The UK saw the biggest drop in retail sales since records began 30-years-ago, despite record increases in grocery sales, especially alcohol. In March, US retail sales also slumped to their worst monthly decline since records began in 1982, despite record grocery retail numbers.

Both these markets delayed the start of their lockdown and have not made their regulations as harsh as other places to support such economic activities. The figures are even starker in Italy, Spain and other places applying the strictest lockdowns, but the true scale of the disruption will only be clear if and when things return to normal.

Almost every well-connected country in the world is facing the same challenge — to identify and react to the outbreak of the virus in the interests of public health and try to maintain economic resilience. How they have managed that challenge will determine the short-term future of their retail sector, along with the rest of the economy. The most we can do now is look ahead on the curve, at the countries who have curbed the number of Coronavirus cases and are starting to de-escalate their lockdown measures, while taking the style of the lockdown and the scale of the outbreak into consideration when forecasting.

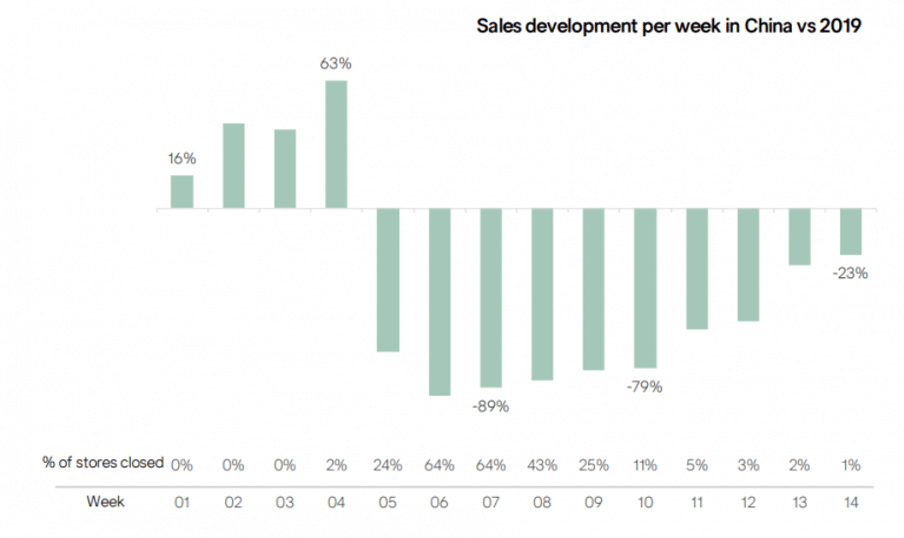

In China, the sales numbers in 2020 vs 2019 tell the story of a very harsh lockdown and an encouraging recovery. This chart from Gartner shows sales development per week in China vs 2019.

The first lockdown in China started in Wuhan on January 23rd and similar measures were rolled out across the country during the following two weeks. This is marked clearly in the sales data, with the 63% increase on 2019 sales the week starting January 20th representing the pre-lockdown rush. Followed by a decrease of over 60% on 2019 sales figures the following week as the lockdown set in. Sales figures bottomed out with over 90% decreases the next week, as lockdown enforcement increased and the market worked through its pre-lockdown sales rush lag.

Things have steadily improved since, however, with the various stages of lockdown easing evident in the sales numbers in weeks 11 and 13, to where average sales returned to just 23% of 2019 figures in week 14. For simplicity, we can look at this as nine-weeks with an over 50% drop in sales, with weeks of near-zero revenue, but not for all forms of retail. Essential services, such as food retail, for example, have stayed open and are seeing a boost in sales as more people cook-from-home.

Amazon, meanwhile, is struggling to keep up with business, even trying to make customers buy less, as those under lockdown rush to shop for home improvement and home entertainment for the lockdown. As the Amazon platform suffers under increased demand, it has driven people to other platforms, decreasing their overall share of online retail.

Those non-essential goods retailers without an e-commerce and delivery system in place during the lockdown state are worst off, facing near-zero revenue for weeks or months. Meaning the specific restrictions of the different lockdowns determines the short-term future of retail, leaning heavily to the success of online “socially-distanced” retail models.

“We’ve all been witnesses to this virus’s ability to make Amazon its errand boy —and Amazon is seriously struggling to keep up the pace. What we previously thought was the retail apocalypse was really just a lengthy warm-up exercise for retail’s quick demise. Major retailers across the globe have closed indefinitely. Millions of retail employees are laid off or furloughed. We are left with the aftermath of a society now conditioned to fear both human contact and touching items or surfaces with high public exposure (two rather crucial aspects of brick and mortar),” says industry commentator, Samantha Brown, in an article for Propmodo.

There are, of course, many big and small retailers who have the financial security to survive a period like that. However, a much smaller group is equipped to handle the lockdown drop followed by a deep recession on their own. This means that much of the retail sector in the most affected countries will depend on government support for their survival.

It is, therefore, the specific criteria of government aid packages that will significantly influence the long-term future of retail. As will the evolving demands of a consumer society that have been forced to isolate and shop online for months. Both influences point to an acceleration of the online retail trend and away from brick and mortar real estate.

“The Covid-19 outbreak will be an extinction-level event for the High Street,” David Jinks, head of consumer research at ParcelHero told the FT. “Many new shoppers developed a taste for home food deliveries and for many other products, and the concern is many may never go back.”

Follow to get the Latest News & Analysis about the Competition in your Inbox!