National climate pledges are inherently ambitious; they appear to represent the educated hopes of governments striving to meet the demands of more conscious citizens and the international community. While few would scrutinize such ambition, not many would expect nations to meet such lofty goals either, with most satisfied to set the bar high and achieve as much as we can. So, when the US government pledged to reach net-zero emissions as a nation by 2050, what should we actually expect to happen?

“Modernizing the American economy to achieve net zero can fundamentally improve the way we live, creating more connected, more accessible, and healthier communities. That does not mean it will happen quickly or without hard work,” writes presidential envoy John Kerry and national climate advisor Gina McCarthy. “There will be many challenges on our path to net zero that will require us to marshal all our ingenuity and dedication. But it can, and must, be done.”

The comprehensive Whitehouse report outlined five key transformations that would support its net zero goals. These can essentially be summarized as electrification and increased building efficiency alongside decarbonization of electricity, as well as some carbon capture and non-CO2 emission reduction policies. The strategy ultimately depends on the rapid evolution of real estate and power, two sectors that are notoriously slow to change, raising doubt on whether “it can be done” by 2050, just 27 years from now.

Shining a light on this issue, a new research report by the Berkeley Lab, in collaboration with economic advisory Brattle, has released the results of a set of computer simulations that chart the potential building decarbonization of the US in a range of scenarios.

Building Efficiency & Decarbonization Scenarios

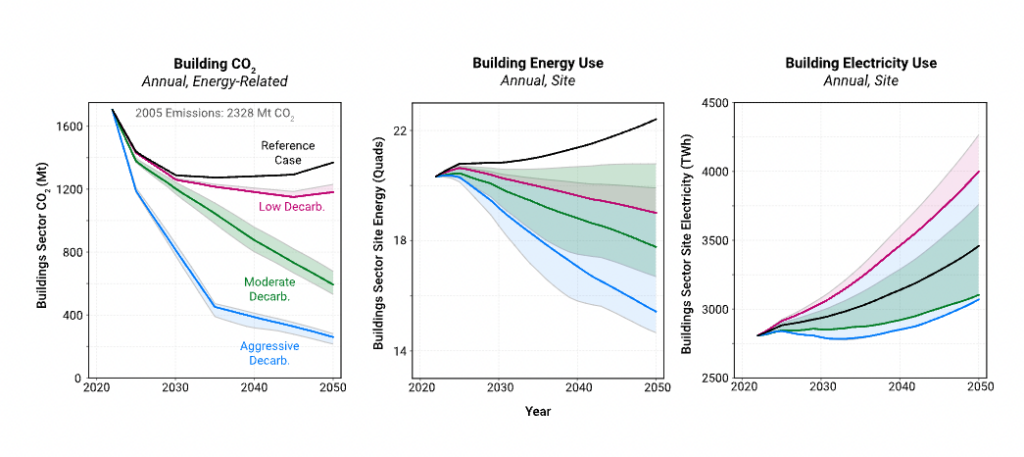

In the most aggressive decarbonization scenario, the researchers found up to a 91% reduction in building CO2 emissions (from 2005 levels) by 2050 using a portfolio of building efficiency, demand flexibility, and electrification measures alongside rapid grid decarbonization. The most aggressive scenario also avoids more than one-third of total building energy use and decreases total building electricity use 13% below the reference case by 2050 despite the high level of building end-use electrification (EL).

At the other end of the spectrum, however, a low decarbonization scenario is a very real possibility in the US, one of the most heavily polluting countries in the world, if the current rate of building decarbonization progress continues, for example.

Buildings essentially represent the demand side of the energy landscape, accounting for 40% of all energy consumed and 74% of US electricity sales, but as much as 30% of that electricity is wasted according to the EPA, making demand-side building efficiency improvements the critical first step.

Demanding Buildings

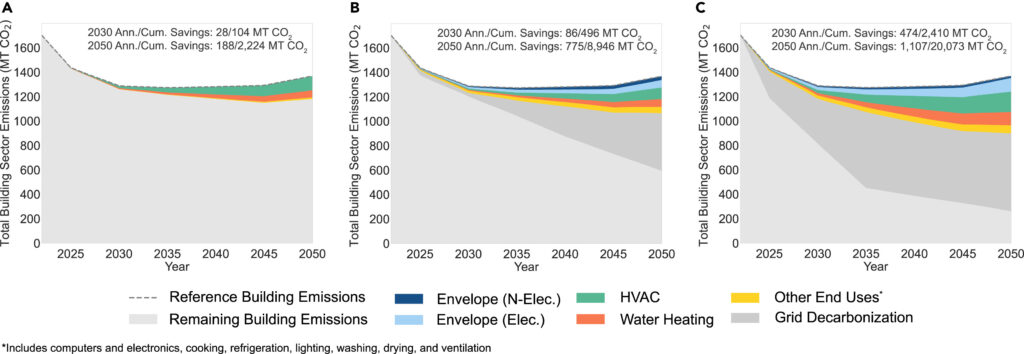

Measures that affect building energy demand are broad and complex but, by focusing on the largest consuming systems and the biggest sources of energy waste, we can begin to understand the bigger picture. The researchers projected that simply improving building envelope performance and upgrading HVAC and water heating equipment to more efficient electric options, could account for up to nearly half of total sectoral CO2 emissions reductions by 2050.

Envelope improvements account for the single-largest share of CO2 emissions reductions (33%–37%) among end uses in the study. Reductions in HVAC and water heating equipment energy use, meanwhile, accounts for an additional 32%–35% and 21%–23% of end-use emissions reductions, respectively.

While other end-uses register sizable reductions in these scenarios, most notably the study found that computers, electronics, lighting, and cooking collectively account for just 14%–17% of end-use reductions in 2050.

The other half of the equation relates to energy supply, namely transitioning to cleaner sources of electricity generation while adapting transmission and distribution to the dynamic nature of electricity demand from buildings.

Supplying Buildings

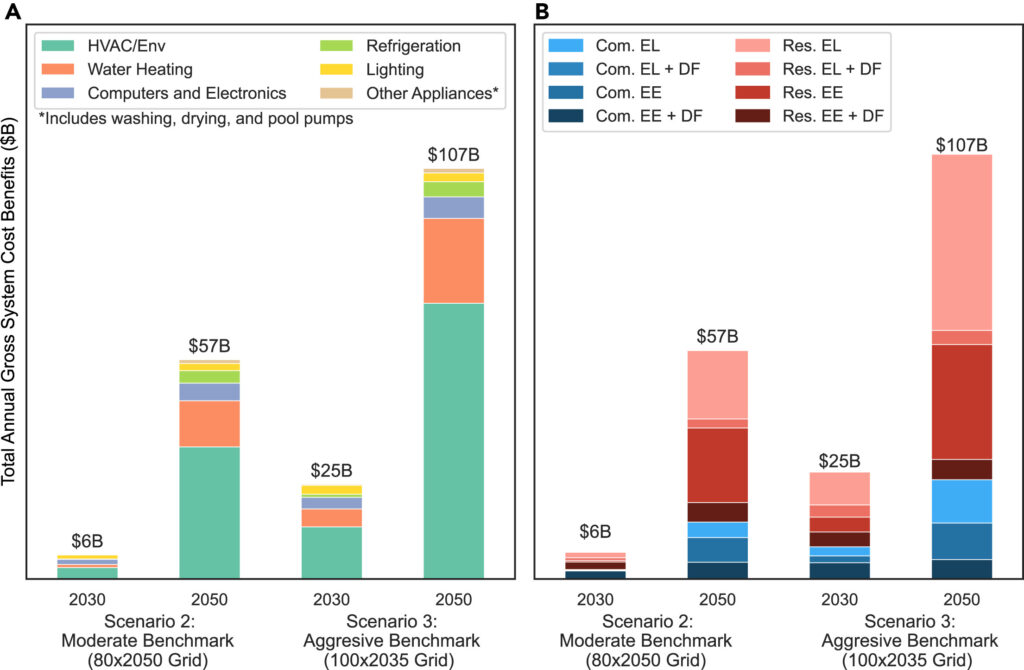

The research found that building efficiency measures could help avoid up to $107 billion in bulk power system investments per year by 2050, or more than a third of the incremental costs of fully decarbonizing the power supply. These avoided costs cover the vast majority (84%) of the demand-side portfolio’s incremental deployment cost. This makes building envelope improvements and HVAC efficiency measures an important precursor for the power sector’s own grid development.

“Building efficiency and flexibility can reduce the cost of decarbonizing the power sector by reducing overall electricity consumption and peak demand, and shifting usage to hours when it is less costly to serve,” reads the paper. “The result is a reduction both in fixed generation and transmission costs and in variable generation costs that were otherwise incurred to serve demand under the power sector decarbonization targets, before taking into account building efficiency and flexibility.”

Building efficiency represents the low-hanging fruit for decarbonization in the coming years.

The researchers outline numerous policy, regulatory, and market-based levers that could influence the proposed building decarbonization pathways. Leading the list of recommendations is the acceleration of early retrofit programs, as well as more stringent codes and standards for building efficiency. Later, they say, we will depend on the commercialization of breakthrough technologies as “key levers for achieving the highest potential for building decarbonization by mid-century.”

Evidence suggests that depending on the real estate and power sectors to spark their own rapid evolutions is unrealistic. Under pressure from their citizens and the international community, the US will continue to drive stricter building and energy regulation but will also have to balance that against economic interests and the status quo in energy and real estate.

Without a significant change to the way these stakeholder groups operate, it is hard to see how deep decarbonization can take shape in the US by 2050. More of the same simply won’t be enough, the US will need some kind of revolution to meet these goals.