In this Research Note, we examine the Building Technologies business of Honeywell, based on their 2022 10K Report, investor presentations and building technology-related activities throughout 2022. The growth strategies of the division in sustainability and public safety emergency communications are also highlighted.

Honeywell Building Technologies is a global provider of products, software, solutions, and technologies that enable building owners and occupants to ensure their facilities are safe, energy-efficient, sustainable, and productive. Honeywell Building Technologies products and services include advanced software applications for building control and optimization; sensors, switches, control systems, and instruments for energy management; access control; video surveillance; fire products; and installation, maintenance, and upgrades of systems.

Honeywell Forge solutions enable customers to manage buildings digitally, connecting data from different assets to enable smart maintenance, improve building performance, and protect from incoming security threats.

In the building automation sector, Honeywell Building Technologies (HBT) is one of the top three global providers of building management systems, control products and energy management solutions and services. Their solutions are found in more than 10 million buildings worldwide. 2021 building automation revenues amounted to 58% of HBT divisional revenues, while fire and security revenues accounted for the remaining 42%.

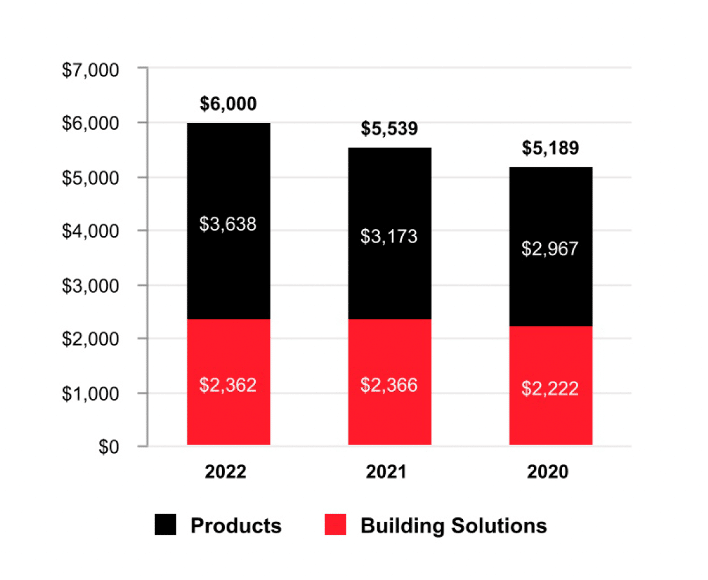

2022 revenues of the Building Technologies division were $6 billion, an increase of $461 million (+8%) compared with 2021. Organic sales grew 14%, led by organic sales growth of $627 million in Products to $3.64 billion and $152 million in Building Solutions to $2.36 billion, primarily due to increased pricing, partially offset by the unfavourable impact of foreign currency translation of $346 million.

HBT segment profit increased $201 million (16.2%) and the segment margin percentage increased 160 basis points to 24.0% compared to 22.4% for the same period of 2021. HBT Service revenues declined to 23.5% of total net sales, compared to 26% in 2021.

Honeywell Building Technologies Net Sales 2020 - 2022

Honeywell reported on two growth strategy initiatives in 2022 for their fire and security and building automation business units.

In their Fire & Security business, the development of a new growth platform to expand the core fire detection business into adjacent areas beyond buildings was covered in our previous article on Mapping the Strategic Direction of Honeywell in the Smart Buildings Space – Part 2.

Honeywell is aiming to use the strength of their core fire detection business to build a new growth platform based on modernizing and digitizing emergency communications infrastructure in the USA. The initiative is targeting a 50%+ CAGR revenue growth between 2021 and 2024.

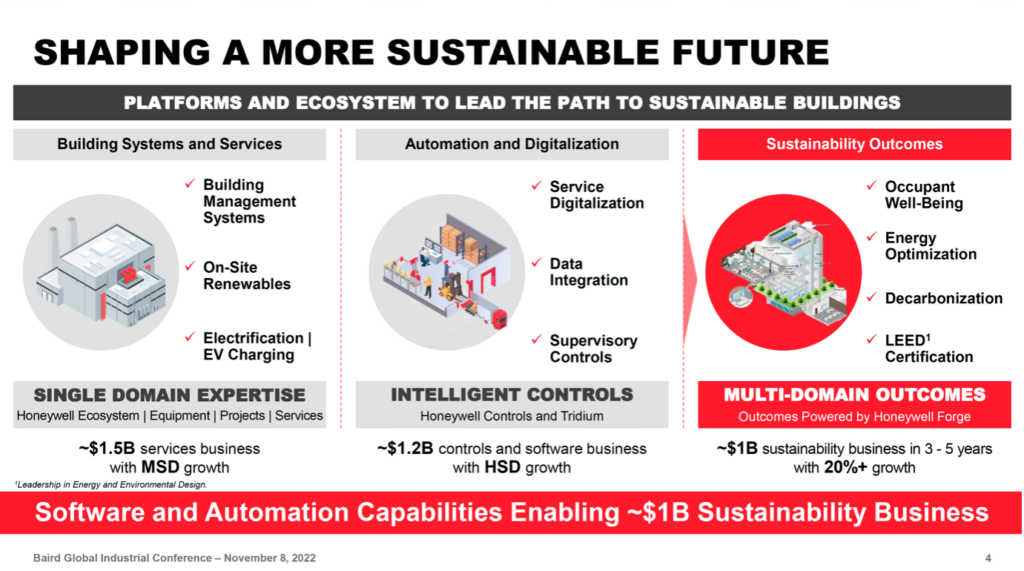

In their Building Automation business, Doug Wright, Honeywell Building Technologies CEO shared some insights into the revenue mix and growth strategy of the division towards Healthy and Sustainable Buildings, at a Baird investor conference on 8th November 2022.

HBT’s $1.5 billion building management systems and services business is projected to grow in mid-single digits, while their $1.2 billion controls and software business, including Tridium, is projected to grow in high single digits. These software and automation capabilities are the foundation for a new Sustainability business unit established in 2022 as a strategic investment to prioritize sustainable buildings.

The business developed as a breakthrough initiative from the healthy buildings focus during the early stages of the pandemic and has now evolved into the dual goals of healthier occupant outcomes and energy savings.

Sustainable Building Technologies develops innovative offerings to reduce the carbon impact of buildings and enable more energy-independent communities, creating healthier spaces for occupants. Leveraging the Honeywell Forge enterprise performance management software solution’s artificial intelligence and machine learning algorithms, the business’ Carbon & Energy Management application autonomously identifies and implements energy conservation measures to help drive efficiency, resiliency, and accountability throughout a real estate portfolio. It continuously investigates, analyzes and optimizes building performance, down to an asset-specific level, measuring critical sustainability-related key performance indicators, including carbon emissions.

The CEO commented that the high-growth regions are currently leading the Sustainability initiative in that they are more biased towards new construction projects. China is probably the most aggressive in introducing technology in buildings to manage their carbon commitments and the Middle East has also become very focused on greening their buildings. The adoption of new technology in new construction is more straightforward than in an aftermarket situation for existing building stock.

Honeywell aims to grow the HBT sustainability business to +$1B in 3-5 years with a 20%+ top line CAGR, which underscores the division’s acceleration in revenue growth announced during Investor Day in March 2022.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.