The commercial real estate sector is undergoing a fundamental transformation in how buildings interact with and manage energy resources. Grid-Interactive Buildings are emerging as a critical solution for property owners facing mounting pressures from rising energy costs, stringent regulatory requirements, and ambitious carbon reduction targets.

Our new research identifies a robust ecosystem of 130 companies providing Grid-Interactive Efficient Buildings (GEBs) integration solutions. These vendors are developing sophisticated platforms that combine demand response capabilities, distributed energy resource management systems (DERMS), and AI-driven optimization tools to create more resilient and sustainable building operations.

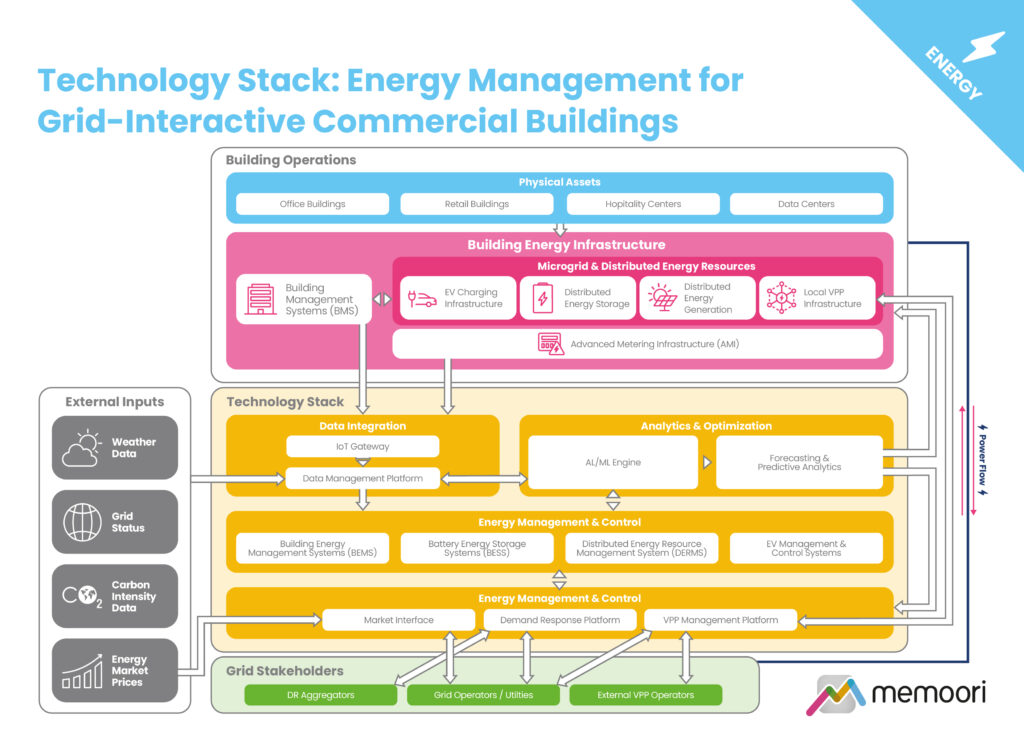

The Grid-Interactive Buildings Technology Stack

Our infographic provides an overview of how commercial buildings integrate with the electrical grid using advanced energy management technologies and DERs. It highlights the relationships between building operations, the technology stack, and the grid stakeholders. It shows the interconnected systems and data flows that optimize energy use, enable grid services, and allow buildings to generate and manage energy locally.

Market Breakdown & Sizing

The global market for energy management software in Grid-Interactive Buildings can be broken down into 4 key application areas, each serving distinct functions that support grid reliability, optimize energy usage, and enhance building flexibility.

- Demand Response & Virtual Power Plants (VPPs) allow buildings to reduce or shift energy consumption in response to grid signals, helping stabilize demand during peak times.

- Distributed Energy Resource Management Systems (DERMS) & Microgrids enable buildings to manage and control on-site renewable generation and storage, providing resilience and allowing participation in local energy trading.

- Distributed Energy Storage software maximizes the efficiency and lifespan of on-site batteries, allowing buildings to store energy for use during peak demand or grid outages.

- EV Charging & Flexible Load Management solutions manage the high energy demands of electric vehicle (EV) charging, distributing load intelligently to avoid grid strain and, in some cases, using EVs as mobile energy storage units.

Each of these application areas plays a crucial and distinct role in transforming commercial buildings into active, responsive participants in the energy grid.

The global market for energy management software in Grid-Interactive Efficient Buildings (GEBs) is poised for significant growth. Our new report projects revenues to increase from $2.98 billion in 2023 to $4.88 billion by 2029, representing a compound annual growth rate (CAGR) of 8.56%. This expansion is driven by increasing regulatory pressures, rising energy costs, and the growing demand for building energy resilience.

The market for grid-interactive buildings has experienced significant consolidation and investment activity since 2021, reflecting the sector’s rapid evolution and strategic importance. Major acquisitions have focused on expanding AI-driven capabilities, enhancing distributed energy resource (DER) integration, and strengthening VPP capabilities. Notable deals include Fluence’s purchase of Nispera, and Budderfly’s acquisition of Sunverge Energy’s DERMS platform.

Investment activity remains robust despite challenging market conditions, with over $4 billion in disclosed funding across 60 private companies in the sector. The average funding round stands at $67 million, with typically seven investors participating per round.

Why should you purchase this research? For Only USD 2,000 it provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their energy management software business.