This Report is a New 2023 Definitive Resource for Evaluating the Smart Building & PropTech Landscape.

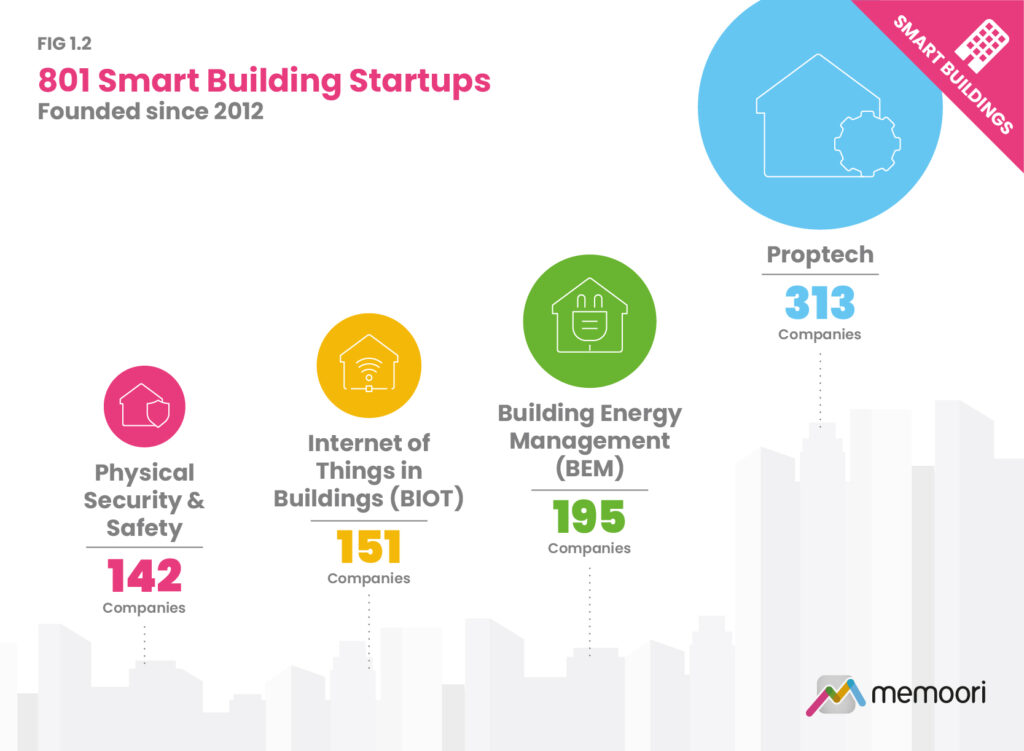

Of the 1,266 companies founded since 2012 in the management and operations phase of the global smart commercial buildings space, 801 are active and fit our definition of a Startup. This report selects 100 startups for further analysis that have gained traction in the last 2 years across 10 major segments.

Our definition of a Startup is “a private company formed no earlier than 2012 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company and is often financed by venture capital or private equity funding.”

The report INCLUDES at no extra cost, a presentation file with high-resolution charts from the report. This report is also included in our 2023 Premium Subscription Service.

What does this Report tell You?

- The number of companies identified which fit our definition has increased by 20% compared to the 665 startups in the 3rd edition of this report published in 2021. The smart building startup landscape is continuing to expand, but at a slower rate than in 2021, when we saw a 38% increase in the number of new entrants founded.

- A further 352 startups have been acquired between 2012 and 2022 – 28% of the total. See our January 2023 Report for further details.

- Non-operational and closed startups account for around 6% of the total landscape.

The information and analysis in this report is based on research and interviews with emerging players in the Smart Building Space. It benefits from Memoori’s previous reports over the last 2 years on subjects such as the Building Internet of Things (BIoT), Cyber Security, Physical Security and the Digital Workplace.

It demonstrates the critical contribution that Startups are making to the introduction of innovation in Smart Buildings & PropTech spaces.

Within its 103 Pages and 42 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand what the StartUp Landscape looks like in 2023 and how these Companies are Shaping the Future of PropTech.

The report shows how technology segments gaining traction are impacted by the increased demand for climate-related technologies to address energy efficiency, grid interactive buildings and carbon emissions management in commercial real estate.

For only USD $2,000 this report provides valuable information for all stakeholders and investors to assess the impact and range of companies in all growth sectors of the smart buildings space.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startup companies will find it particularly useful. Want to know more? Download the Brochure.

Table of Contents

- Executive Summary

- 1. The Global Smart Buildings Landscape of Startups

- 1.1 Technology Categories for Smart Building Startups

- 1.2 Overview of New Entrants

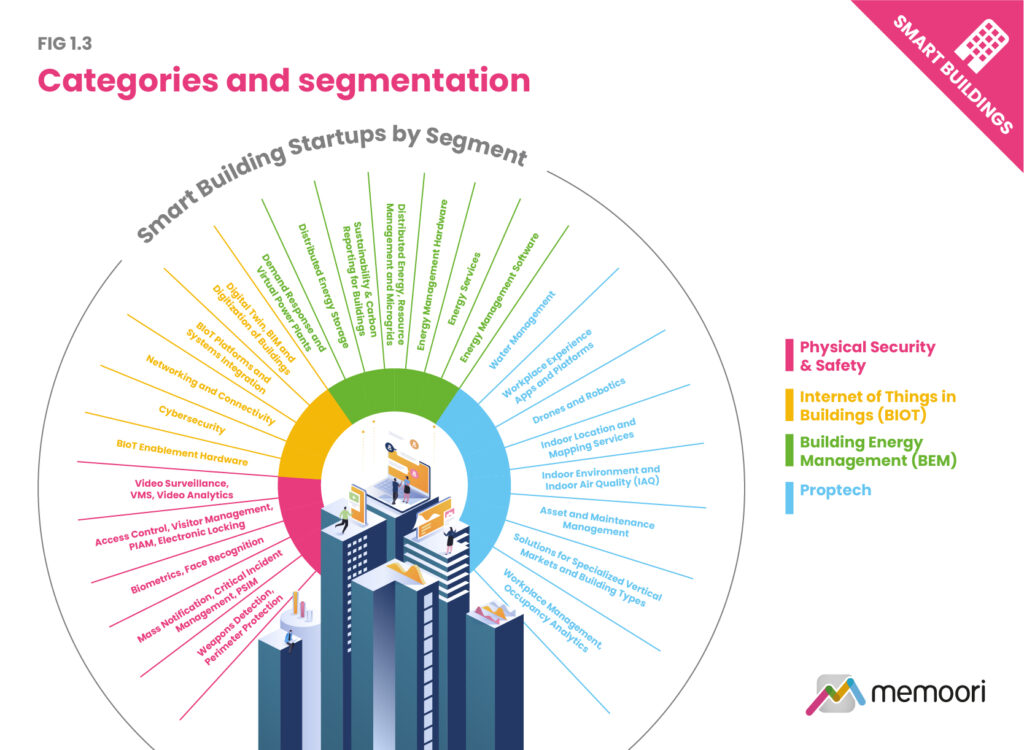

- 1.3 Categories and Segmentation

- 1.4 Smart Building Startups by Segment

- 1.5 Regional Distribution of Startups

- 2. Smart Building Startups Gaining Traction

- 2.1 Internet of Things in Buildings (BIoT)

- 2.1.1 Building IoT Platforms

- 2.1.2 Digital Twin Solutions

- 2.2 Building Energy Management

- 2.2.1 AI-Powered HVAC Optimization

- 2.2.2 Sustainability and Carbon Management

- 2.2.3 Renewable Energy Management

- 2.3 PropTech

- 2.3.1 Asset Management and Maintenance

- 2.3.2 Occupancy Analytics

- 2.3.3 Solutions for Specific Vertical Markets

- 2.4 Physical Security

- 2.4.1 Access Control

- 2.4.2 Video Analytics

- 2.1 Internet of Things in Buildings (BIoT)

- 3. Startup Closures

- 3.1 Non-Operational Startups and Closures

- 3.2 Layoffs and Redundancies

- 4. Future Outlook for Startups

List of Charts and Figures

- Fig 1 The Global Smart Building Landscape of Startups

- Fig 1.1 Technology Categories for Smart Building Startups

- Fig 1.2 801 Active Smart Building Startups Founded Since 2012

- Fig 1.3 Categories and Segmentation

- Fig 1.4 Smart Building Startups by Segment

- Fig 1.5 Regional Distribution of Startups

- Fig 2 Smart Building Startups Gaining Traction

- Fig 2.1 Internet of Things in Buildings (BIoT) Landscape

- Fig 2.1.1 BIoT Platforms Landscape and Startups Gaining Traction

- Fig 2.1.2 Digital Twin Solutions in Buildings Landscape and Startups Gaining Traction

- Fig 2.2 Building Energy Management Landscape

- Fig 2.2.1 AI-Powered HVAC Optimization Startups Gaining Traction

- Fig 2.2.2 Sustainability & Carbon Management Startups Gaining Traction

- 2.2.3 Renewable Energy Management Startups Gaining Traction

- Fig 2.3 PropTech

- Fig 2.3.1 Asset Management & Maintenance Startups Gaining Traction

- Fig 2.3.2 Occupancy Analytics Startups Gaining Traction

- Fig 2.3.3 Retail Sector Startups Gaining Traction

- Fig 2.4 Physical Security in Buildings Landscape

- Fig 2.4.1 Access Control Startups Gaining Traction

- Fig 2.4.2 Video Analytics Startups Gaining Traction

- Fig 3.1 10 Closed Startups since 2021

- Fig 3.2 Layoffs & Redundancies in the Smart Building Space

Companies Mentioned INCLUDE (BUT NOT LIMITED TO);

75F | Accacia | Aedifion | AiFi | Akila | Alcatraz AI | Ambient.ai | Animated Insights | Arloid Automation | Audette | AvidBeam | Awiros | Axiom Cloud | BeamUP | Brainbox AI | Candi Solar | Cape Analytics | Carbon Title | Cleanwatts | Cleartrace | Cloudpick | Cohesion | Dabbel | David Energy | Deepki | Defigo | DeltaQ | Density | Einhundert Energie | Enerbrain | Enviria | Envoy | Estate Logs | Facilio | Faradai | FlexiDAO | Frequenz | Grabango | Grid Edge | Haltian | Hysopt | iLobby | Infogrid | Infraspeak | Invicara | Jooxter | KODE Labs | Kogniz | LevelTen Energy | Locatee | Mapiq | Measurabl | Metrikus | Myrspoven | Nostromo | OakTree Power | Oloid | Origami Energy | Oriient | Parakey | Passive Logic | Phaidra | Placer | PlanRadar | Plentific | Pluxity | Pupil | R8Tech | Robin | Sensei | Sharry | Simplifa | Singularity | Smarten Spaces | SmartViz | SpaceOS | Spaceti | Spintly | SpinView | Spot AI | Spotr | Standard AI | Staqu Technologies | SwiftConnect | Swiftlane | Tallarna | Terminus Technologies | Thing Technologies | Thoughtwire | Trigo | Uptick | Vantiq | Veesion | VergeSense | Verkada | Viisights | Visionary.ai | WeMaintain | Willow | Wtec SmartEngine | XY Sense | Zippin