Our new research delves into the investment from venture capital, private equity and corporate backers for smart building startups. Since 2015, total capital invested in startups in the global smart building space amounted to over $31 Billion. In the last 2 years (which are the focus of this report) it reached unprecedented levels with $5.9 Billion being invested in 2022 alone.

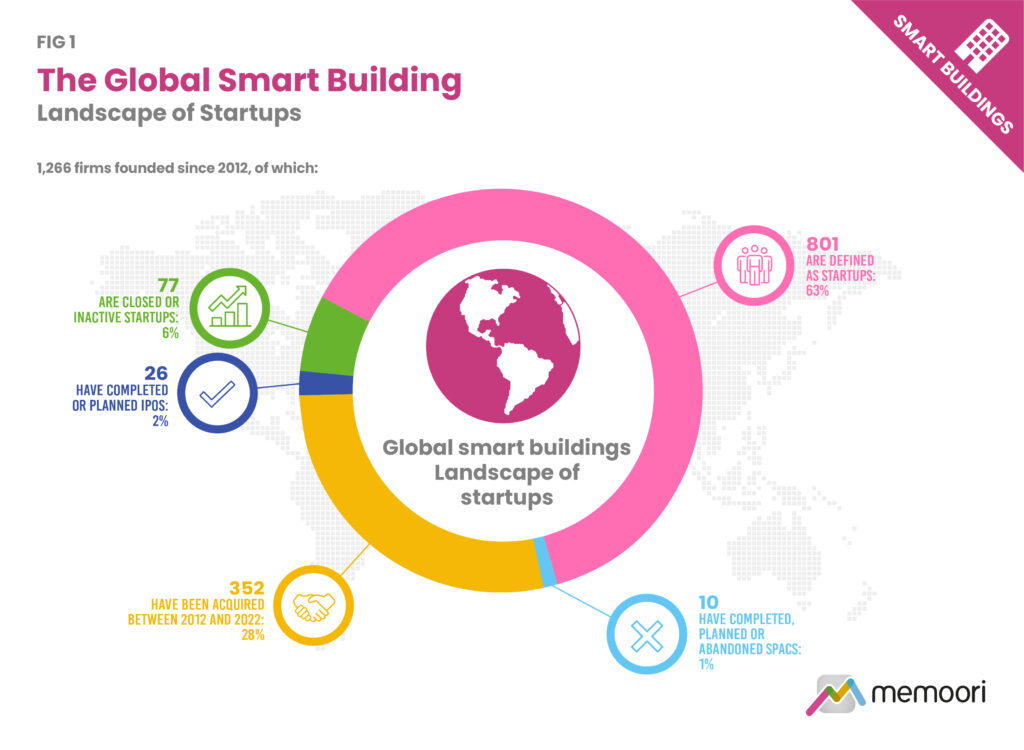

We have identified 1,266 startups founded since 2012 that have targeted the management and operations phase of the commercial building industry. This number has increased 20% in the 2 years since we published our last startup research. Of this cohort, 28% (352 startups) have been acquired between 2012 and 2022. Also, 6% (77 startups) have either closed or become inactive in the same timeframe.

For clarity, our definition of a Startup is “a private company formed no earlier than 2012 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company and is often financed by venture capital or private equity funding.”

Of all the companies to receive investment, the research identifies the highest-funded startups in the smart buildings space in the last two years. The top 20 firms have each attracted between $225 million and $2.6 billion in total disclosed funding.

Our new research demonstrates the critical contribution that Startups are making to the introduction of innovation in smart buildings and PropTech. The information will be of value to all companies engaged in managing, operating and investing in smart buildings. In particular, those looking to acquire innovative companies will find it useful.

The report is available for $2,000 USD and includes a spreadsheet which lists all Startup acquisitions and investments in 2021 & 2022 and a presentation file with high-resolution charts from the report. This research also forms part of our 2023 Premium Subscription Service.

Corporate Investors’ Support of Startups

Corporate strategic investors across the built environment are playing an increasingly significant role in supporting startups, not just in terms of funding but also with strategic partnerships.

The report provides a detailed assessment of the ecosystems of 10 incumbent players. It identifies JLL, Johnson Controls and Schneider Electric as the top 3 corporate investors in the smart building space.

For more details, please visit the report page – https://memoori.com/portfolio/startups-in-smart-buildings-2023/