In this Research Note, we examine Azbil, a Japanese public company with a leading position in the domestic building automation market. Our analysis is based on their FY2022 annual results, year ending 31st March 2023 and investor presentations.

The Building Automation (BA) business, the largest of three business units, accounts for 46% of consolidated net sales for the Group. Total group revenues increased 8.5% to 278.4 billion yen year ending 31 March 2023.

The BA business provides air conditioning control technologies incorporated in numerous large-scale facilities, including office buildings, hotels and shopping centers. They are used to conduct detailed measurements of temperature, humidity and other factors and control facilities and equipment in a manner that delivers comfort and energy savings.

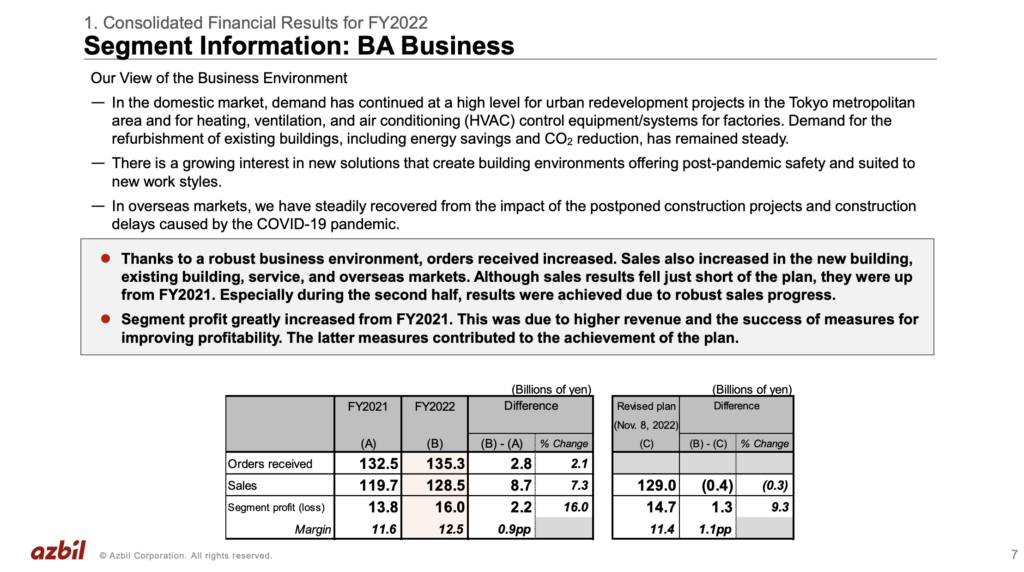

Azbil BA sales, year ending 31 March 2023 increased 7.3% year on year to 128.5 billion yen (around $896 million) due to growth in the fields related to new large-scale buildings and also growth in overseas business. This result was just short of the financial plan for the year which targeted BA sales of 129 billion yen, a 7.7% year-on-year increase.

In their domestic market, demand has continued to grow for urban redevelopment projects in the Tokyo metropolitan area and for HVAC control equipment and systems for factories. Demand for the refurbishment of existing buildings, including energy savings and CO2 reduction, has remained steady.

There is also growing interest in new solutions that create building environments offering post-pandemic safety and suited to new work styles. In overseas markets, the segment has steadily recovered from the impact of postponed construction projects and delays caused by the COVID-19 pandemic.

BA segment margin was 12.5%, up from 11.6% in the previous year, due to initiatives undertaken to enhance profitability and increased revenue.

The Azbil financial plan for FY2023, year ending March 2024, targets BA sales of 130 billion yen, a 1.1% year-on-year increase. Based on the buildup in the order backlog at the start of FY2023, sales are expected to increase steadily. The domestic market will remain robust and overseas markets are expected to recover and return to pre-pandemic levels.

Currently, in addition to comfort and energy conservation, the azbil Group’s role in air conditioning control is dramatically expanding to include responding to infectious diseases, meeting the needs of diverse ways of working (ABW: activity-based working) and operating a virtual power plant which uses cloud-computing and IoT technology to adjust the power demand of many buildings.

Azbil Building Automation Vision

The overall vision for the BA business is to become an Asia-based world-class supplier of building systems. Core strategies in implementing the medium-term financial plan include:

- Expand business fields, including collaboration with other companies

- Strengthen energy-saving solutions business, including ESP and their approach to the existing buildings market

- Expand cloud services

- Develop the overseas business

In January 2023, Azbil formed an alliance with CEC, Clean Energy Connect, a Japanese corporate green power solutions business. Together with CEC, Azbil will help customers achieve decarbonization by providing renewable energy solutions in addition to energy conservation.

By combining Azbil's demand response technology, they aim to realize the effective use of renewable energy, which has large output fluctuations, and improve the utilization rate of renewable energy in their customers' buildings.

Azbil aims to increase sales by several billion yen from the next fiscal year onwards by expanding the provision of BEMS and energy-saving solutions that combine renewable energy.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.