This report is a new 2022 study on the global market for digital workplace solutions and is our 3rd comprehensive evaluation of workplace experience and occupancy analytics for commercial office space.

Technology-based user experience in commercial office space is becoming the norm as countries start to remove COVID restrictions. As the digital workplace takes shape in businesses worldwide with a revised set of working styles, be that remote working, hybrid working, or flexible working, changes will necessitate enhanced technology to enable data-driven decision making about the use of office space.

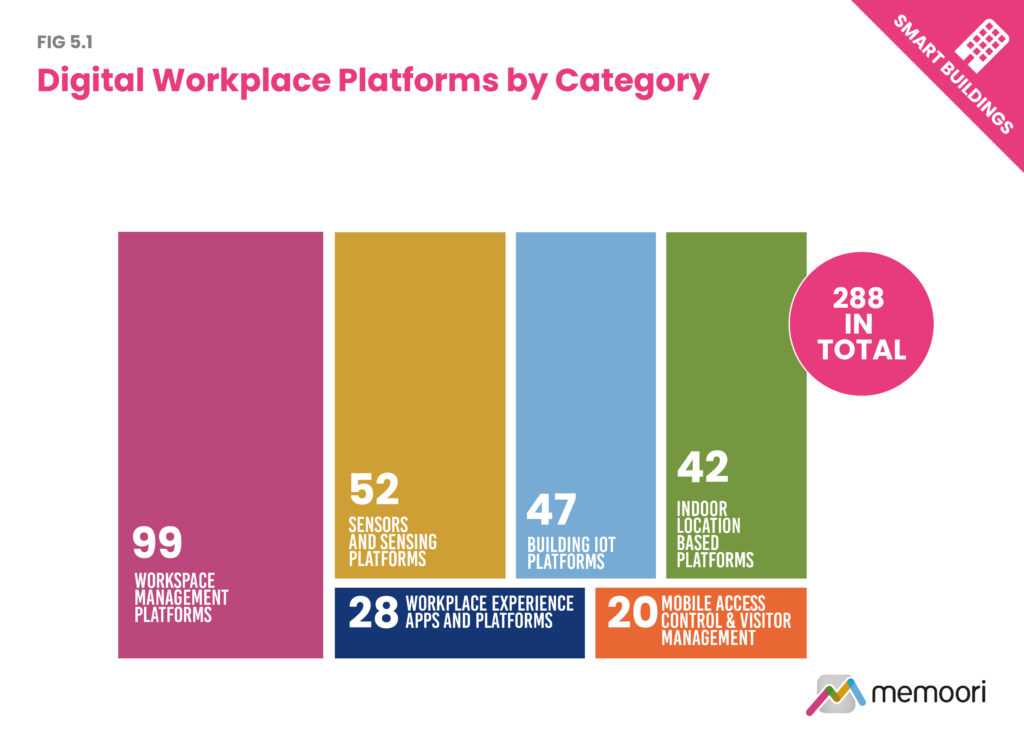

Many new tools have emerged on the market to secure the health and safety of building occupants, simplify the management of offices, optimize their occupancy and improve workplace experience, collaboration and productivity; all while space and schedules are being desynchronized. This report seeks to bring clarity and order to an innovative PropTech market where 288 vendors are vying to increase their market share and lead the disruption of commercial real estate.

The report evaluates the size and structure of the global digital workplace market, breaks down size by geographic region, and forecasts sales to 2026. It INCLUDES at no extra cost, spreadsheets listing all major vendors, deployments, acquisitions, and investments, AND a graphics pack with high-resolution charts from the report.

Key Questions Addressed:

- What is the size and structure of the global digital workplace market? The report has an assessment of the global market size in 2021 and forecast to 2026 and an evaluation of the major platforms in use.

- What are the main drivers for industry growth? This report assesses the main industry drivers, barriers to growth and key regulatory trends. It also includes an overview of use cases and deployments in office buildings.

- What does the competitive landscape look like? There is an analysis of the markets supply side structure and comprehensive coverage of M&A and investments over the last 2 years.

At Memoori, we have decades of experience in the evaluation of building technology markets, and regularly publish reports on several areas of PropTech including Workplace Experience Apps, Building Internet of Things, StartUps in Smart Buildings, AI and Machine Learning and Physical Security. This has given us a solid grounding on which to build our growth projections.

The methodology employed to conduct this research was a combination of bottom-up and top-down analysis, including interviews with established incumbents and emerging players and extrapolated analysis of the market specific to commercial office buildings.

Within its 171 Pages and 28 Charts and Tables, The Report Presents All the Key Facts and Draws Conclusions, so you can Understand what is Shaping the Future of the Workplace:

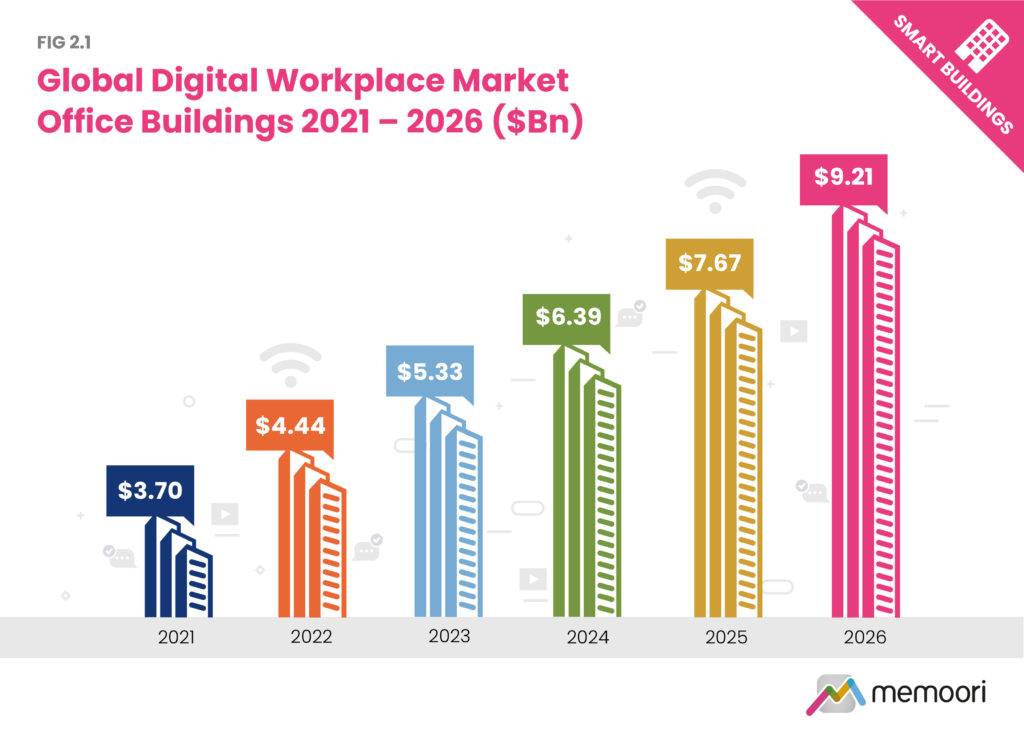

- The Global Digital Workplace market in commercial office space is estimated at $3.70 Billion in 2021, rising to $9.21 Billion by 2026, growing at a rate of 20% CAGR.

- In the last two years, the number of companies in the digital workplace sector has shown a 30% increase with 288 firms in our current analysis compared to 221 suppliers identified in the 2nd edition of this report.

- The digital workplace sector is a rapidly evolving market opportunity within commercial real estate. The market is in the early stages of maturity, having seen considerable activity over the past two years accelerated by the COVID-19 pandemic. Companies need new ways to deliver an environment in the post-pandemic era that the modern workforce demands.

Starting at only USD $2,500 for a single user license this report provides valuable information so companies can improve their strategic planning exercises AND look at the potential for developing their business through merger, acquisition, and alliance.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in workplace technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful. Want to know more? Download the Brochure.

Table of Contents

- Preface

- Executive Summary

- 1. Introduction

- 1.1 De-Densification of the Office and Hybrid Working

- 1.2 Research Scope and Methodology

- 1.3 Key Definitions

- 2. The Global Market in Office Buildings

- 2.1 Market Overview

- 2.2 Global Market Size 2021 and Forecast to 2026

- 2.3 Breakdown of Geographic Regions (EMEA / North America / Asia

- 3. Applications and Use Cases

- 3.1 Safety and Security

- 3.2 Finding

- 3.3 Communication

- 3.4 Personalization

- 3.5 Optimize

- 3.6 Control and Conserve

- 4. Deployments in Office Buildings

- 5. Platforms and Hardware

- 5.1 Workspace Management Platforms

- 5.2 Workplace Experience Apps and Platforms

- 5.3 Indoor Mapping and Location Platforms

- 5.4 Building IoT and Connected Lighting Platforms

- 5.5 Mobile Access Control and Visitor Management Systems

- 5.6 Sensors and Sensing Platforms

- 6. Drivers for Growth

- 6.1 Hybrid Working

- 6.2 Flexible Offices

- 6.3 Employee Experience and Occupant Centricity

- 6.4 Healthy Buildings

- 6.5 Internet of Things in Buildings

- 6.6 AI and Machine Learning

- 7. Barriers to Growth

- 7.1 Landlord / Commercial Occupier Disconnect

- 7.2 Implementation Costs and Return on Investment (ROI)

- 7.3 Privacy, Security and Trust

- 7.4 Diverse Range of Technologies, Vendors and Solutions

- 8. Key Regulatory Trends

- 8.1 Relevant Legislation

- 8.2 Smart Building Standards and Certification

- 8.3 Workplace Experience and Wellness Standards

- 9. Structure and Competitive Landscape

- 9.1 Routes to Market

- 9.2 Competitive Landscape

- 10. M&A, Investments and Partnerships

- 10.1 Mergers and Acquisitions

- 10.2 Venture Capital Funding and Private Equity Investments

- 10.3 Technology Partnerships and Ecosystems

- 1. Introduction

Appendix

- A1 – Digital Workplace Supplier Listing

- A2 – Deployments in Office Buildings

- A3 – Mergers and Acquisitions Jan 2020 – Dec 2021

- A4 – Venture Capital and Private Equity Funding Jan 2020 – Dec 2021

List of Charts and Figures

- Fig 1.1 – Average Peak Occupancy Rate in Global Offices Week by Week August – November 2021

- Fig 2.1 – Global Digital Workplace Market Office Buildings 2021 – 2026 ($Bn)

- Fig 2.2 – Digital Workplace Market by Region, Office Buildings 2021 – 2026 ($M)

- Fig 2.3 – EMEA Digital Workplace Market, Office Buildings 2021 – 2026 ($M)

- Fig 2.4 – North America Digital Workplace Market, Office Buildings 2021 – 2026 ($M)

- Fig 2.5 – Asia Pacific Digital Workplace Market, Office Buildings 2021 – 2026 ($M)

- Fig 3.1 – Use Cases Defined by Smart Building Attributes

- Fig 3.2 – Use Cases of Workplace Experience Apps

- Fig 5.1 – Digital Workplace Platforms by Category

- Fig 5.2 – Workspace Management Platforms including Room and Desk Booking and IWMS

- Fig 5.3 – Workspace Management Platforms

- Fig 5.4 – Room & Desk Booking

- Fig 5.5 – Integrated Workplace Management Platforms (IWMS)

- Fig 5.6 – Workplace Experience Apps and Platforms

- Fig 5.7 – Indoor Mapping and Locations Platforms

- Fig 5.8 – Building IoT and Connected Lighting Platforms

- Fig 5.9 – Mobile Access Control & Visitor Management

- Fig 5.10 – Sensors and Sensing Platforms

- Fig 6.1 – Hierarchy of Real Estate Needs

- Fig 6.2 – Commercial Smart Building IoT Device Projections by Vertical Market (2020 – 2025 Millions)

- Fig 6.3 – Commercial Smart Building related IoT Devices by Application (2020 – 2025 Millions)

- Fig 6.4 – AI and Machine Learning Offerings by Use Case

- Fig 9.1 – Geographic Distribution of Digital Workplace Vendors

- Fig 9.2 – Number of Smart Building Startups by Segment 2021

- Fig 10.1 – Digital Workplaces M&A 2016 – 2021

- Fig 10.2 – Digital Workplace VC and PE Funding 2016 – 2021

List of Tables

- Table 5.1 – Definition of Platform and Hardware Categories

- Table 8.1 – Wellness and Workplace Employee Experience Standards and Certification

- Table 9.1 – Highest Venture Capital Funding Rounds by Value 2020 – 2021

Companies Mentioned INCLUDE (but NOT Limited to);

12CU Smart Spaces | 4Site | 75F | 9am | ABB | Accruent | Acuity Brands | Agilquest | Allthings | Altacogni /Yanzi | Appspace | Archibus | Armored Things | Aruba Networks | AssetWorks | Axonize | Basking Automation | Beringar | bGrid | Bosch | Brivo | Buro Happold | Butlr Technologies | Causeway Technologies | CBRE | Cisco | Cognian Technologies | Cohesion | Condeco Software | Convene Workplace | Coor | Coworkr | Cree Lighting | CrowdComfort | Cureoscity | CXApp | Delta Controls | Density | Deskimo | Disruptive Technologies | District Technologies | Doordeck | Eden Workplace | En-Trak | Envio Systems | Envoy | Equiem | Esri | essensys | Eutech / Iviva | Fabriq OS | Fagerhult | FLIR Systems | Flowscape | FM:Systems | Freespace | FSI | GoSpace AI | Greenwaves Technologies | Greetly | Haltian | HB Reavis | Healthy Workers | Helix RE | Herman Miller | HID Global | Hilo | Hipla Technologies | Honeywell | HqO | Humanyze | IBM | Igor | ilobby | Indoor Ninja | Infogrid | infsoft | Ingy | InnerSpace | Inpixon | iOffice | Irisys / True occupancy | Ivani | IWG | JLL | Joan | Johnson Controls | Jooxter | Kaarta | Kastle Systems | Kisi | Kloudspot | kontakt.io | Korbyt | Kuban | L&T Technology Services | Lane | Latch | Lightfi | LMG Building Intelligence | Locatee | Lone Rooftop | Mapiq | MappedIn | Maptician | Mapwize | Mapxus | MazeMap | Metrikus | Microsoft | Mist Systems | Mitie | MOD.CAM | Modo Labs | Moffi | MRI Software | Navigine | Navisens | NavVis | Nexkey | NextNav | Nexudus | NFS Technology | Nomad Go | Novelda | Nspace | Nube IO | NuLEDS | Office App | OfficeMaps | OfficeRnD | OfficeSpace Software | OfficeVitae | Openpath Security | OpenSensors | Optix | Digital Lumens | PeopleSense by IRLynx | Pinestack | Planon | Platformatics | Pointgrab | Pointr | Prescriptive Data | Pressac | Priva | Prolojik | Pronestor | ProSpace | Proximi.io | Proximity Space | Proxy | ProxyClick | Quanergy | Quuppa | R-Zero | Rapal | Relogix | Ricoh | Rigado | Robin | Ronspot | Saltmine | Satellite DeskWorks | Schneider Electric | Seatti | Semana | Sembient | Senion | Senseagent | Sense_ | Sensorberg | Sequr, now Genea | Serraview | ServiceNow | Service Works Global | SharingCloud | Sharry | Shuwei | Sidewalk Labs | Siemens Workplace Technologies | Signify | Silvair | Sine | Situm | Smart Spaces OS | SmartEagle | Smarten Spaces | SmartSpace Global | SmartSpace Software | Smartway2 | Space Platform | SpaceConnect | Spaceflow | SpaceIQ | Spaceology | SpaceOS | Spacesforce | Spaceti | SpaceTrak | Spacewell | SpatialDNA | SPICA Technologies | Steelcase | Steerpath | Steinel | SwiftConnect | Synconext | Tactic | Tango Analytics | Terabee | Thingdust | Thing-it | Thoughtwire | Tmpl Solutions | Traction Guest | Trimble | UbiqiSense | VergeSense | View | Visioglobe | Vlogic Systems | VTS Rise | WeWork | Willow | Wisp by Gensler | Witco fka MonBuilding | WorkGrid | WorkMesh | Workvivo | Wrld3D | wtec smartengine | WukongBox | Wx | Xandar Kardian | Xicato | Xovis | XY Sense | Yardi | Zan Compute | ZapfloorHQ | Zerv Access Solutions | Zlink | Zonifero | Zumtobel

Download the Brochure or Contact us Directly to Discuss Alternative Payment Options.