In this Research Note, we examine the recent Triton announcement of a merger between its portfolio companies, Assemblin and Caverion to create a Northern European technical building installation and services group “providing the most comprehensive and cutting-edge solutions across the full lifecycle of the built environment”.

We highlight the strategic rationale of the Caverion acquisition, the overall positioning of the new group, and key takeaways for the smart buildings business across the Nordic and DACH regions. This article is based on the 2023 annual reports of each company, an investor presentation of 7th March 2024, and our analysis of their building automation portfolios. We previously covered the extended bidding war for Caverion between Bain and Triton in 2022 and 2023, here and here.

Strategic Rationale

The acquisition of Caverion by Assemblin Group AB creates a stronger, more diversified, and resilient group. Clear market-leading positions are achieved in all Assemblin’s current geographies coupled with geographical diversification into Denmark and Northern Europe as well as an increased share of service revenue. The transaction improves financial KPIs in the combined group.

Assemblin Group Positioning

The Assemblin Caverion Group is positioned to leverage market trends, particularly addressing the aging building infrastructure across Europe, and responding to increasing customer demand for energy efficiency, sustainability, and automation within buildings, infrastructure and industry.

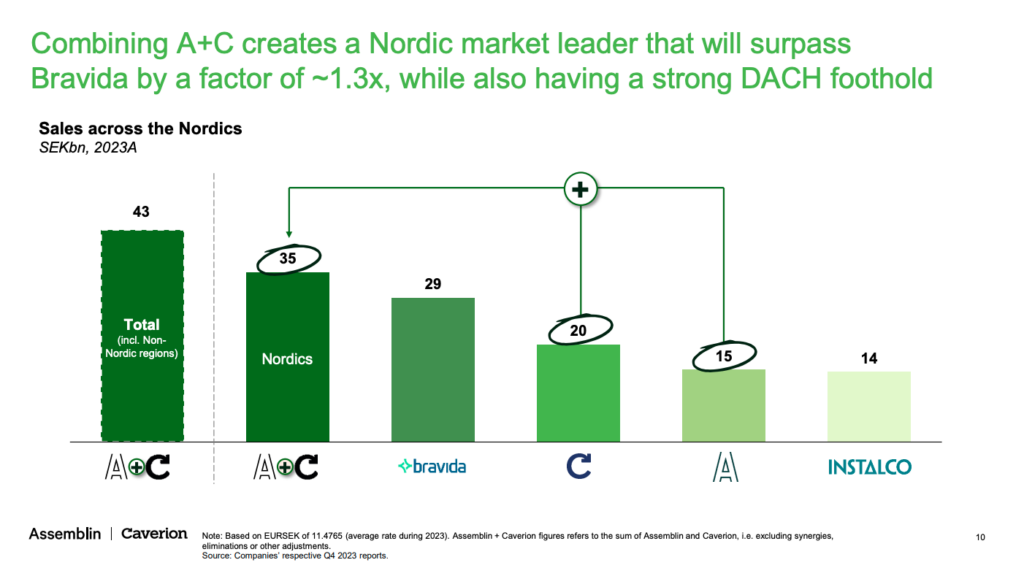

Upon completion, the Assemblin Caverion Group will operate across ten countries, generate an annual turnover of approximately EUR 3.8 billion/SEK 43.5 billion, and employ around 21,900 employees. The new group will become a market leader across the Swedish, Finnish, and Norwegian markets, surpassing Bravida by a factor of ~1.3x, while also having a strong DACH foothold.

Assemblin is an end-to-end installation and service partner with operations in Sweden, Norway, and Finland. The company designs, installs, and maintains technical systems for air, water and energy. They reported annual sales of approximately SEK 14.8 billion and more than 7,000 employees at more than 100 locations in the Nordic region.

Assemblin’s smart building activities are centred around Fidelix, a Finnish group, acquired in September 2021, to deepen their building automation offering. Fidelix offers installation and building management systems for climate-smart buildings and currently generates annual sales of about EUR 200 million and has more than 800 employees.

Fidelix offers property automation and control of indoor conditions, through packaged, intelligent BMS solutions. The Fidelix Group also includes the EcoGuard, Larmia and Lansen brands and the service company Säätölaitehuolto. Operations are mainly conducted in Finland but also in Sweden and Norway. Customers mainly include property owners, construction companies and installation companies.

Caverion

Caverion is a Finland-headquartered provider of sustainable multi-technical installation and service solutions for the built environment across 10 countries in Northern and Central Europe.

Its services span the entire lifecycle of the built environment, with expertise across a range of capabilities including base and smart disciplines, managed services and advisory, engineering and digital solutions. Caverion employs approximately 15,000 people, serving its customers in over 200 different locations. 2023 revenue was EUR 2,490.9 million.

Caverion SmartView digital customer platform is deployed in over 18,000 buildings across Europe. Digital offerings such as Caverion SmartView, remote services and building automation solutions are claimed to differentiate Caverion from its competitors. Developing and continuing the company’s digital and energy management leadership is also considered by its new owners to be important elements in future growth.

The SmartView platform enables its users to see at a glance how their building is performing, playing a key role in optimizing building conditions, energy consumption, and remote monitoring utilizing multiple methods to monitor indoor air quality, temperature, and occupancy in buildings.

Caverion and Assemblin combined are a significant technical installation and service partner for commercial buildings in northern Europe. With the backing of private equity, the merged company is well-positioned to compete in the smart buildings space against the established building automation vendors.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.