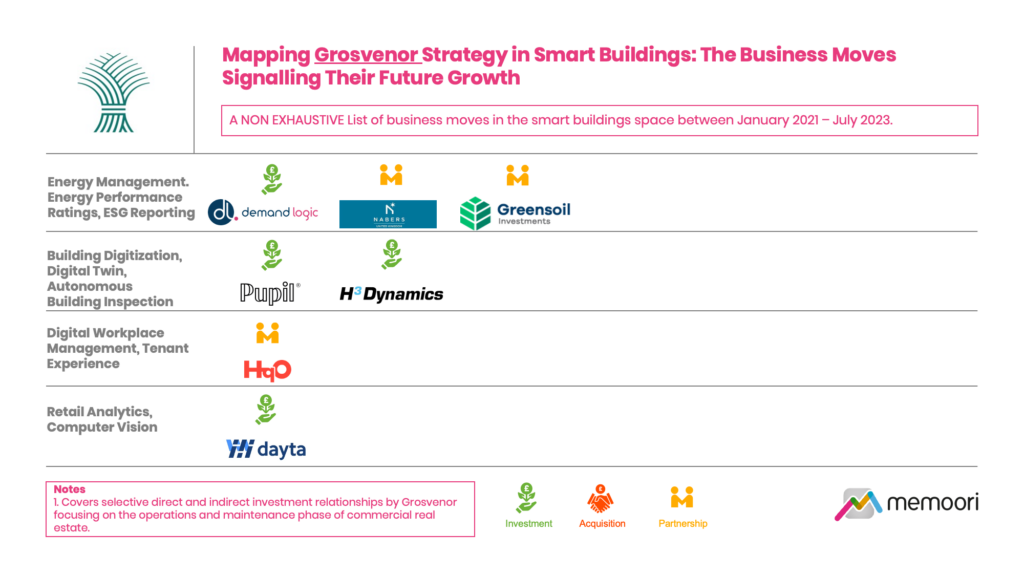

This Research Note examines the emerging strategic priorities of Grosvenor Property Group in the smart commercial buildings space. We have mapped strategic partnerships and investment activity by categorizing the various business relationships by technology and investment type over a 3-year period between January 2021 and July 2023.

Grosvenor (GPUK) is the UK’s largest private property group, developing, managing and investing in property in over 40 cities around the world, with revenues of over $1.2 billion.

A key aim of the UK business is that all its office buildings over 1,000m2 will have a NABERS UK energy rating above 4.5* by the end of 2025.

- In July 2022, Grosvenor achieved the UK’s first NABERS UK rating of 4.5* at Toronto Square, Leeds.

- In March 2023, Grosvenor achieved its second NABERS UK Energy rating with a 3* ranking awarded to 33 Davies Street, a 28,900 sq. ft office building in Mayfair, London. Grosvenor aims to improve the building's performance and target a rating of at least 4.5* by 2025, which will be achieved through retrofit measures as well as the monitoring and improvement of key building systems to improve their efficiency, and continued maintenance on the building’s existing solar panels.

To support the innovation needed to meet their goals, Grosvenor has invested directly in several startups and technologies disrupting how the sector operates.

In June 2022, Grosvenor announced its UK property business had allocated £65 million to be deployed into European early-stage companies capable of accelerating the attainment of its ambitious environmental, social and commercial goals. Grosvenor’s first investment was made in Demand Logic when the UK startup closed a pre-Series A round for its building management software.

To further reduce onsite energy use in UK properties, Grosvenor is also using their technology platform which helps building owners and occupiers reduce energy consumption and costs by providing live data on the building’s energy usage. So far, Demand Logic has identified £16 million in energy savings in over 300 buildings and enabled savings of up to 30% in Grosvenor’s buildings.

In October 2022, Grosvenor’s UK property business invested in Pupil, a spatial data company that has created an ecosystem to digitally map the built world. Pupil’s products, Spec and Stak, combine artificial intelligence, industrial-grade light detection and ranging scanning hardware to capture millions of points of measurement to document commercial and residential properties and produce digital twins of the spaces.

Grosvenor is entering into a strategic partnership with Pupil to create a digital footprint of a significant portion of its portfolio, including floor plans, photography, CAD drawings, lease plans, site information drawings and 3D models. Leveraging Pupil’s technology, Grosvenor will map a significant part of its UK portfolio.

Grosvenor’s indirect investments in the smart buildings space have been undertaken through the GreenSoil Building Innovation Fund (GBIF), based in Toronto, Canada.

The $59 million (USD) PropTech venture capital fund was launched in 2015, with anchor funding of $20 million from the Grosvenor Group in 2016. Prior to 2021, GBIF has invested in several companies that focus on the operations and maintenance phase of commercial real estate, including Amatis (wireless lighting controls), SensorSuite, Thoughtwire and Goby (ESG reporting platform).

Grosvenor has also invested in two smart building startups based in Asia.

- In March 2022, a $1 million pre-Series A investment in Dayta AI, a Hong Kong-based provider of a retail data analytics platform.

- In October 2021, they participated in a $26 million Series B funding round for H3 Dynamics Holdings. The Singapore firm focuses on supplying autonomous inspection and incident response solutions powered by drones. H3 Dynamics has built and commercialized a proprietary, digital inspection and rectification automation software, starting with smart-city applications such as high-rise façade maintenance for the Singapore and the Southeast Asian market.

Grosvenor is adopting a similar early mover proptech investment strategy to JLL, backed by their aim to support improved office building performance and to meet their sustainability goals.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.