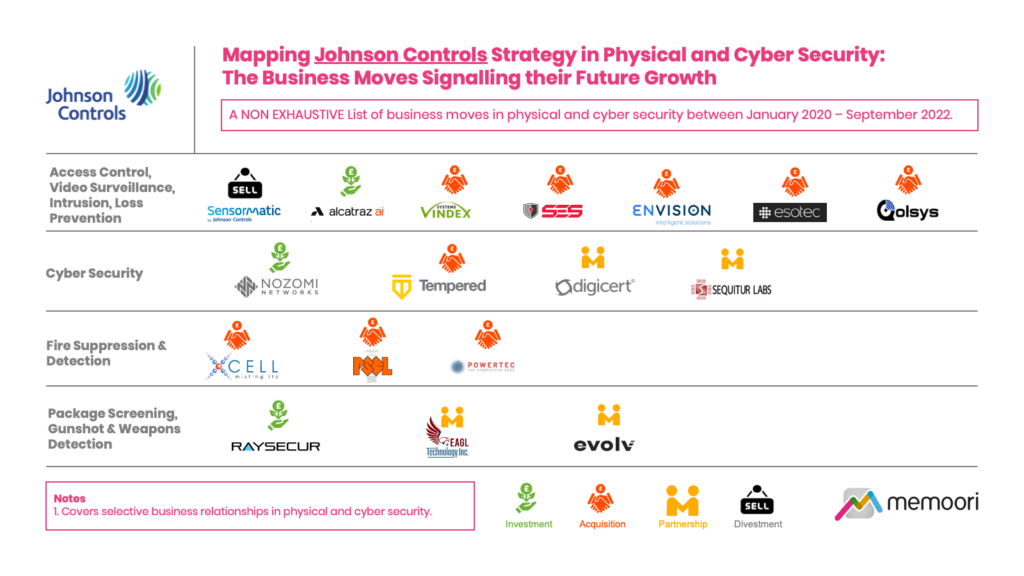

This Research Note examines the emerging strategic priorities of Johnson Controls (JCI) in physical and cyber security. We have mapped acquisitions, divestments, strategic partnerships and investment activity to ascertain the growth ambitions of the group, by categorizing the various business relationships by technology and investment type over a 3-year period.

This article, part 2 of a 2-part analysis, is intended as a non-exhaustive indicator of JCI’s strategic direction between January 2020 and September 2022. Part 1, can be found here - https://memoori.com/mapping-the-strategic-direction-of-johnson-controls/

The commentary below relates to business relationships established in 2022.

Venture Capital Investments

In the last year, JCI Ventures, the corporate venture arm of Johnson Controls, has been ramping up investments. The most recent deal was participation in a $25 million Series A round for Alcatraz AI announced in September 2022. The US-Bulgarian company offers autonomous access control using 3D facial authentication and AI to create safe spaces. In essence, Alcatraz AI replaces the need for badges and security guards as an identification method in office buildings and enterprises with high-security needs. Founded in 2016, by Vince Gaydarzhiev, Alcatraz AI is a “hardware-as-a-service” startup that aims to provide more secure access control without the added friction or high personnel costs.

In August 2022, Johnson Controls signed a framework agreement with Nozomi Networks, in order to utilize the Nozomi Networks toolset for the benefit of its customers. The business also announced its participation in last year's $100 million funding round for the OT and IoT security specialist, further signalling its commitment to deliver specialized cyber security solutions for its OpenBlue secure communications stack.

Acquisitions

With nine bolt-on acquisitions to date since the start of FY2022 in October 2021, Johnson Controls is accelerating its M&A activity to augment the group’s technology offerings in physical security, cyber security and fire detection and suppression. While their strategy to expand their regional presence in the UK and Ireland has also been advanced.

- In August 2022, Johnson Controls announced the acquisition of Vindex Systems, a UK systems integrator to strengthen its range of electronic security solutions designed to protect people, property and assets. Delivering access control, CCTV and ANPR (automatic number plate recognition), Vindex Systems supports a range of high-profile UK customers across the banking, retail, healthcare, aerospace and commercial property sectors.

- In June 2022, Tempered Networks was acquired to bring zero trust cyber security to connected buildings worldwide. Tempered Networks has created 'Airwall' technology, an advanced self-defence system for buildings that enables secure network access across diverse groups of endpoint devices, edge gateways, cloud platforms and service technicians. Johnson Controls will roll out the Tempered Networks platform across deployments of its OpenBlue AI-enabled platform and will embed its technology in an increasing number of products and services.

- In April 2022, Johnson Controls acquired Security Enhancement Systems LLC (SES), a Northbrook, Illinois-based provider of mobile-based, keyless access control solutions used in critical infrastructure, including telecommunication towers for major providers.

- Also in April 2022, Johnson Controls announced the acquisition of Xcell Misting Ltd, a fire protection company that designs and installs fire suppression and detection systems. Xcell Misting Ltd, headquartered in Norfolk, UK and founded in 2010, specializes in water mist technologies for diverse sectors including food, technology and data centres, high-hazard and gas turbines, car plants, residential and waste management.

- In March 2022, Johnson Controls completed the acquisition of Powertec Pumps to strengthen its fire suppression offering in the UK.

- Again in March 2022, Armagh, Northern Ireland-based Envision Intelligent Solutions was acquired by Johnson Controls. The business specializes in technology-enabled remote monitoring and perimeter protection services.

Divestments

The forthcoming sale of the Global Retail business was announced in the 2nd quarter 10Q 2022 report issued on 4th May.

"During the second quarter of fiscal 2022, the company determined that its Global Retail business within its Building Solutions North America, Building Solutions Asia Pacific and Building Solutions EMEA/LA segments met the criteria to be classified as held for sale”

No further details have been announced. Sensormatic Solutions, the global retail business of Johnson Controls, provides critical insights into retail inventory, shopper experience and loss prevention, featuring the Sensormatic, ShopperTrak and TrueVUE brands. ShopperTrak is the market leader in this category with +2000 clients.

In the security and fire sector, Johnson Controls has strengthened its focus on cyber security while bolt-on acquisitions have enabled geographic expansion in the UK and Northern Ireland.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.