Almost two years on from the announcement that STANLEY Security was to be acquired in December 2021, this Research Note examines the electronic security business of Securitas, rebranded as Securitas Technology, based on Securitas investor presentations, 2022 annual report and Q3-2023 interim report, 7th November 2023.

This article highlights the strategy, financials and progress of the business in integrating the acquisition and repositioning the group as a technology-based supplier of integrated solutions in higher-growth markets.

Securitas Technology, officially launched in March 2023, brings together two of the leaders in electronic security: Securitas Electronic Security and STANLEY Security. The announcement follows the completion of Securitas’ acquisition of STANLEY Security in July 2022.

The business offers a full suite of video, access, intrusion, fire and integrated systems and services. Securitas Technology employs approximately 13,000 people across the globe, including more than 5,100 field technicians, and has a strong position in 18 markets globally, including Canada, France, Mexico, Sweden, the UK and US, as well as several other key countries across Europe.

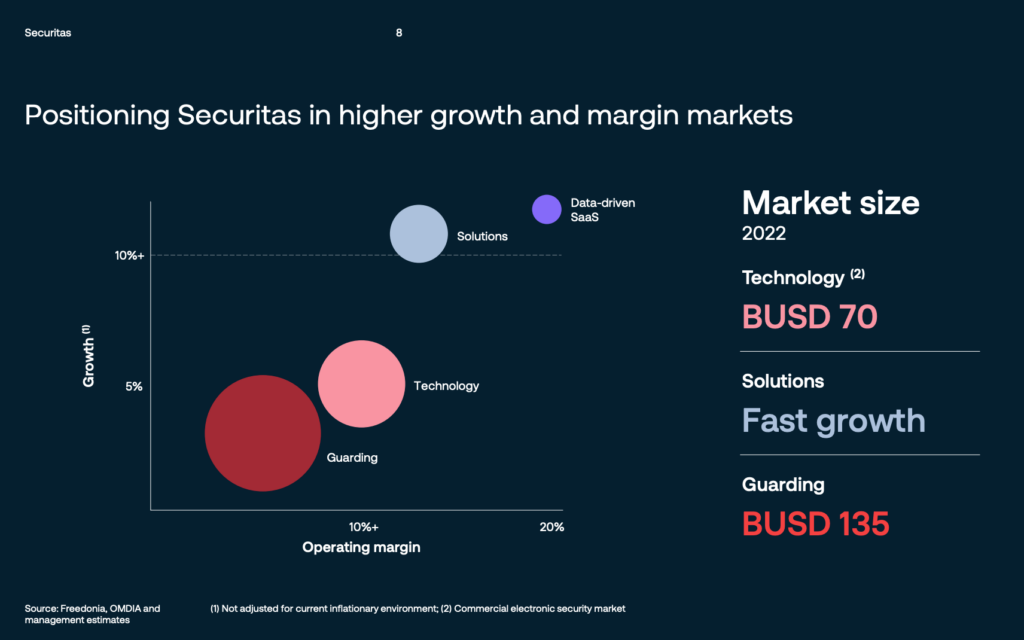

Securitas Strategy

Securitas accelerated its scale in technology-based solutions through the acquisition of STANLEY Security. The acquisition aligns with their strategy to be a security solutions partner strongly positioned to deliver higher growth and increased profitability in the future through the following four strategic areas:

- Taking the lead within Technology, by teaming up with Stanley Security: High recurring revenue, with the technology platform further driving the shift to cloud and subscription-based business models and growing recurring revenue.

- Guarding services focused on profitability through active portfolio management in the stable high recurring revenue guarding business with a client retention rate of approximately 90%.

- Creating a global security solutions partner: Well-positioned to serve the comprehensive and increasingly complex needs from global clients to SMEs.

- Leveraging a global platform to drive innovation: Strengthened proposition and profitability upside by scaling technology and solutions.

Technology and Solutions Financials

“Technology and Solutions” is the Securitas reportable segment which broadly equates to their electronic security offerings. This comprises two broad categories:

- Technology consists of the sale of alarm, access control and video installations comprising design, installation and integration. Remote guarding (in the form of alarm monitoring services), that is sold separately and not as part of a solution, is also included in this category. The category further includes maintenance services. Finally, there are also product sales (alarms and components) without any design or installation.

- Solutions are a combination of services such as on-site and/or mobile guarding and/or remote guarding. These services are combined with a technology component in terms of equipment owned and managed by Securitas and used in the provision of services.

2022 combined Technology and Solutions revenues were reported as SEK 36.98 billion (around $3.4 billion), 28% of total Securitas group revenues.

2023 Progress

Magnus Ahlqvist, President and CEO commented on the progress of the transformation activities in the Q3-2023 Interim Report, 7th November 2023:

“Leadership in technology and solutions and in digital capabilities are core to the execution of our strategy. With STANLEY Security we are number two in the global security technology market and our combined solutions offering is unique. The transformation programs we have implemented in North America and are implementing in Europe and Ibero-America fundamentally shift our digital capabilities as a company, and as communicated earlier we expect to conclude the transformation activities during 2024.”

The technology market presence of Securitas has strengthened considerably with this strategic move, generating significant client value by offering enhanced technological capabilities and reinforcing their top three ranking in the global electronic security market.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.