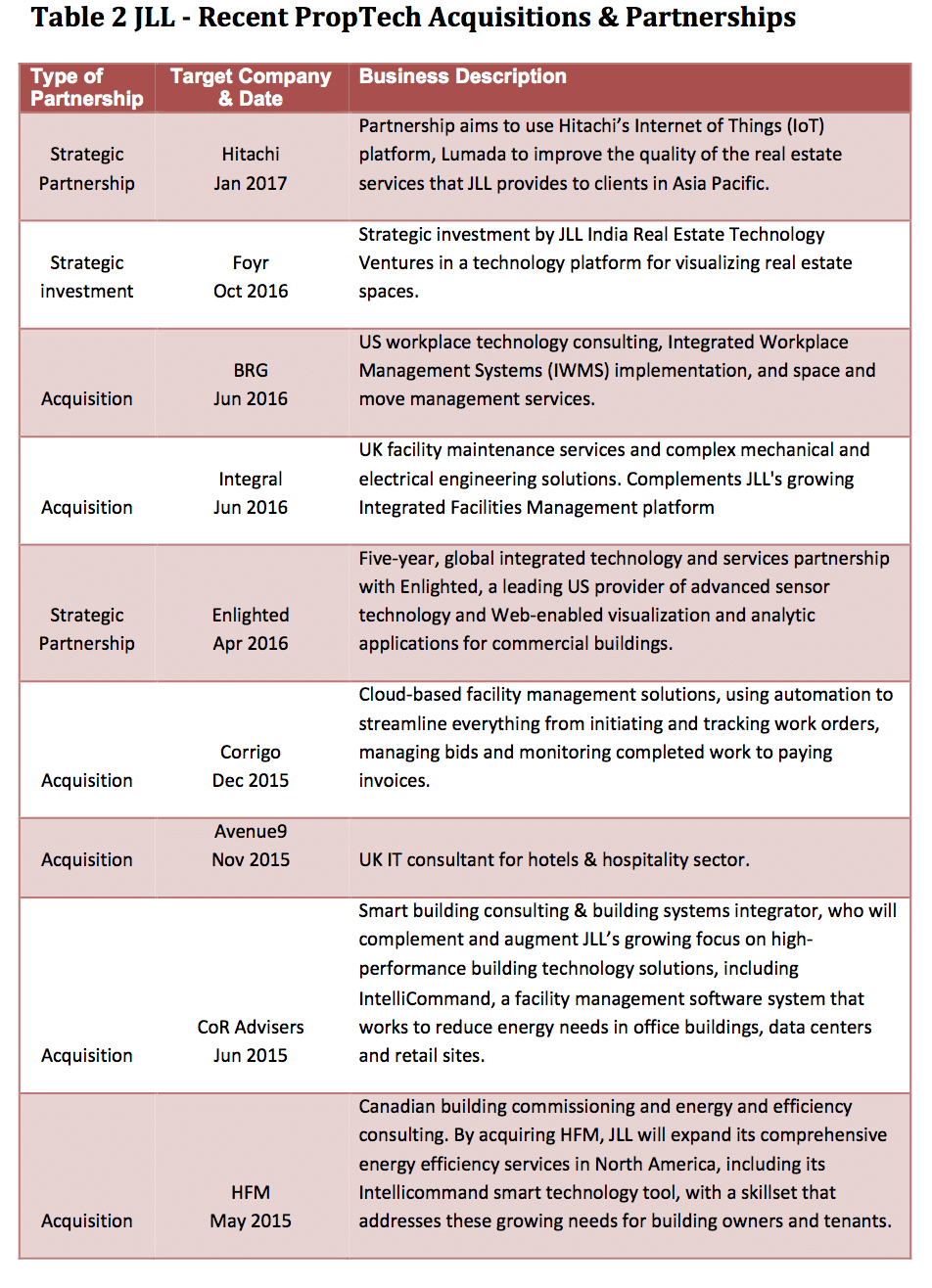

These capabilities have been acquired not only through M&A, but also via strategic partnerships and technology venture funding. More recently, support for early stage companies in accelerator and incubator programs has also been evident.

For some time, both companies have been expanding their portfolios to include expertise in energy efficiency and sustainability consulting, smart building integration systems, space utilization software, smart lighting systems and facility management SaaS. More recently, augmented and virtual reality platforms as an aid to visualizing interior spaces are seen as investment opportunities and acquisition targets while the emerging trends for coworking and agile work environments are challenging the main players to adopt new proptech strategies for their clients.

See tables 1 and 2 for details of recent acquisitions and partnerships of CBRE and JLL.

In line with the trend identified in Memoori's latest report on Startups and their Impact on Smart Buildings, real estate service providers have begun to work together with startup companies in fundamentally new ways, with a focus on flexible, early-stage, open-ended partnerships.

CBRE announced a strategic relationship with UK-based Pi (Property Innovation) Labs in October 2016. Pi Labs claims to be Europe’s first venture capital platform to invest exclusively in early stage ventures in the property tech vertical. The partnership with CBRE focuses on the mutual exchange of property industry expertise and insights into the emerging trends and developments in the rapidly growing proptech sector.

Ciaran Bird, Managing Director of CBRE in UK said: “Our relationship with Pi Labs allows us to be at the forefront of proptech, and helps us to identify emerging technologies for the benefit of our clients and the property sector as a whole. Pi Labs has evolved rapidly since its inception and can now provide us with a unique view of the trends and new proptech innovations for all aspects of the real estate sector.”

JLL also sees its role, in proptech as a co-innovator and a partner to scale products for the benefit of their clients.

JLL India launched a real estate venture funding arm in October 2016, which aims to invest in early-stage companies which can potentially disrupt the real estate business. Their first investment is in Foyr, a technology platform for visualising real estate spaces.

In the next 12-18 months, the venture plans to invest in 10-15 early-stage companies working on technologies such as blockchain technologies, visualisation and augmented reality, artificial intelligence, sustainable energy, water efficiency, smart commercial buildings, smart city tech applications, property management, data analytics and home automation.

JLL is also a partner of 'The Heart Warsaw', a brand new corporate-startup collaboration center, which opened in February 2017. For JLL, ‘The Heart Warsaw’ is an access point to innovations of CEE start-ups dealing with smart buildings, smart cities and IoT, according to a recent interview with Michael Ewert, the Head of Business Solutions and Business Intelligence EMEA at JLL.

We can expect to see more collaboration between real estate service providers and technology firms, whether they are startups or later stage companies, as the main players adopt proptech innovations, IoT solutions and a data driven approach for clients looking to make better use of their commercial real estate portfolio.

[contact-form-7 id="3204" title="memoori-newsletter"]