Our new research shows that funding from venture capital, private equity, and corporate backers for smart building startups reached $6.9 billion in 2024, the 3rd highest year in value since 2015. This funding was spread across 279 funding rounds, a 17% increase on 2023.

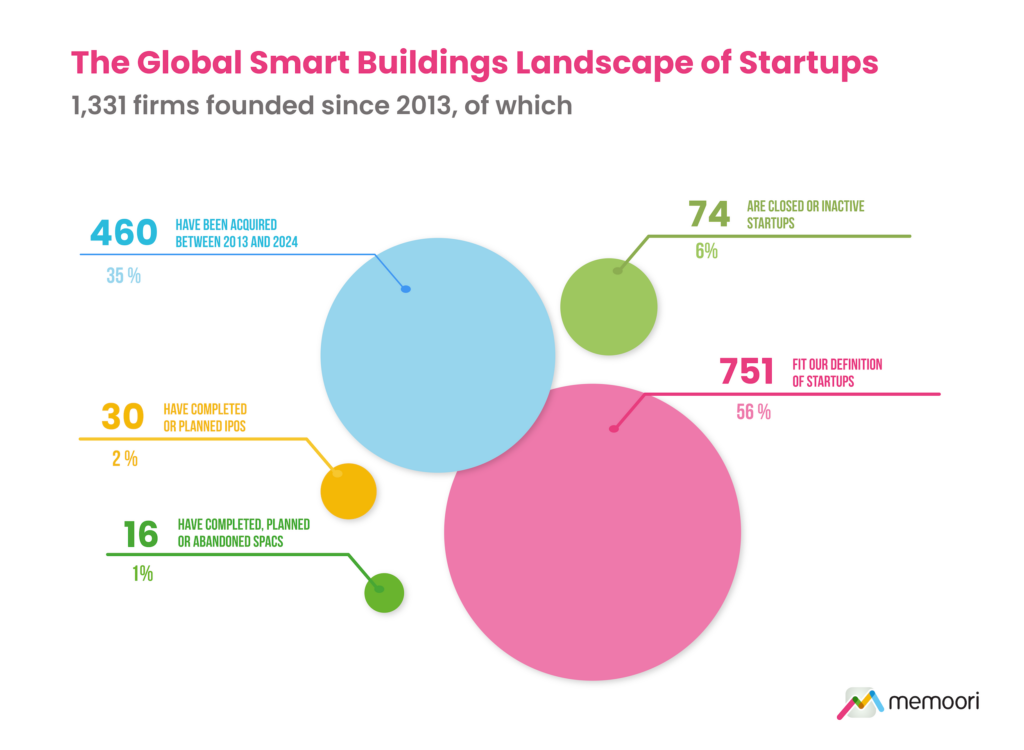

We identified 1,331 startups founded since 2013 in the management and operations phase of the global smart commercial buildings space. In total 460 have been acquired since 2013, 35% of the total landscape. 74 are closed or inactive, 6% of the total.

Our definition of a startup is “a private company formed no earlier than 2013 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is generally financed by venture capital or private equity funding.”

This report is our 6th comprehensive evaluation of startups and scaleups in the operations and maintenance phase of the lifecycle of commercial real estate. It highlights venture capital funding, M&A, and strategic investments over the last year.

Startup Funding Rounds

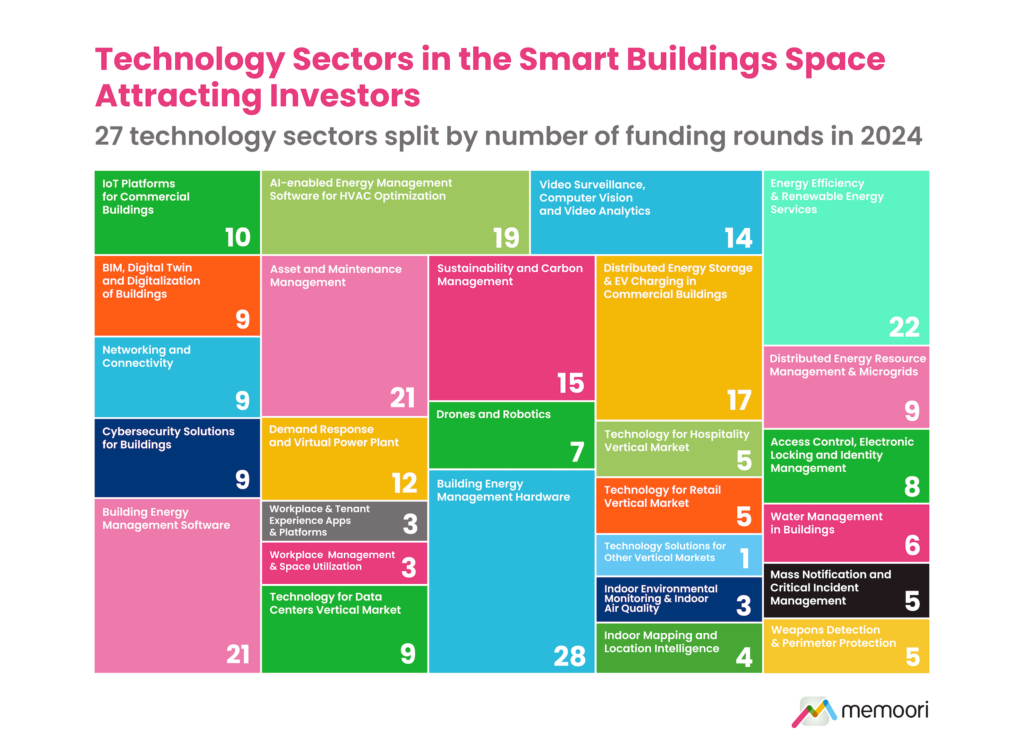

50% of funding rounds in 2024 related to Building Energy Management (BEM) technology for carbon reduction, energy savings, and the integration of solutions for renewable energy and grid interactivity in buildings.

60% of this Building Energy Management funding was raised by startups in Europe, nearly double the ratio for North America, which sits at 33%. This emphasis highlights Europe’s commitment to cultivating a smart buildings landscape aligned with environmental sustainability.

Our research also takes a detailed look at APAC startups gaining traction, with 30 Asian firms including Terminus, Spintly, and Asuene selected for this report. The information contained in the report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire companies will find it particularly useful.

Many of these tech sectors overlap with certain technologies/systems/companies. I’m assuming that means many of these rounds do as well?

Thanks Ian. Perhaps you could elaborate on your question because I’m not sure I fully understand what you are asking. We have tried to choose technology sectors that are reasonably well defined, but sure, as with most things, there are grey areas. So there may well be funding rounds that others would define differently, though not many IMO.