In this Research Note, we examine MapsPeople, a Danish public company providing indoor mapping and navigation software. This analysis, covering their latest financial results, Go-to-Market strategy and 2023 guidance, is based on press releases, investor presentations and their 2022 Annual Report. This article updates our previous analysis of August 2022.

MapsPeople is a SaaS company based in Nørresundby, Denmark with offices in Germany, US and Singapore. Specializing in developing and implementing the MapsIndoors dynamic mapping platform, MapsPeople provides the solution for handling both basic wayfinding and navigation in large building complexes, as well as optimizing the utilization of indoor spaces through smart integrations.

Founded in 1997, mapping was and continues to be the core of the business. MapsIndoors consists of software development kits (SDKs) for any platform, APIs, and a content management system (CMS). The software is currently running in more than 40 different countries.

The platform helps large corporate offices to optimize resource utilization, assists guests navigate to their seats at stadiums, displays vacant parking lots, or helps avoid long queues. The solution is primarily built on Google Maps, making the transition from outdoor to indoor completely seamless.

MapsPeople has two primary revenue streams: MapsIndoors and Google Maps which is primarily aimed at the northern European market based on a Premier Partnership with Google.

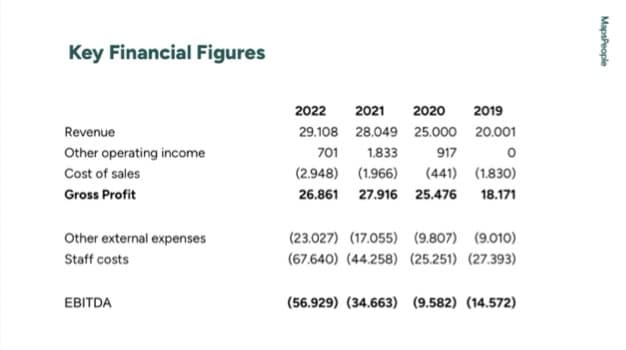

MapsPeople reported 2022 revenue of DKK 29.1 million (around USD $4.3 million), +4% increase on prior year, and contracted ARR of DKK 70.1 million, corresponding to a YoY growth of 71%.

In mid-February 2023, MapsPeople announced a DKK 10M private placement, a directed issue of new shares and a new loan facility of DKK 10M, corresponding to total gross proceeds of DKK 20m.

With MapsPeople’s high expected growth rates, the gross proceeds of DKK 20M should ensure that MapsPeople can deliver on the expectations for 2023. Thus, the total net proceeds are expected to be used for continuous growth and business development.

Their partner-based Go-to-Market strategy is the primary growth driver, and specifically OEM partners, who integrate MapsIndoors as a component in their own SaaS solution. The partner channel accounted for 78% of their contracted ARR at the end of 2022.

MapsPeople Acquisition of Point Inside

The strategic vertical market focus is on Corporate Offices, Stadiums and Convention Centers. In April 2023, two further vertical markets, the retail and airport sectors, were addressed through the acquisition of US based Point Inside's, Inc. customer contracts and indoor mapping assets.

These include indoor maps of more than 1,800 shopping malls in the US and more than 200 airports globally, which will help accelerate the growth opportunities for MapsPeople’s partners that provide solutions to these strategic verticals. Furthermore, the transaction strengthens MapsPeople’s presence in the retail sector that increasingly depends on new technology to attract and engage consumers by enhancing their shopping experience.

The transaction is expected to have a contribution to MapsPeople’s ARR of DKK 8M, a contribution on revenues in 2023 of DKK 4-5M (Annualized impact of DKK 8M), as well as a positive impact on 2023 EBITDA of DKK 2-3M (Annualized DKK 4M).

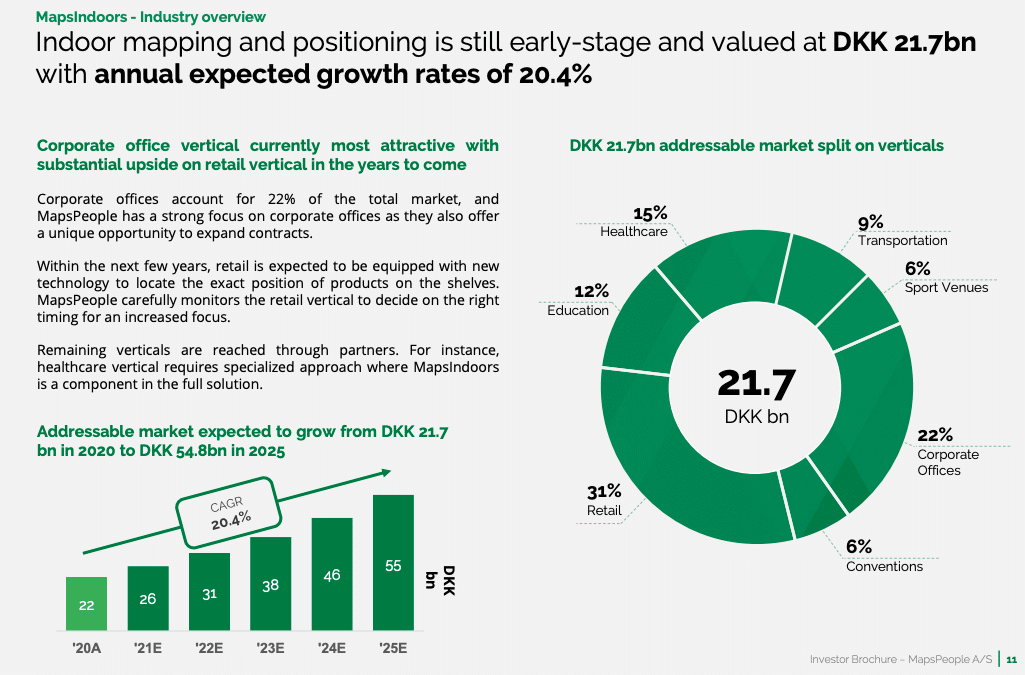

They estimated that the market for indoor mapping and positioning was worth DKK 21.7 Bn in 2020 and due to grow at a CAGR of 20.4% to 2025.

Note that two months after the 2022 results were announced, a revised 2023 outlook was issued by the company, due to order intake in Q4-2022 and Q1-2023 being less than planned. Revenue guidance of DKK 52-62M originally reported in March 2023, is revised down to DKK 38-45M.

As a result of this lower revenue forecast, MapsPeople now expects to initiate a new capital raise of DKK 20-25M as soon as possible. The capital to be raised is to finance the transformation from Framework Orderbook to high ARR growth in 2023, that subsequently is expected to deliver the high revenue growth, and fully finance operations through 2024 until profitability.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.