In this Research Note, we examine Legrand Group, from the perspective of its latest financial results, strategic roadmap and acquisitions, based on investor presentations and their 2022 Universal Registration Document.

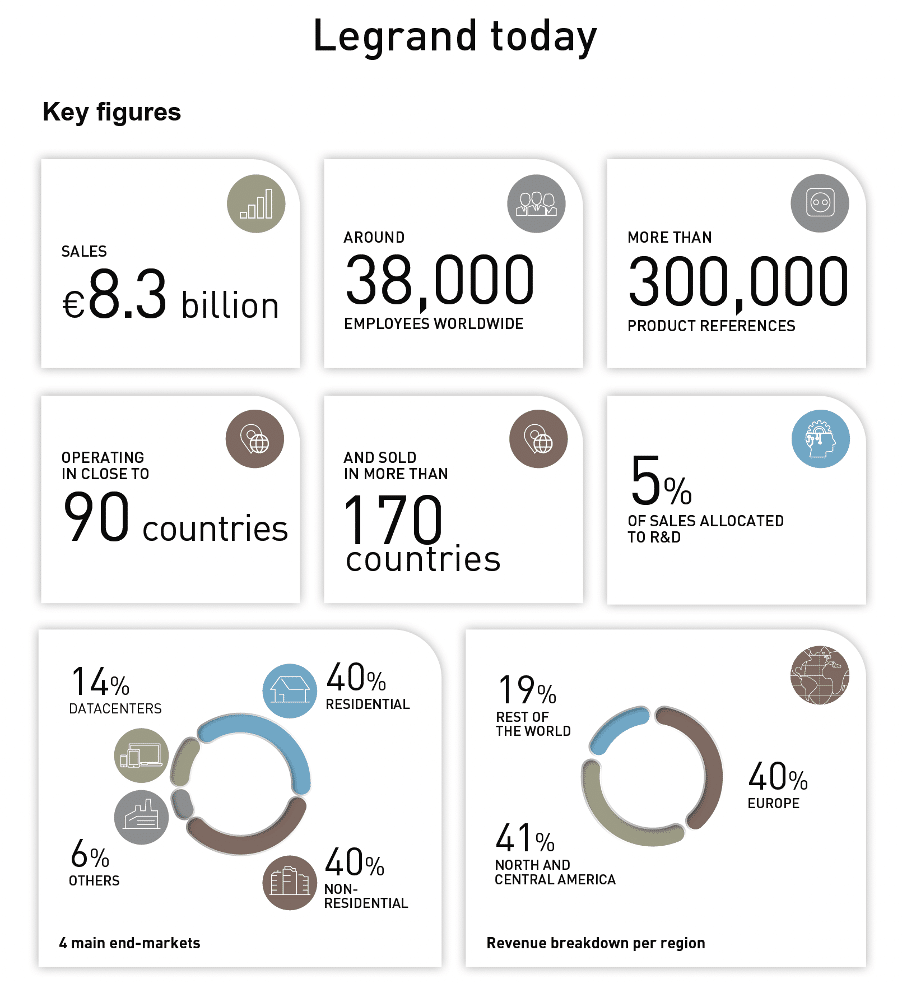

Legrand positions itself as the only global specialist in electrical and digital building infrastructure, with the largest product offering on the market. Legrand offers a wide range of more than 300,000 products and solutions in over 100 product families. As a giant in profitable niches, Legrand leads as the number 1 or number 2 player in product areas such as wiring devices, emergency lighting, architectural lighting and door entry systems.

Almost all of its sales relate to buildings:

- Residential spaces: less than 40% of sales in 2022, with half coming from the renovation segment;

- Datacenters: around 14%;

- Non-residential spaces (offices, hotels, healthcare, education, etc.): more than 40%, with half coming from the renovation segment; and

- Other spaces (including industrial sites and infrastructure): around 6%.

Legrand generated sales of nearly €8.3 billion in 2022, a significant annual increase of +19.2%. This performance reflects the Group’s solid business momentum and pricing power, with very active supply chain management against the backdrop of supply disruptions.

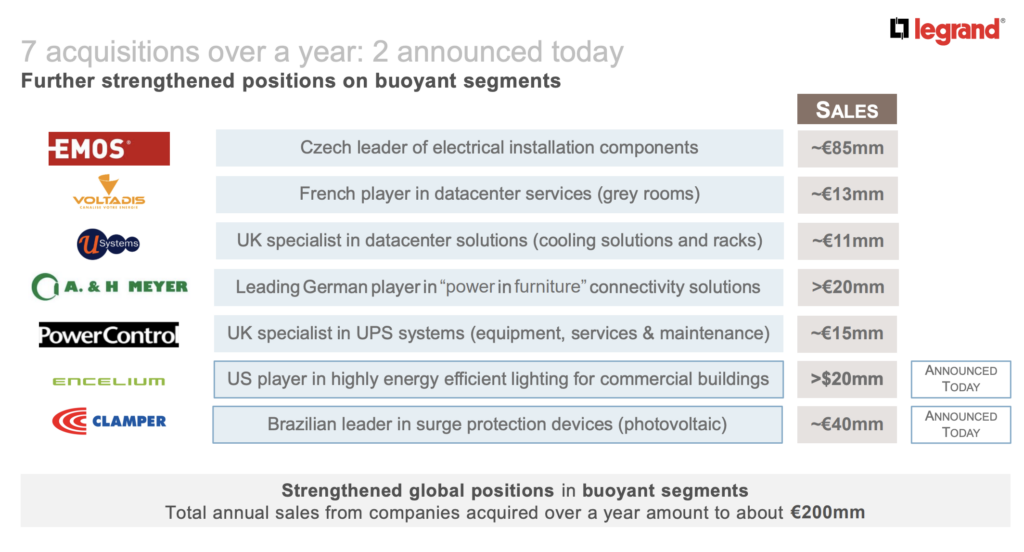

The group also continued to increase their market share in promising markets by means of targeted acquisitions, with seven companies joining Legrand in the space of one year.

Legrand announced the acquisition of Encelium on 6th December 2022. A US manufacturer of energy-efficient lighting for commercial buildings with annual sales of over $20 million, the firm is based in Boston (Massachusetts). The acquisition comes as part of Legrand’s ongoing global strategy to further strengthen its position in the commercial lighting control sector.

Encelium will become part of Legrand’s Building Control Systems division, which operates in North and Central America. With its in-fixture control options, site lighting, and DALI controls, Encelium will enhance Legrand’s offering with an expanded portfolio of solutions, alongside brands including Wattstopper, Legrand Shading, and Vantage.

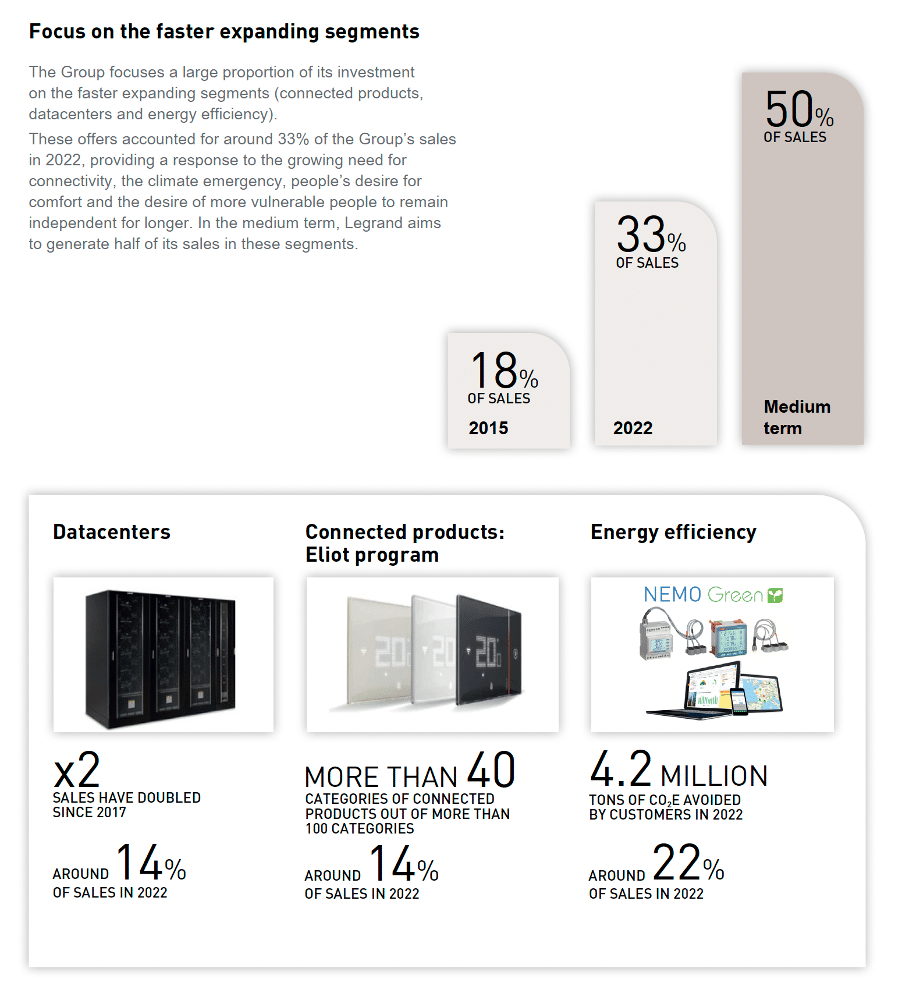

In addition to its traditional growth levers, Legrand has taken a targeted approach to three faster expanding segments which provide above market growth – Datacenters, Energy Efficiency and Connected Products. Underpinned by this strategy, sales in these faster expanding segments rose from around 18% in 2015 to 33% in 2022.

As part of its strategic roadmap, the Group has set itself the target of generating around 50% of its sales in these segments.

The Eliot program was launched in July 2015 to speed up deployment of the Internet of Things within the Group’s offering and thereby enable Legrand to be a major player in connected products in buildings. The program accounted for around 14% of sales in 2022. The number of connected product families has doubled since launch to more than 40.

In 2022, Legrand sales from connected products accounted for around €1.2 billion and broke down into a balanced split by vertical, with offerings for:

- Residential spaces, for example consisting of user interfaces, power protection panels, door-entry systems, smart thermostats, etc.;

- Non-residential (commercial buildings), for example consisting of Digital Lighting Management solutions, smart emergency lighting, energy consumption metering systems, etc.; and

- Datacenters, for example smart Power Distribution Units, busways with metering, Uninterruptible Power Supplies, etc.;

The Group’s strategy aims to democratize connected buildings (i.e., bring them to the mainstream) through products known for their ease of installation and configuration as well as their modularity. They are particularly well suited to small and medium-sized buildings.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.