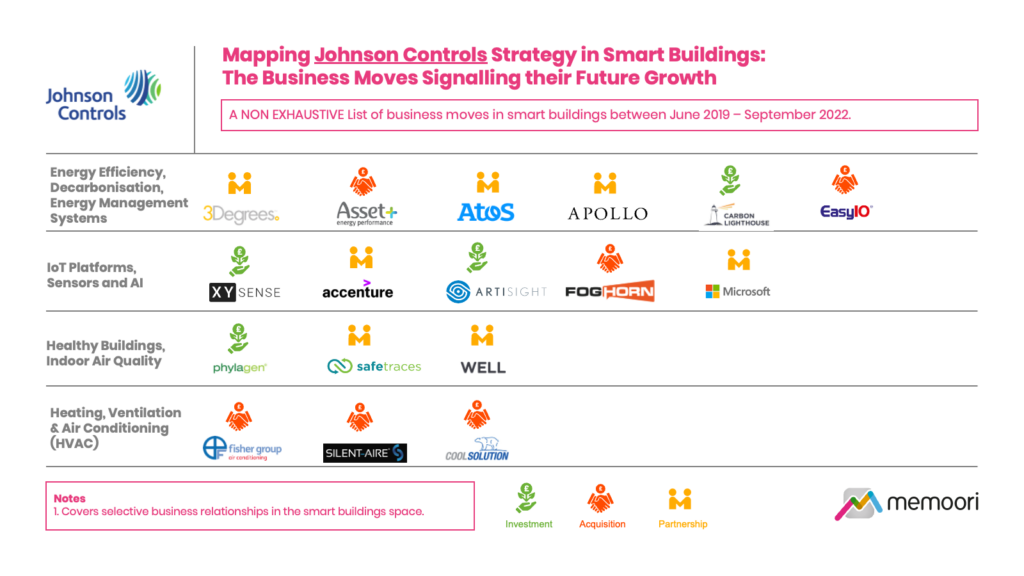

This Research Note examines the emerging strategic priorities of Johnson Controls (JCI) in the smart buildings space. We have mapped acquisitions, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the group, by categorizing the various business relationships by technology and investment type over a 3-year period. This article, part 1 of a 2-part analysis, is intended as a non-exhaustive indicator of JCI’s strategic direction between June 2019 and September 2022.

Since April 2019, when Johnson Controls closed the sale of its Power Solutions battery manufacturing and energy storage division, the company has focused on being a building technologies pure player. More recently, JCI leadership has outlined several main priorities to capitalize on key growth drivers, such as decarbonisation, healthy indoor environments, and digital building technology. The business plans to accelerate development of high-growth digital services, primarily by transforming its large service business with differentiated solutions and innovative deal structures through the OpenBlue platform launched in 2020.

We noted in November 2019 that having transformed itself from a set of conglomerate businesses, we expected a revised strategy to strengthen and invest in their global market-leading positions in HVAC, Fire & Security and Building Management, whether through acquisitions, venture capital investment, open innovation or strategic partnerships.

Our strategy mapping exercise showed that this was indeed the case, with 15 acquisitions, a potential divestment, 7 venture capital investments and 11 partnerships of note, in total over the last three years. And a notable acceleration of M&A activity and VC funding in 2022.

The commentary below primarily relates to business relationships established in 2022.

Energy Efficiency and Decarbonisation

In May 2022, Johnson Controls announced the acquisition of Asset Plus, a specialist provider of energy reduction and zero-carbon measures for the UK public sector. Delivering sustainability savings for multiple NHS organisations, local authorities, and educational establishments, Asset Plus provides strategic support and project management for energy efficiency measures and retrofitting across complex built environments. Its services will further enable Johnson Controls to deliver a turnkey net zero offering to UK clients.

IoT Platforms, Sensors and AI

In July 2022, XY Sense, an Australian workplace analytics provider, raised a US$10M Pre-Series A round, in which JCI Ventures participated as a strategic investment. XY Sense’s anonymous occupancy sensor technology can be integrated into JCI’s OpenBlue digital offering.

We analysed the Artisight transaction in July 2022, a strategic investment that will complement Johnson Controls’ suite of connected solutions for healthcare facilities offered by the OpenBlue Healthcare platform.

In January 2022, Johnson Controls completed the acquisition of FogHorn, a developer of Edge AI software for the industrial and commercial Internet of Things (IoT) solutions. FogHorn’s headquarters in Sunnyvale, California will function as an “AI Hub” for Johnson Controls. Their software will be integrated throughout the OpenBlue platform embedded within their OpenBlue Bridge data exchange which will allow for better applications of intelligence at the edge device level, be more secure, and lower costs relative to cloud-based applications.

In summary, the last three years have seen Johnson Controls strengthen vertical markets including the healthcare sector, workplaces and data centres while the focus of technology investments has been at the edge-device level and on artificial intelligence (AI).

Part 2 of this Research Note examines the emerging strategic priorities of Johnson Controls in physical and cyber security.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.