The Internet of Things for Buildings (BIoT) is simply so vast that it would be better described as an ecosystem than a business sector. An ecosystem is a community of elements, which interact with each other and their physical environment to create balance and functionality in a system. Where one business could potentially serve and even dominate every element of a business sector, the vastness and complexity of an ecosystem demands that firms work with one another to allow the system to function and evolve.

“The opportunities presented by the BIoT are wide-ranging, complex and require a huge variety of different skills and market expertise to fully exploit. As such no single company has the means to tackle the market alone,” states our latest report The Internet of Things in Smart Commercial Buildings 2018 to 2022.

“Instead, forward thinking vendors across the supply chain are carefully considering which particular market opportunities they wish to pursue. What horizontal and vertical markets offer the greatest potential, what new skills, capabilities and market expertise they need to invest in developing, and what solution offerings will appeal most to end-users to help them establish the strongest possible position in the market,” our report continues.

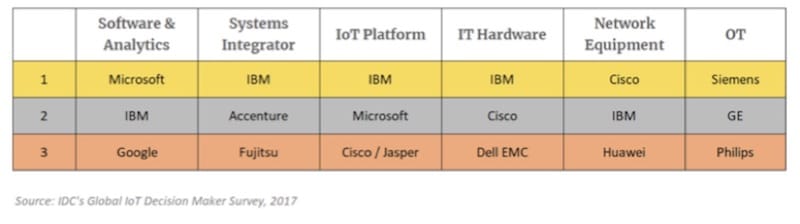

Consider the dominance of giants Microsoft, IBM and Google in the field of software and analytics, a vital component of the BIoT. The status quo changes when you look to integrate those systems, where IBM are joined by Accenture and Fujitsu as the leading integrators. Then consider IT hardware, another vital BIoT component, where Cisco and Dell EMC compete with IBM at the highest levels. IBM may be a diverse and colossal firm in terms of IT but even it can’t tackle the operational side of the smart building, where GE, Siemens and Phillips still reign.

The table below show the top three responses to the question, “who leads the market” for each BIoT category within the IDC Global IoT Decision Maker survey. The results show the wide spread of firms across this diverse market landscape which is bringing IT and OT together in unprecedented ways.

The IoT and BIoT are the epitome of the cyber-physical revolution, where the virtual and real worlds collide. The brick-and-mortar of buildings have become the fertile soil for the growth of sensory technology that interprets our physical world in digital terms.

The building’s “digital twin” allows for advanced analytics to take place, which in turn creates actionable insights to support the decision-making of building managers and artificial intelligence systems. These enhanced decisions are then fed into operational technology in order to enact digital intelligence in the physical world.

“As the IoT blurs the lines between the previously distinct IT and OT world, and wireless sensor networks connect physical and digital spaces, this shifts the borders of what used to delineate where one kind of service ends and another begins,” our new report says, explaining the challenge facing IT and OT firms attempting to breach each others borders.

“In the case of the BIoT, building services are being delivered in new ways. These shifting boundaries may mean that building systems industry incumbents more familiar with a dominant market position in the OT world may find themselves playing more of a supporting role in a broader IoT landscape going forward,” our comprehensive report continues.

It is this collision of OT and IT worlds that allow the ecosystem to maintain, un-dominated by one corporation or even one industrial group. Consider lighting in isolation, by transforming their services into an IoT offering, lighting firms have entered the unfamiliar world of IT and into in direct competition with IT vendors who, in turn, have found opportunities in the operational realm. “What may once have been thought of as a new physical frontier for IT companies is proving to be the perfect cyber opportunity for “old world” sectors like lighting and vice versa,” we said in a 2017 article.

Both the IT and OT sectors for buildings are also broad and complex in their own right. While large firms exist that maintain a commanding position in each, they rule with others and are dependant on small to medium sized enterprises for innovation and niche technologies. In the arena of the building, the complexity of each realm and that fact that every component of each is attempting to meld IT and OT together creates a complex map of interaction, codependency and co-evolution, as depicted by this infographic from our recent report:

“While the BIoT landscape as a whole remains somewhat fragmented, a vibrant ecosystem of developers, startups and established players from both the building systems and ICT domains is steadily emerging,” explains the report. “While some of this change is due to continued M&A activity, much of the evolution is down to a greater degree of partnering and collaboration in the market.”

Partnering and collaboration, alongside the numerous alliances and consortia that have emerged in the BIoT space are fundamental to the consolidation and evolution of the ecosystem and development of the market. It is this engagement and entanglement between IT and OT that is defining and shaping the future of buildings in the IoT age.