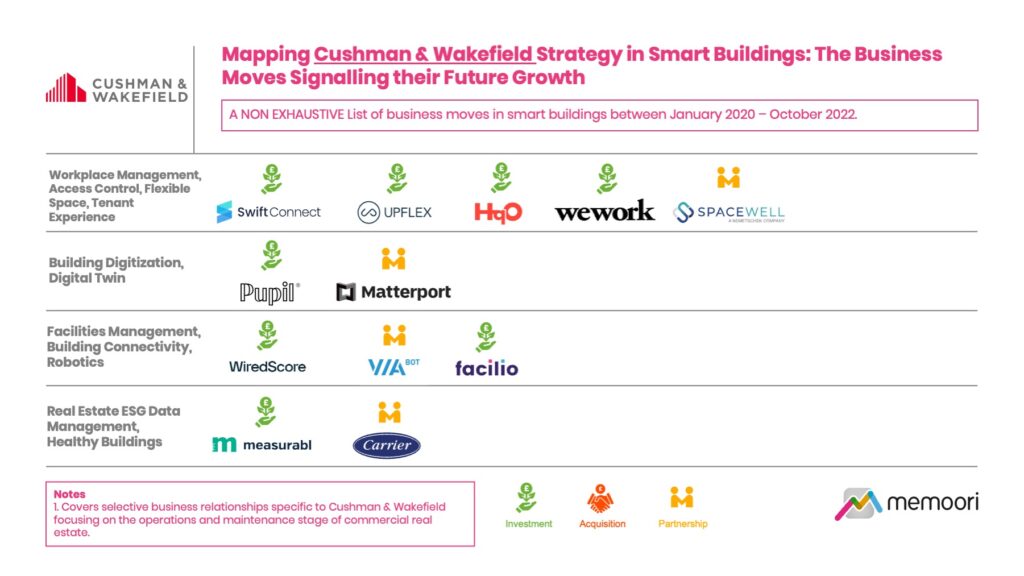

This Research Note examines the emerging strategic priorities of Cushman & Wakefield in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the business, categorizing the various business relationships by technology and investment type over a 3-year period. This article is intended as a non-exhaustive indicator of Cushman & Wakefield’s strategic direction between January 2020 and October 2022.

Cushman & Wakefield (C&W) is a leading global real estate services firm that serves real estate occupiers and owners. The company is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and approximately 60 countries. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services.

Our strategy mapping exercise highlights 4 partnerships and 8 venture capital investments of relevance over the last three years.

The commentary below highlights some of the recent investments and partnerships in Workplace Management, Building Digitization, Real Estate ESG Data Management sectors and more.

Workplace Management, Access Control, Flexible Space, Tenant Experience

In October 2022, C&W participated in a $17 million Series A financing of SwiftConnect to scale their access control integration platform for hybrid workplaces in corporate real estate. Founded in 2020, SwiftConnect’s software platform enables seamless flexible access by automating the provisioning and lifecycle management of access credentials across different buildings and office spaces, as the need for flexible workplaces continues to evolve.

C&W was one of three strategic investors who participated in a Series A funding round of Upflex, a US provider of a suite of SaaS solutions for the hybrid workplace in May 2022.

In October 2021, C&W completed a strategic investment of $150 million in WeWork. The partnership is intended to focus on helping building owners and corporate occupiers improve the daily user experience through use of WeWork’s proprietary software that will integrate traditional building features like access control and reservation systems with onsite hospitality and amenity programming.

Brett White, Executive Chairman & CEO of Cushman & Wakefield said “Through this partnership, Cushman & Wakefield will scale WeWork’s technology offerings around tenant experience beyond their own branded spaces into the rest of the office market, giving our clients access to leading data and insights that drive optimal workplace experience and return on investment.”

Building Digitization

Cushman & Wakefield announced a strategic partnership and investment in Pupil in June 2022. Pupil, a UK-based startup founded in 2015, is a spatial data company that has created an ecosystem to digitally map the built world, taking physical offline buildings and digitising them.

Through its products, Spec and Stak, Pupil combines proprietary artificial intelligence (AI) and industrial-grade Light Detection and Ranging (LiDAR) scanning hardware to capture millions of points of measurement to document commercial and residential real estate and produce next-generation digital twins of the spaces. Cushman & Wakefield will use Stak globally to deliver value to clients by combining digital assets, rapid capture times and high-speed delivery to turn buildings into software, with floor plans, photography, CAD drawings, lease plans, site information drawings and digital twins.

Facilities Management, Building Connectivity, Robotics

In June 2022, C&W was one of several strategic investors who participated in WiredScore’s $15 million Series B round. Founded in 2013 in New York City, WiredScore is the organization behind the WiredScore and SmartScore certifications: the internationally recognized digital connectivity and smart building rating systems for real estate, helping landlords design as well as promote buildings with powerful digital connectivity and smart capabilities.

In May 2021, ViaBot — a robotics startup bringing maintenance and management automation to large properties — announced its public launch with $6.1 million in funding. And as part of the launch, it also disclosed a key strategic partnership with Cushman & Wakefield, which has deployed ViaBot’s RUNO robots to properties in the Bay Area for sweeping and security services.

Real Estate ESG Data Management, Healthy Buildings

Measurabl, a widely adopted ESG (environmental, social, governance) technology platform for real estate, announced in September 2021 it had closed $50 million in Series C funding. Founded in 2013, Measurabl was a first mover in developing sustainability software for commercial real estate. C&W participated in the financing.

Of the 12 partnerships and investments made by Cushman & Wakefield in the last three years, 9 of these alliances were with startup companies, which can be viewed as a confirmation of the significance that the company places on providing access for their occupiers to innovative software and technology offerings.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.