Since 2017, we have tracked around 970 funding rounds worldwide across the smart buildings space which has attracted over $16.5 billion in disclosed capital investment by venture capital, private equity and corporate investors.

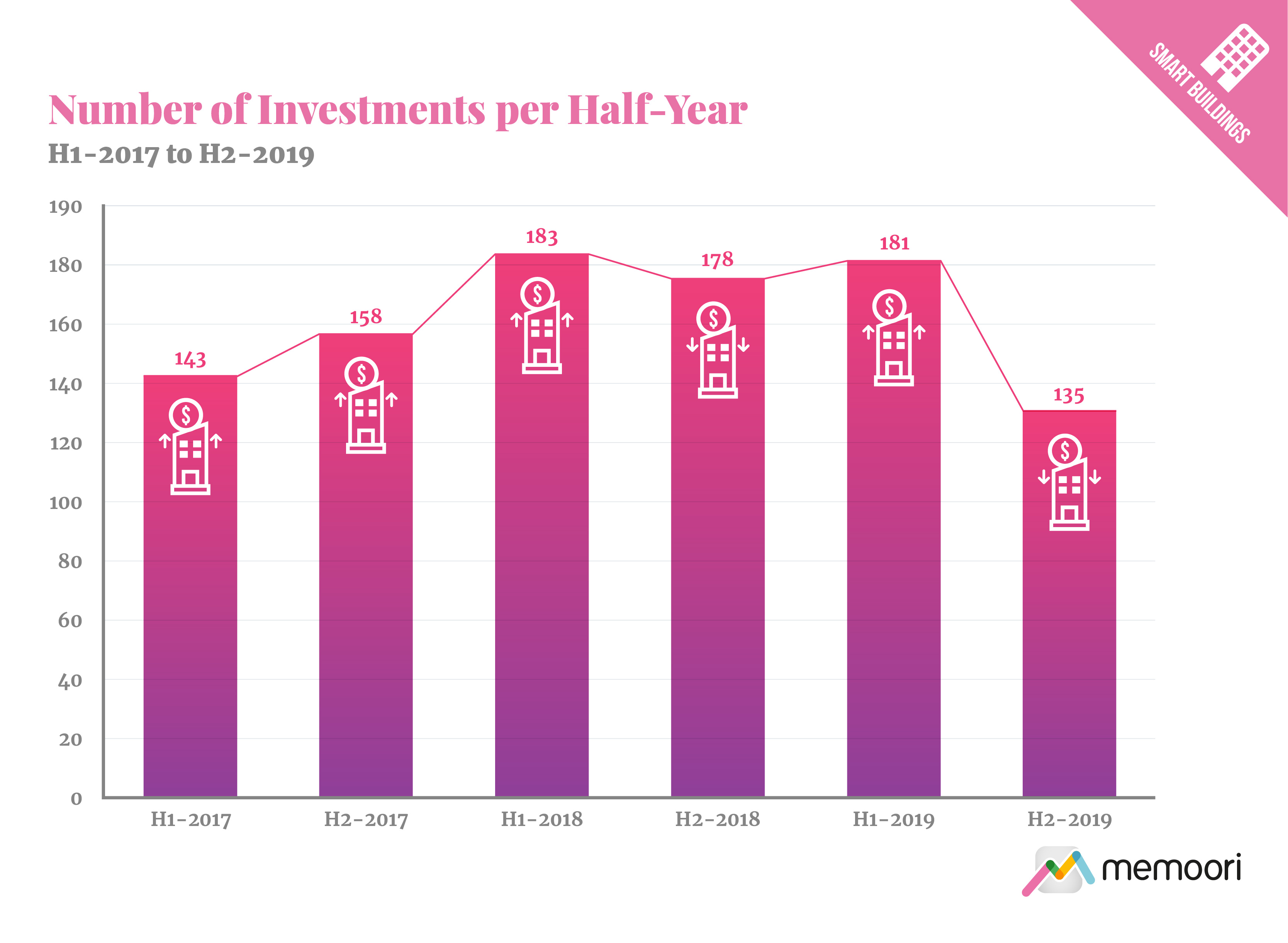

Investment in 2019 amounted to $5.4 billion spread over 316 funding rounds. This is around 31% lower than the record level of $7.8 billion capital investment over 361 rounds in 2018, but a 61% increase on the 2017 level of $3.3 billion spread over 301 rounds.

Of the 970 investments over the past three years, 54% were to companies located in North America, reflecting the comparative ease with which firms based in the USA and Canada can gain funding. Companies based in Europe and the Middle East accounted for 35% of the total number of funding rounds while firms in the Asia Pacific region accounted for 11% of the total.

The data in our new report reveals an unprecedented rise in global investment since 2017, which is confirmation of a shift in the slowly evolving smart buildings space.

With the number of funding rounds rising to over 300 per annum, the heightened level of activity maintained over the last three years is a significant indicator of the growing acceptance and adoption of intelligent building technology.

It shows increased confidence by investors in the sector and indicates the positive response startups and established players are receiving for their products and services in the smart buildings marketplace. We predict that funding will continue at current levels into 2020.

At 70 pages with 11 charts & tables & ONLY $1,500 USD for a single user license, M&A and Investments in Smart Buildings H2 2019 includes 20 company profiles of acquisitions and investments together with 20 profiles of buyers and investment firms, presenting our view of their respective strategies and significant M&A or investment activity. Updates are published every 6 months.