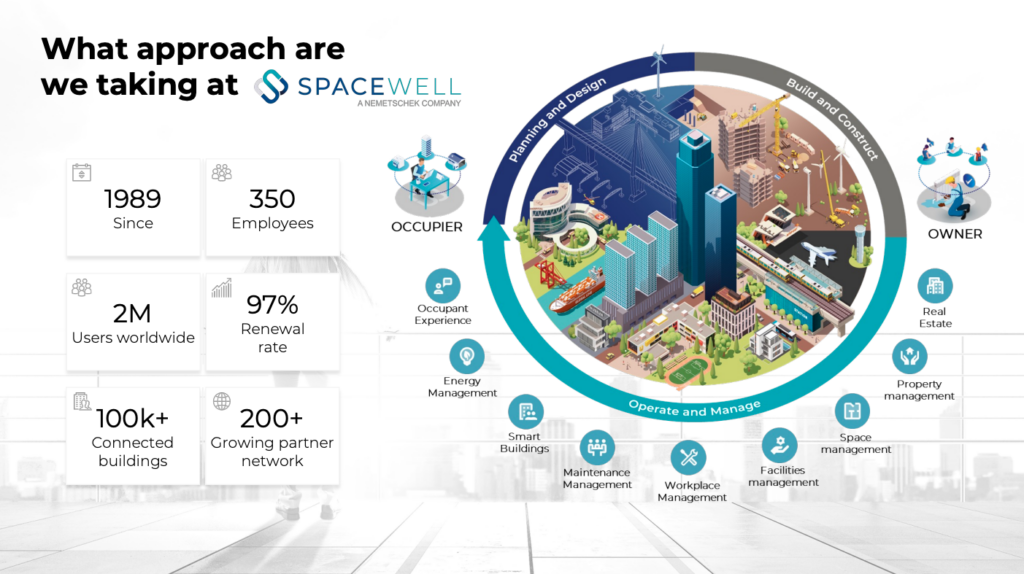

In this Research Note, we examine Spacewell, part of the Manage segment of Nemetschek, which provides software for the management and operations phase in the building lifecycle.

This article is based on their 2023 annual results, investor presentations, Annual Report of the parent company, published on 21st March 2024 and the group’s strategy in the smart buildings space.

The Nemetschek Group, the No 1 Architecture, Engineering and Construction (AEC) software provider in Europe and one of the top three global AEC software vendors, is driving the digitalization of the building industry, through its portfolio of brands, including Allplan, Bluebeam, dRofus, GraphiSoft, Nevaris, Vectorworks and Solibri focused on BIM.

Listed since 1999 and quoted on the Frankfurt Stock Exchange, the Munich-based company generated revenues of €851.6 million in 2023, an increase of 6.2% compared with the previous year.

The Manage segment has two brands, Spacewell and Crem Solutions, which offer software solutions across all commercial processes in property management as well as modular and integrated solutions for property, facility, and workplace management (IWMS).

The portfolio also includes a smart building platform that uses intelligent sensors and big data analysis to help improve productivity and efficiency in the operation and management of buildings. These are complemented by artificial intelligence-based energy management solutions for optimizing the use of energy in buildings and reducing CO2 emissions.

Spacewell Product Portfolio

Spacewell software for building maintenance planning and management was launched in April 2023. The SaaS software solution consists of three products: Maintenance Planning, Maintenance Management, and Compliance.

Spacewell Financial Highlights

The smallest of four reportable segments accounting for 7% of Nemetschek 2023 revenues, the Manage segment increased revenue growth by 8.0% (adjusted for currency effects:9.8%) to €59.1 million.

According to the 2023 Annual Report, the Manage segment is continuing to feel the effects of macroeconomic uncertainty coupled with the consequences of the global pandemic, which are having a protracted impact on this segment.

However, the stabilization in demand from facility managers emerging in the second half of the previous year, particularly in the European commercial construction sector, continued in the course of 2023.

Even so, facility managers’ capital spending budgets have still not returned to pre-crisis levels. Because the degree of digitization is particularly low in this segment and the importance of energy efficiency and savings in existing operated buildings is also steadily rising, the Nemetschek Group continues to see potential for further growth in this segment.

Segment EBITDA fell from €4.3 million in the previous year to €1.4 million. As a result, the EBITDA margin contracted from 7.8% in the previous year to 2.3% in 2023. This performance was particularly attributable to capital spending on the new Digital Twin Business Unit.

Digital Twin

In the 2023 Annual Report, it was announced that starting in 2024, the Digital Twin business unit, which has been consolidated in the Manage segment since January 2023, was to be consolidated within the Design segment along with the dRofus brand and dTwin solution. See our previous coverage of this topic.

No explanation for this change in segment structure was given, but we assume that the primary focus of digital twin solutions in Nemetschek is no longer on the operational and management phase of large complex building portfolios.

Spacewell Indirect Channel Strategy

In 2023, Spacewell further developed its indirect channel strategy to expand its SaaS solution delivery. For example, Spacewell established a number of strategic partnerships with IT services companies and sensor providers in the UK market – with TCM IP Services, Pressac Communications and MASS Information Systems.

Spacewell’s reseller partnership with MASS Information Systems for the UK and Ireland workplace management market was announced in November 2023. MASS is positioning the Spacewell IWMS product as significantly better value for money than a traditional high-end IWMS, because the total cost of ownership of a Spacewell solution is less expensive than other high-end solutions.

Spacewell faces strong competition from a range of global and regional vendors of workplace and building management software. They rank high in the IWMS marketplace and are starting to gain traction in the broader European smart buildings space.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.