This Research Note examines the emerging strategic priorities of Johnson Controls (JCI) in the smart buildings space. We have mapped acquisitions, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the group, by categorizing the various business relationships by technology and investment type over a 3-year period. This article, part 1 of a 2-part analysis, is intended as a non-exhaustive indicator of JCI’s strategic direction between June 2019 and September 2022. Since April 2019, when Johnson Controls closed the sale of its Power Solutions battery manufacturing and energy storage division, the company has focused on being a building technologies pure player. More recently, JCI leadership has outlined several main priorities to capitalize on key growth drivers, such as decarbonisation, healthy indoor environments, and digital building technology. The business plans to accelerate development of high-growth digital services, primarily by transforming its large service business with differentiated solutions and innovative deal structures through the OpenBlue platform launched in 2020. We noted in November 2019 that having […]

Most Popular Articles

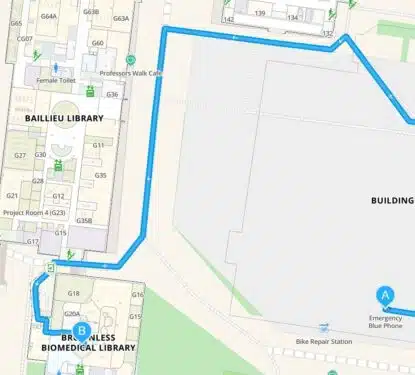

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]

Smart Building Tech Evaluation: Build a Framework with Me!

The smart building technology market presents a unique challenge for commercial real estate professionals: how do you efficiently evaluate thousands of technology vendors when every week brings new pitches, new solutions, and new promises? The sheer volume of vendors, from energy management platforms to occupancy analytics providers, makes systematic evaluation nearly impossible with traditional methods. […]

Johnson Controls UK Analysis: 8 Strategic Acquisitions Since 2022 Drive Revenues

This Research Note examines the major Johnson Controls UK businesses relating to building automation, fire and security systems, highlighting their latest financial data, year ending 30th September 2024. It is based on the annual reports of 3 companies, Johnson Controls Building Efficiency (UK), Tyco Fire & Integrated Solutions (UK) and ADT Fire & Security. We […]