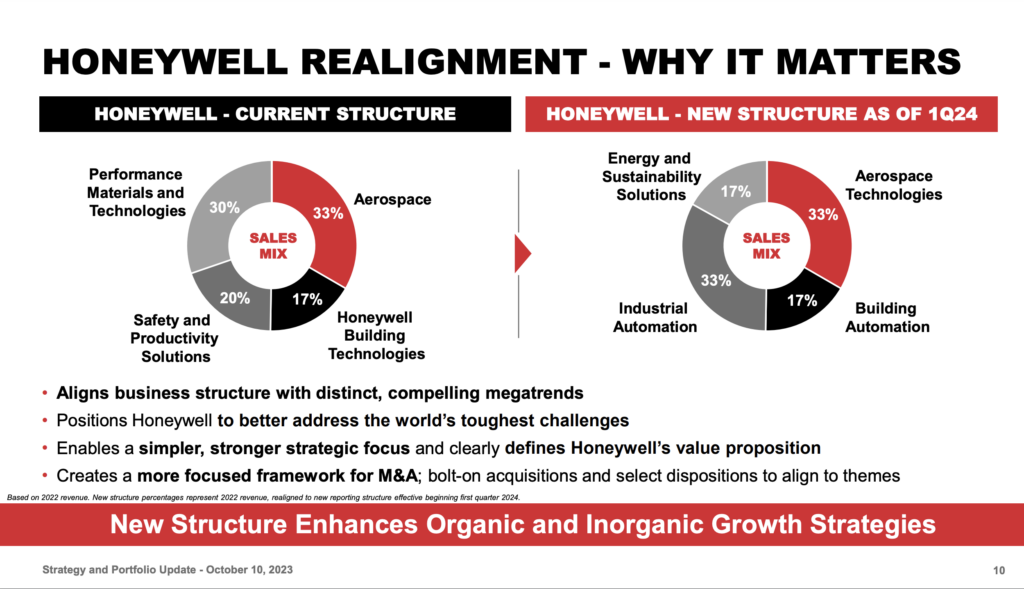

On 10th October 2023, Honeywell announced plans to realign its business segments around three megatrends: automation, the future of aviation, and energy transition. This Research Note focuses on what this means for the smart buildings market.

The US conglomerate’s perspective for organic and inorganic growth was further highlighted on a 1st December webcast, together with the subsequent announcement on 8th December that its Building Automation business would acquire Carrier’s Global Access Solutions.

The reorganized reporting structure is intended to enable a simpler, stronger strategic focus, to deliver accelerated organic sales growth and inorganic capital deployment, creating greater value for shareholders. The new segmentation will take effect beginning the first quarter of 2024.

Honeywell Building Automation

The realigned Building Automation business segment accounts for 17% of 2022 group revenues, which equates to the former Honeywell Building Technologies business, we examined here.

Through hardware, software, sensors, and analytics, Honeywell aims to help customers convert buildings into integrated, safe, and more sustainable assets. With solutions and services used in more than 10 million buildings worldwide, Building Automation will continue to strengthen Honeywell’s position in attractive end markets like hospitals, airports, education, and data centers.

Portfolio Realignment

On 1st December 2023, Honeywell's CEO Vimal Kapur provided a more detailed update of the portfolio realignment in a 4Q23 Leadership Webcast presentation.

The new structure is expected to enhance inorganic growth strategies by accelerating the M&A pipeline. The focus is on bolt-on acquisitions to optimize current portfolios. The group also intends to divest approximately 10% of its portfolio that does not align with the new business structure.

Honeywell expects to leverage a different portfolio growth mindset in the realigned organization through three initiatives: a new Innovation playbook, high-growth regions and monetizing the installed base through software and services.

Acquisition of Carrier’s Global Access Solutions Business

On 8th December 2023, Honeywell announced plans to enhance and strengthen its building automation capabilities with the acquisition of Carrier Global Corporation’s Global Access Solutions business for $4.95 billion, in an all-cash transaction.

With approximately 1,200 employees operating in 33 countries, Carrier's Global Access Solutions business is a provider of advanced access and security solutions, electronic locking systems, and contactless mobile key solutions.

This pending sale will allow the business to build on the strength of its leading brands, innovative solutions, strong partner relationships and high growth potential. The acquisition will add three brands to Honeywell’s portfolio with a focus on life safety and digital access solutions, including:

- LenelS2, a leading business for over 25 years in commercial and enterprise access solutions, including well-known offerings OnGuard and NetBox, used by numerous Fortune 100 customers.

- Onity, which offers electronic locks, including hospitality access, mobile credentials, and self-storage access. Nine of the ten top hotel chains are customers.

- Supra’s cloud-based electronic real estate lockboxes offer mobile credentials and access management, as well as a leading digital platform to optimize scheduling for property showings.

The purchase price of $4.95 billion represents ~13x 2023E EBITDA, inclusive of tax benefits and run-rate cost synergies. The transaction is expected to close by the end of the third quarter of 2024, subject to customary closing conditions, including receipt of certain regulatory approvals.

The acquired Carrier security business adds over $1 billion in revenues to Honeywell’s $6 billion Building Automation Business.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.