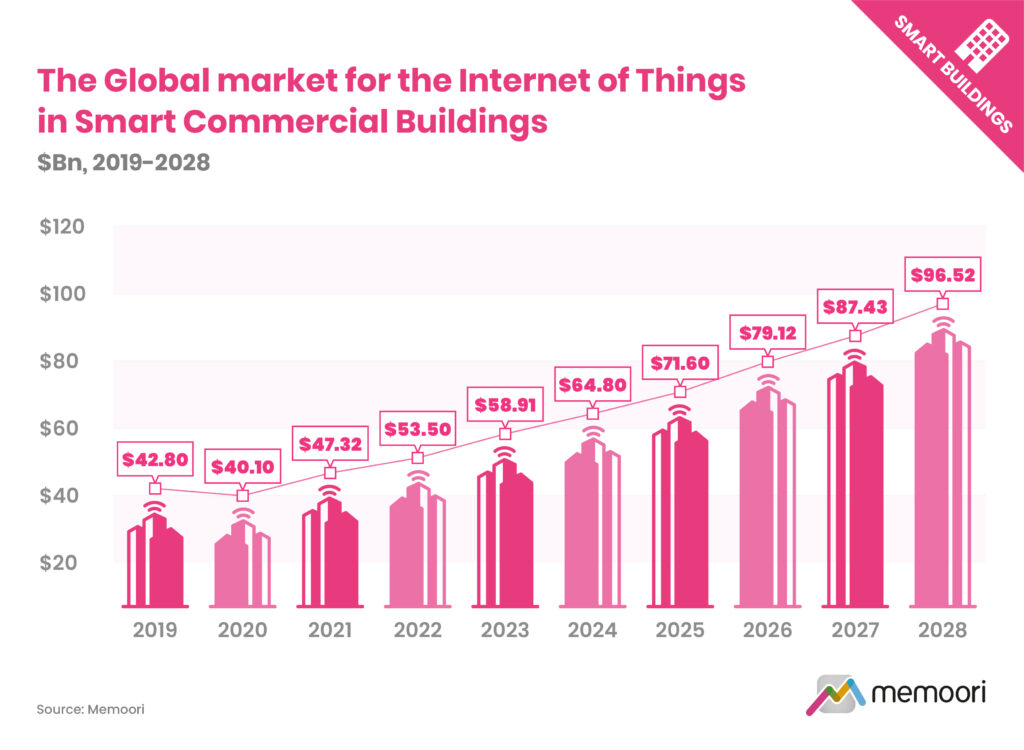

Our latest analysis indicates that the Internet of Things market in Smart Commercial Buildings (BIoT) grew to $53.5 billion in 2022, representing a 13% rise from 2021. Performance was slightly down from our forecast of 13.8% for the year due to several factors, including a slower-than-anticipated overall economic recovery, a lack of chipsets, and disrupted supply chains.

Memoori forecasts that the BIoT market size will grow at a CAGR of 10.33% to $96.5 billion between 2022 and 2028.

IoT market adoption is being driven in large part by real estate stakeholders investing to improve the sustainability credentials of their assets and also to enhance their performance, resulting in better rent and yields. Rising energy costs are also putting more focus on energy-efficient technologies and sustainable solutions are likely to remain a significant priority for many companies.

The building sector is making progress towards sustainable development and reducing energy consumption. The EIA’s 2018 CBECS consumption and expenditures survey found that commercial buildings consumed 12% less energy per square foot of floorspace in 2018 than in 2012. However, the building sector still falls short of the targets required for sustainable future development, as buildings and building construction contribute to one-third of global energy consumption and almost 40% of CO2 emissions.

To achieve net zero by 2050, building owners and operators must redouble their efforts in new construction and retrofits. The IEA is now calling for an increase in retrofit rates of 2.5% annually by 2030, up from less than 1% today.

A significant barrier to growth is cybersecurity as some smart commercial buildings are increasingly susceptible to cyber attack. Smart building systems and devices often lack dynamic patching capabilities, and facilities management teams may lack the IT skills required to manage cybersecurity.

The Building Internet of Things market is complex and multifaceted, involving a wide range of players from traditional building automation companies to specialized manufacturers, ICT vendors, property firms, and software vendors offering middleware, platforms, and cloud-based data analytics services. While some companies offer end-to-end BIoT solutions, others specialize in specific areas such as data intelligence, automation, or energy optimization and analytics.

The smart commercial building startup landscape is also expanding rapidly, with a 20% increase in the number of new entrants founded since 2021. Consolidation is expected in the wider platforms space, but there remain considerable market opportunities for cloud-based software offerings for specialist applications or vertical markets.

While the level of fragmentation in the BIoT market can act as a source of confusion and frustration for buyers, leading platform solution providers are beginning to emerge, and the user base seems likely to coalesce around a more limited number of platform providers.