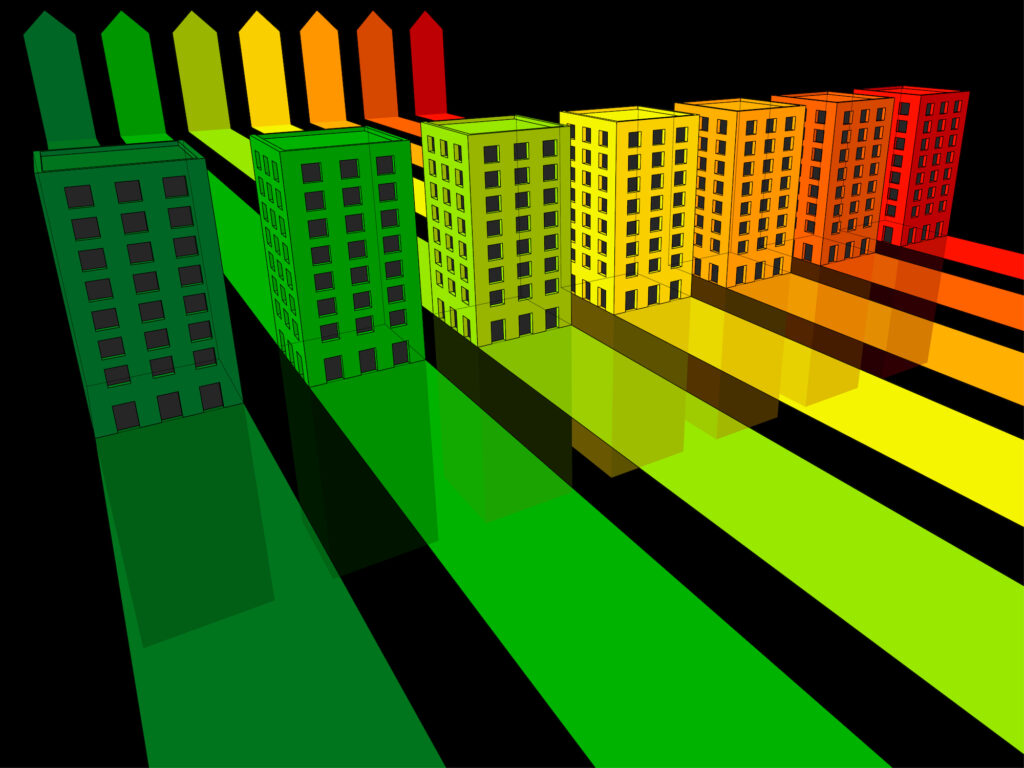

In the UK, an April update to the minimum energy efficiency standards (MEES) regulations for non-domestic buildings means large swathes of commercial real estate will have to improve their energy performance or face closure.

As climate change dominates the headlines once again, building regulators will double down on environmental commitments, and commercial real estate owners will be forced to make hard decisions about the future of their assets and the smart investments that could save them.

“Large-scale action in all sectors of the economy will be required, including tackling emissions generated by the building stock, which accounts for 31% of our national emissions. Energy efficiency is vital in reducing emissions, and in preparing non-domestic buildings for low carbon heat,” reads a UK government report.

“It is one of the most cost-effective ways in which businesses can reduce their energy use and lower the associated bills in the buildings they occupy, improving the productivity of UK businesses and the security of the UK energy supply.”

The UK government could be considered a pioneer in the global fight against climate change, becoming the first major economy to legislate for net zero greenhouse gas emissions in June 2019, targeting net zero by 2050. In addition, the UK has interim Carbon Budgets, which require a 57% reduction in emissions from across the UK economy by 2032, as well as ambitions to reduce business energy use by 20% by 2030 under the Clean Growth Strategy.

However, data from the Siemens Financial Services model reveals that £93 billion worth of commercial properties in the UK now risk becoming stranded assets.

The latest MEES update now demands that commercial real estate has an Energy Performance Certificate (EPC) rating of at least E to be rented. Government estimates suggest that around 11.4% of existing commercial buildings in the country currently fail to meet that standard, but the rate varies widely by building type and region.

According to analysis by PBC Today, 56 million square meters of commercial office space currently fails to meet that EPC rating, for example, which is approximately 75% of the UK’s office floorspace, and this is much more pronounced outside of the nation’s more affluent southeast region.

Over two million landlords must now improve the energy efficiency of their lower-rated buildings or face penalties ranging from £5,000 to £150,000, as well as a percentage of the rentable value of the building —10% for less than 3 months and 20% for longer.

In addition to the financial penalties, buildings owners and investors risk reputational damage through a “name and shame” publication of non-compliant companies on a public register. However, most significant is the possibility of properties becoming unlettable, creating stranded assets with no commercial value until upgrades are made.

Many will see the new regulations as unfair to landlords already struggling in the current economic climate and even harmful to the UK economy if a significant portion of commercial real estate is left unoccupied. However, with public opinion on climate change at an all-time high after July 2023 was announced as the hottest month ever recorded and there will likely be little sympathy for landowners unwilling or unable to make the required changes.

Moreover, there is a growing understanding that increasing the efficiency of buildings is not just good for the environment, but also offers significant benefits to the building owners too.

“British companies are believed to be missing out on around £1 billion in cost savings achievable through investment in energy efficiency. Improving energy performance, however, can be a costly and complicated process,” reads a recent paper from Siemens Finance.

“Given the expected costs of conversion, organizations across the public and private sectors are increasingly looking for financially viable ways to make the energy-efficiency upgrade. Working with specialist financiers, potential energy savings can be harnessed to effectively subsidize the investment, meaning building conversion can often be achieved at zero net cost.”

Such financiers increasingly offer packages which leverage future energy savings to fund immediate green building upgrades. Funding covers a wide range of technologies, from boilers to solar panels, HVAC improvement, insulation, smart building controls, and many other approaches to renewable power generation and energy efficiency.

Existing building retrofit approaches have demonstrated the ability to reduce energy expenditure by as much as 15-25% according to the Siemens paper, presenting landlords clear and viable payback periods on green technologies that could save their otherwise stranded assets.

“Regulatory and market pressures are creating a need for commercial real estate landlords to act on net-zero,” says Pete Colverd, Head of Building Products UK at Siemens. “The good news is that much of the technology that can help the sector significantly reduce carbon emissions is already on the market. Whether it’s remodelling the physical fabric of buildings, or using hardware and software to glean better insights from your estate – there are a number of things landlords should be considering now to future-proof their assets.”

Whether you think the pressure to comply with intensifying energy performance regulation is fair on the UK’s commercial landlords will likely depend on your views on economics and the environment. Public opinion in the UK increasingly supports tighter regulation as the influence of younger generations grows in society, suggesting that regulations will only get stricter as current and future governments vie for popularity. As a result, the UK’s underperforming commercial landlords face a clear choice, either utilize available technology and financing to upgrade their buildings or, eventually, offload their stranded assets to someone who will.