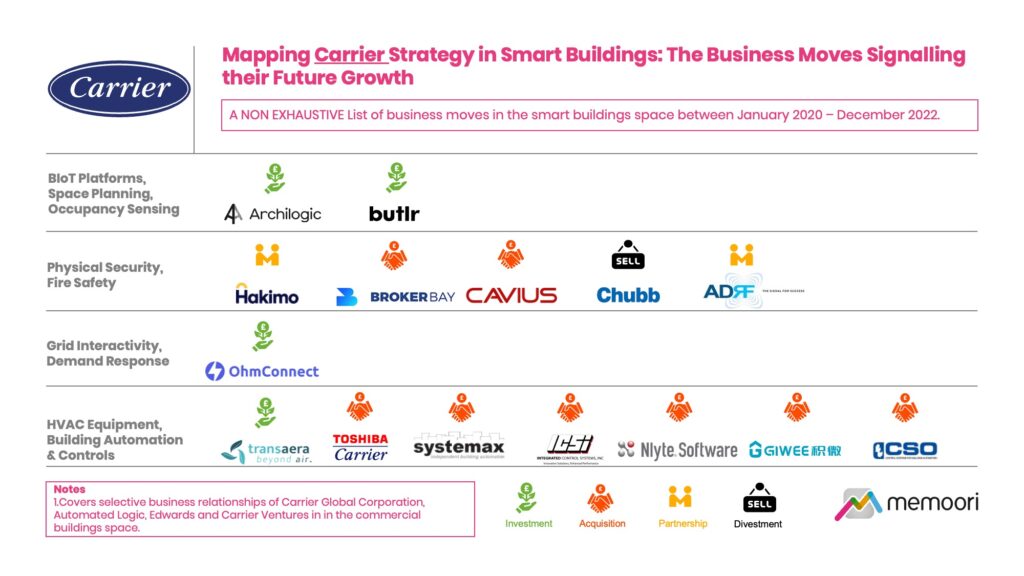

This Research Note examines the emerging strategic priorities of Carrier Global Corporation in the smart commercial buildings space. We have mapped M&A, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the business, by categorizing the various business relationships by technology and investment type over a 3-year period. This article is intended as a non-exhaustive indicator of Carrier’s strategic direction between January 2020 and December 2022.

Carrier Global Corporation was established as an independent public company, following its spinoff from United Technologies Corp in April 2020. The business is one of the top three global HVAC equipment manufacturers, with a portfolio which also includes fire and security products and building automation solutions and services.

Carrier recently established a corporate venture capital unit, Carrier Ventures in February 2022. Focused on next-generation technology, high-growth potential and sustainability, Carrier is aiming to build a portfolio of companies that will contribute to decarbonizing buildings and creating healthier, safer environments.

In total, our strategy mapping exercise highlights 8 acquisitions, 4 venture capital investments, 2 strategic partnerships and I divestment of relevance over the last three years.

The commentary below highlights some of the key investments and partnerships in Fire and Security, Building Automation and IoT Platforms.

Carrier Fire & Security

The major business move within the Carrier fire and security business was the divestment of Chubb Fire & Security. They have repositioned as a core fire and security products business with the sale of the lower margin installation business of Chubb Fire & Security announced in July 2021. The divestiture of this $2.2 Billion business to APi Group was completed in January 2022 for an enterprise value of $3.1 billion.

The sale enabled them to focus on its core fire & security product businesses and to re-allocate proceeds from the divestiture toward higher strategic imperatives, including digital and recurring SaaS revenues.

In November 2022, LenelS2, a Carrier advanced security systems and services brand, announced a global reseller agreement with Hakimo, a technology startup founded in 2020 offering artificial intelligence (AI) enhanced physical security monitoring software. The agreement allows LenelS2 to offer the Hakimo solution, which integrates with LenelS2’s OnGuard and NetBox access control systems, to its value-added reseller community. Hakimo’s solution addresses two of the top challenges that enterprise security teams face – false alarms and tailgating.

The Access Solutions offering within its Fire & Security business was strengthened in September 2021 with the acquisition of Broker Bay, a US developer of real estate scheduling software, founded in 2016. The software's ability to reduce a brokerage's administrative workload, streamline the real estate scheduling and showing experience, as well as standardize electronic lockbox access, which complements Supra electronic lockbox access solutions for North American real estate agents.

In April 2021, Edwards, a division of Carrier Global Corporation, and provider of fire detection and alarm solutions, announced a strategic agreement with Advanced RF Technologies, Inc. (ADRF), a U.S. provider of in-building wireless solutions for first responders. The agreement expands Edwards' fire and life safety products to include ADRF's suite of in-building public safety communication solutions to help keep buildings and their occupants safe.

Carrier HVAC & Building Automation

Automated Logic, Carrier’s long-established building controls platform has been mostly U.S.-centric to date. However, the company has recently started to expand its global footprint outside North America as well as expanding its domestic controls contracting reach. We covered the recent acquisitions of 2 independent ALC controls contractors and Nlyte data centre software provider in our Feb 2022 article examining Carrier’s building automation business.

BIoT Platforms, Space Planning & Occupancy Analytics

In September 2022, Carrier Ventures completed three investments: Archilogic, Butlr and Transaera. Archilogic, a Swiss startup founded in 2014, offers a spatial data platform. It provides product managers and software developers with infrastructure for building scaled, spatially aware apps that let end users interact with their spaces in the way they need. Archilogic's software will be used in Carrier's Abound cloud-based digital platform to give customers a view of their building interiors, allowing them to unlock and visualize building data to create healthier, more efficient spaces.

Butlr, a U.S. venture-backed startup spun out of the MIT Media Lab in 2019, has developed a people-sensing platform which uses body heat and machine learning to detect occupancy, headcount and activity. Butlr's thermal sensing technology will be embedded in the Abound digital platform to enable building owners and operators with real-time insights to improve energy efficiency while ensuring occupant wellness.

Carrier has come late to the table in partnering and investing through its newly formed venture capital unit; however, its strategy to embed innovative startup technology in its Abound digital platform may help to accelerate deployment across its substantial installed HVAC equipment base.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.