In this Research Note, we examine the Building Technologies business of Honeywell (HBT) based on their 2023 10K Report, investor presentations and commentary from their Q4 investor call.

The strategic rationale for the Carrier Access Solutions acquisition is further discussed and significant investments and partnerships by HBT throughout the year are highlighted.

Honeywell Products & Services Portfolio

Honeywell Building Technologies products and services include advanced software applications for building control and optimization; sensors, switches, control systems, and instruments for energy management; access control; video surveillance; fire products; and installation, maintenance, and upgrades of systems.

Launched in May 2023, the Honeywell Forge for Buildings software, hardware and services supports building owners and operators in achieving sustainability, operational efficiency, occupant experience, compliance, safety and security, and resilience goals.

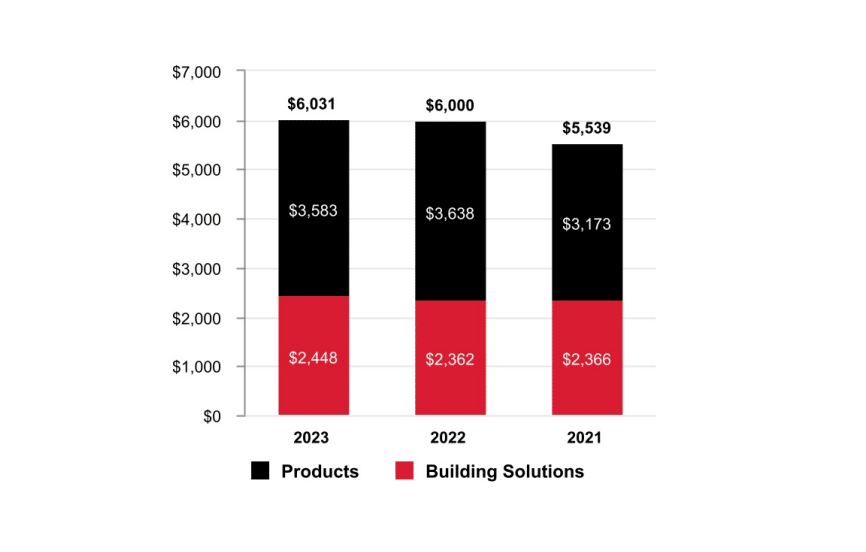

HBT 2023 Financials

Sales increased $31 million (1%) due to higher organic sales growth of $145 million in Building Solutions driven by increased pricing in building projects and services, partially offset by the unfavourable impact of foreign currency translation of $88 million and lower organic sales of $27 million in Products driven by lower sales volumes.

Segment profit increased $66 million and segment margin percentage increased 100 basis points to 25.0% compared to 24.0% for the same period of 2022. Margin expansion was driven by productivity actions and price/cost management, partially offset by an unfavourable business mix.

Carrier Access Solutions Acquisition

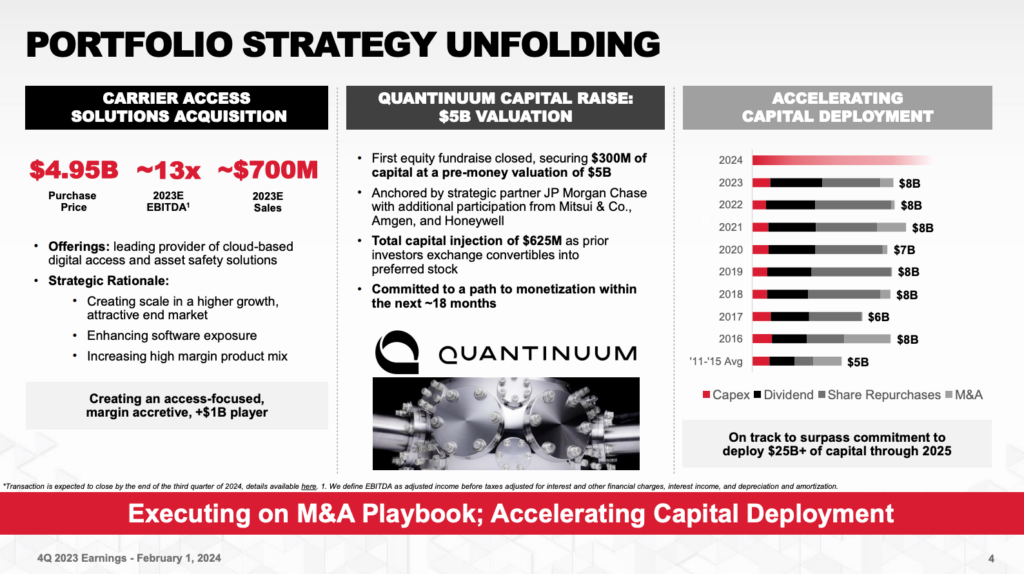

We analyzed Honeywell’s plan to realign its reportable segments and augment its Building Automation business with the acquisition of Carrier’s physical security business in December 2023.

The transaction was discussed in the Q4 Investor call, during which the CEO explained his thinking behind the “bolt-on” acquisition which is adding to their core Building Products portfolio.

Honeywell had a moderate position in security and this acquisition makes them a meaningful player. The transaction is expected to close by the end of the third quarter of 2024.

The strategic rationale for acquiring the Access Solutions business was further outlined in three key points in Honeywell’s recent Investor Relations Insights report:

- Creating scale in a higher growth, attractive end market: With this addition of over $700M in revenue and accretive margin profile, they are transforming their building security products business into an access-focused, +$1B revenue player alongside their leading fire and building management system franchises. The fragmented asset safety space remains a high priority for mission critical sectors like data centers, pharmaceuticals, and critical infrastructure, with differentiated growth prospects driven by demand for digitalization. The company believes this combination creates a compelling security products platform that will also enable further inorganic growth opportunities.

- Enhancing software exposure: This acquisition bolsters Honeywell’s existing software position, adding to their multi-domain system integration offerings enabled by the Honeywell Forge platform, including Connected Life Safety Systems, Tridium, and Enterprise Buildings Integrator (EBI).

- Increasing high margin products mix: They are also enhancing their equipment-agnostic products business mix, further improving their margin profile and differentiating themselves from equipment providers.

HBT Partnerships, Funding and Investments

In March 2023, Honeywell announced a strategic investment in Redaptive, which will accelerate a collaboration to bring Energy-as-a-Service (EaaS) capabilities to private sector-owned commercial and industrial buildings.

This collaboration combines Honeywell's experience in energy savings performance contracting (ESPC) and building controls capabilities with Redaptive's innovative data technology and EaaS platform. It provides customers with more ways to baseline current energy usage and reduce consumption to achieve their sustainability goals – with little-to-no upfront investment.

In May 2023, Honeywell and Arcadis announced a collaboration to provide tools and services that help optimize energy use and carbon emissions in commercial buildings worldwide. With an initial focus on five projects in various locations worldwide, the companies will jointly offer a range of end-to-end solutions to help clients and customers expedite progress toward their carbon-reduction goals.

In June 2023, Honeywell joined forces with a group of leading industry partners, including Telguard, NAPCO Security Technologies and Resideo, to help deliver more detailed contextual information about commercial fire emergencies to first responders.

In January 2024, Honeywell announced a new collaboration with NXP Semiconductors. The collaboration aims to help make buildings operate more intelligently by integrating NXP Semiconductors’ neural network-enabled, industrial-grade applications processors into Honeywell’s core building management systems (BMS). The memorandum of understanding will initially focus on the Honeywell Optimizer Suite of products, which offer flexible building control and automation.

Ultimately, the goal is to fully leverage NXP’s i.MX chipset capabilities to further enhance all Honeywell’s BMS product offerings with AI/machine learning and data analytics for greater building autonomy, energy efficiency, and maintenance.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.