In this Research Note, we examine RightCrowd, an Australian public company providing workforce access, visitor management, presence control and access analytics. This analysis covers their latest financials, year ending 30 June 2022, based on the 2022 Annual Report, investor presentations and subsequent strategic repositioning.

Founded in 2004, RightCrowd is a global provider of security, safety and compliance solutions that manage the access and presence of people. RightCrowd has offices in Seattle, Belgium, Manila, and the Gold Coast, with over 140 employees across a range of specialisations. The company provides the following solutions;

- Workforce Access is a Physical Identity & Access Management (PIAM) solution, which automates the access control processes for employees and contractors across their lifecycle.

- Visitor Management is an enterprise solution that handles the security, compliance, and operational requirements of large organizations. It ensures the safety, security, and compliance of visitors throughout buildings and facilities.

- Presence Control offers security wearables for the workplace which make authorized presence visible to everyone.

RightCrowd Strategic Divestment

On 4th July 2023, RightCrowd announced it had signed a conditional Share Purchase Agreement to divest its physical security-related Workforce Access, Visitor Management and Presence Control businesses to Bloom, a New York based technology investment firm. RCW will focus on the rapidly growing global Identity Governance and Cyber Security Markets and accelerate its earlier stage, SaaS-based, Access Analytics business. Bloom will be appointed an Access Analytics OEM partner for physical security uses.

The RightCrowd Board recently conducted a review of the company's operations given the significant change in investment market conditions over the last 18 months and the greatly escalated cost of capital to support the growth of all RightCrowd’s product lines. While all the product lines hold genuine market potential, the board determined to prioritise allocation of capital to growth of the Access Analytics business after negotiations progressed with an interested buyer for the established physical security business line.

A purchase price of AUD $13.5 million has been agreed with Bloom to purchase the physical security-related businesses, which include the Workforce Access, Visitor Management, and Presence Control product lines. The sale is subject to shareholder approval under ASX Listing Rule 11.2.

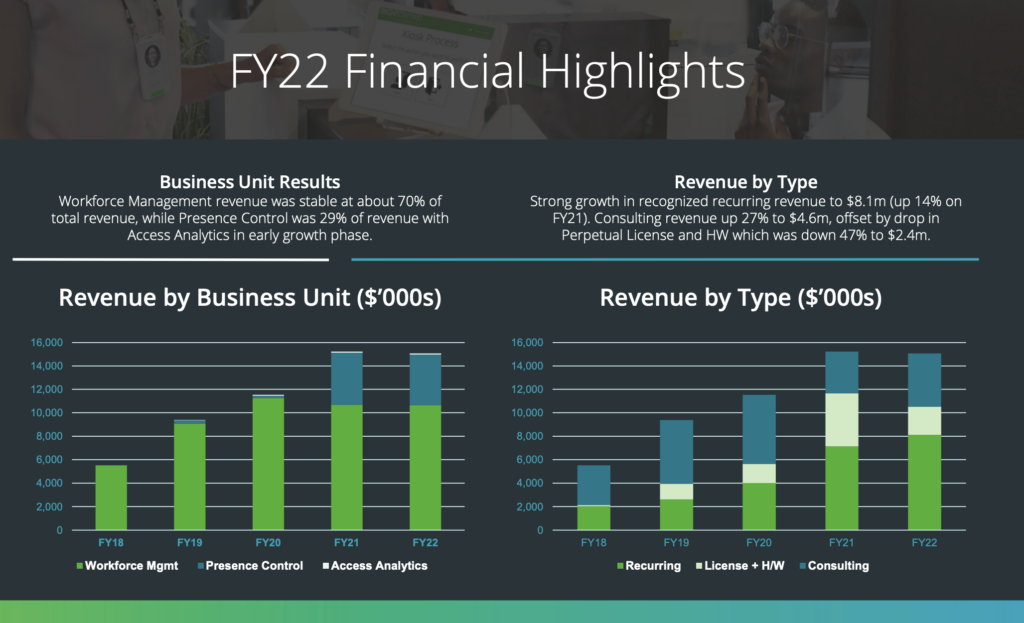

In 2022, the Workforce Management business, including workforce access and visitor management, accounted for AUD $10.6 million, around 70% of total revenues. The Presence Control segment accounted for AUD $4.35 million, around 29% of total revenues. Based on this data, EV/Sales multiple for the transaction is 0.9.

The strategic repositioning of RightCrowd into the Identity and Cyber Security Markets is based on the Access Analytics business (formerly known as RightCrowd IQ). The lightweight cloud-based platform is designed to address complex identity and access compliance challenges in a modern, sustainable way, while ensuring compliance with industry regulations. The business reported AUD $98,000 revenues in FY 2022, with recurring revenue growth expected to show in FY 2023.

RightCrowd CEO Peter Hill said:

“As the largest shareholder, I have made a deliberate decision to maintain alignment with all RightCrowd shareholders and lead the listed company to commercialise Access Analytics in the faster-moving Identity and Cyber Security Markets. Even though Access Analytics is in its early stages, ARR has grown relatively quickly over the last year, and based on the current pipeline is showing all the hallmarks of a highly scalable business.”

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.