In this Research Note, we examine Stem, the first pure-play smart energy storage company to go public in the US. This article is based on their 2022 annual results, 10K Report, investor presentations and previous analysis.

Founded in 2009, Stem is an energy storage company that offers commercial and industrial (C&I) customers a complete solution of integrated battery storage systems, network integration and battery optimization via its Athena proprietary AI-driven software platform.

Stem has been engaged in disrupting the energy storage market since 2013, which is having a profound impact on smart buildings, as our interview with CEO, Salim Khan noted at that time.

Stem, Inc. announced in December 2020 that it was to become publicly listed through a business combination with Star Peak Energy Transition Corp., a publicly traded special purpose acquisition company. The transaction was completed in April 2021.

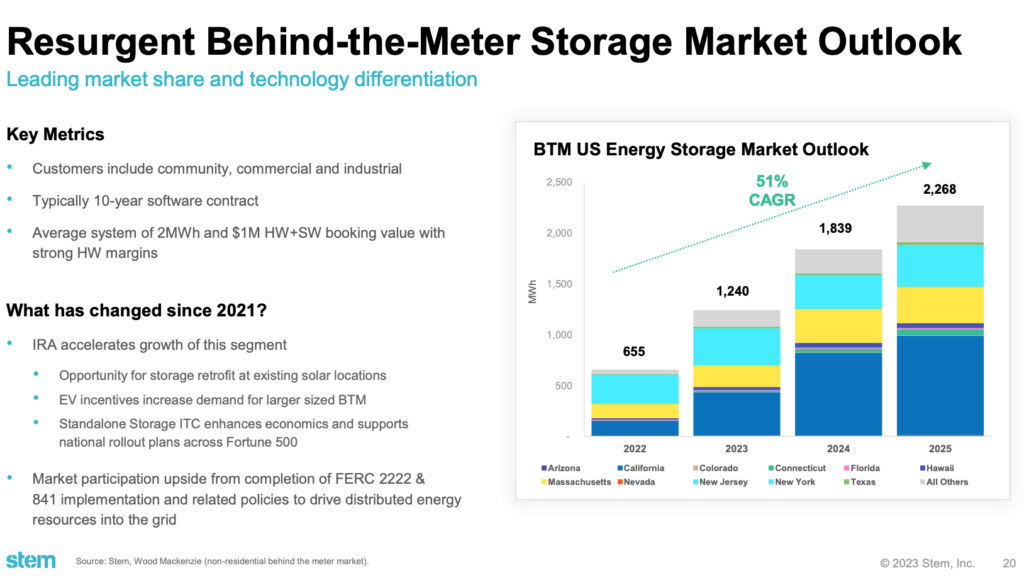

The company operates in two key areas within the energy storage landscape: Behind-the-Meter (BTM) and Front-of-the-Meter (FTM). BTM systems provide power that can be used on-site without interacting with the electric grid and passing through an electric meter.

Stem’s software reduces commercial and industrial customer energy bills, increases their energy yield, and helps customers facilitate the achievement of their corporate environmental, social, and corporate governance (“ESG”) objectives.

Acquisition

In February 2022, Stem completed the acquisition of AlsoEnergy for an aggregate purchase price of $652 million. The transaction combines AlsoEnergy’s solar asset performance monitoring and control platform, PowerTrack, with Stem’s AI-driven analytics platform, Athena. The combined company will deliver a one-stop-shop solution for front-of-meter and commercial & industrial (C&I) customers with solar and storage needs.

In the fiscal year ended December 31, 2020, AlsoEnergy generated approximately $49 million in revenue and realized a 60% gross margin across its software, grid edge monitoring, controls, and services businesses.

Financials

Stem revenue grew 186% from $127.4 million in 2021 to $363.0 million for the year ended December 31, 2022.

The change was primarily driven by a $203.9 million increase in hardware revenue primarily due to an increase in demand for systems related to FTM partnership agreements and the inclusion of AlsoEnergy’s revenue in the current period.

Services and other revenue increased by $31.7 million compared to the year ended December 31, 2021, primarily due to the inclusion of AlsoEnergy’s revenue in the current period. The company reported 660 employees.

Stem generates hardware revenue, which accounts for over 85% of total revenues:

- Hardware revenue: $310.8 million in 2022 - is generated through partnership arrangements consisting of promises to sell an energy storage system to solar plus storage project developers.

- Services and other revenue: $52.1 million in 2022 - is mainly generated through arrangements with host customers to provide energy optimization services using their proprietary software platform coupled with a dedicated energy storage system owned and controlled by Stem throughout the term of the contract. Fees charged to customers for energy optimization services generally consist of recurring fixed monthly payments throughout the term of the contract and in some arrangements, an installation and/or upfront fee component.

Outlook & Energy Storage Market Forecast

The company expects to be EBITDA positive by the second half of FY2023 and growth in software and services is expected to drive a 15-20% long-term EBITDA margin.

The BTM energy storage market in the USA is resurgent, due to the impact of the Inflation Reduction Act of 2022, with an estimated 51% CAGR forecast, 2022 to 2025.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.