This article was written by Daphne Tomlinson, Independent Senior Research Associate at Memoori.

New entrants are exerting their influence on the smart buildings space in several areas – in the number and diversity of startups, the increase in investments, acquisitions and partnerships and the shift in focus to solutions aimed at building occupants.

Memoori’s new report on Startups and Their Impact on Smart Buildings 2019 demonstrates how new entrants are changing the smart buildings landscape.

In the report, we define a startup as a private company formed no earlier than 2009 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company nor listed on any major stock exchange and is often financed by venture capital or private equity funding.

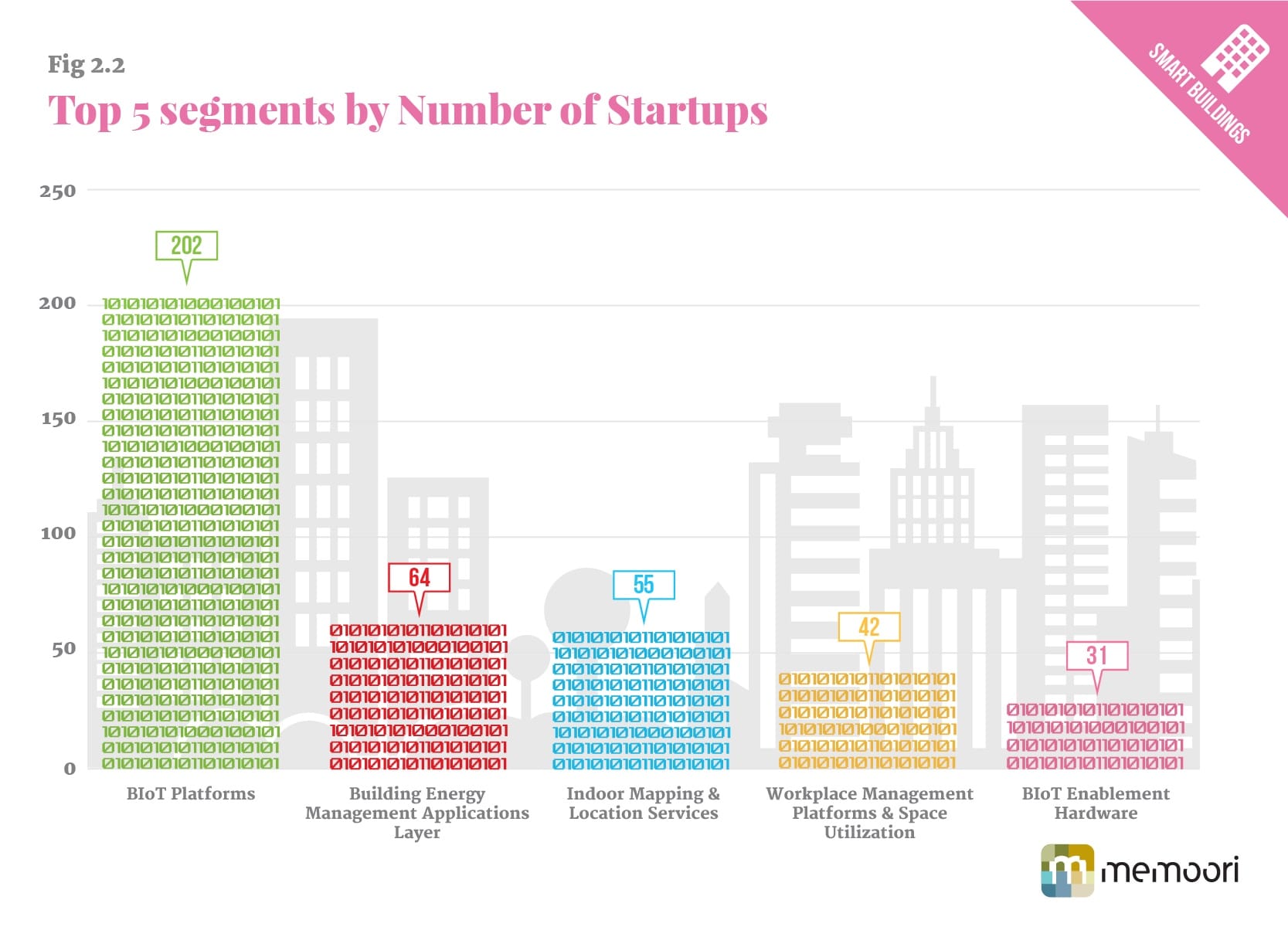

With over 600 active new entrants in the smart commercial buildings sector, including those who have been acquired or taken the IPO route since 2009, the landscape has become crowded, but we are still seeing businesses entering the market with no apparent slowdown.

The adoption of PropTech solutions has been evident and will continue to exert a major influence in 2019. PropTech is triggering a new era of opportunity in commercial real estate, even though many of the new entrants are focused on innovation outside the scope of our report. We limit our definition of PropTech to products, solutions and services, which address the management and utilization of Commercial Real Estate.

PropTech areas excluded include companies providing technology and tools to construct, find, purchase, evaluate, finance and lease property. Even so, we estimate that between 30-40% of proptech startups are addressing the management and utilization stage in the lifecycle of a building asset.

Our report demonstrated that the last 2 years accounted for almost 60% of all smart building startup acquisitions tracked since 2012, showing a clear trend towards consolidation in 2018. This has continued into the first month of 2019, with three acquisitions of startups already announced: WeWork’s acquisition of Euclid, Buddy Platform’s acquisition of LiFX and Tendril’s acquisition of EEme.

Smart building innovators can expect to be closely followed by all the stakeholders in the built environment: those involved in supplying software, solutions and services for building technology infrastructure, commercial real estate operations, facilities management, IT, telecommunications and energy services.

With VC and PE investment pouring into smart building innovation, there has also been an increased level of support for specialized venture funds and incubators by established incumbents in the sector.

Beyond financial investment in new entrants, the trend identified in Memoori’s latest analysis is for established solution providers to collaborate with startup companies, with a focus on flexible, early-stage, open-ended partnerships.

One of the most far-reaching consequences, which can be attributed to the impact of new entrants in the smart commercial buildings space, has been the shift in focus to employee productivity and engagement. For many years, vendors of commercial building systems based their value propositions on technology and energy efficiency alone, with little attention given to the building users.

With the advent of human-centricity, particularly in the workplace, simpler solutions spearheaded by new entrants targeting occupants with apps, bring a consumer-like experience to commercial buildings that had been lacking in the past and also enable more direct interaction with buildings, which can contribute to increasing employee productivity and engagement.

We believe consolidation and collaboration is set to continue for the next 2 to 3 years as more and more companies look to add IoT capabilities to their offerings, incumbents look to redefine their business models and attempt to remain competitive in the light of new market entrants.