In this Research Note, we examine Motorola Solutions’ video security and access control business in the past year, based on their full-year financial results announced on 8th February 2024, an Investor Overview published in January 2024 and other announcements.

We also review two recent acquisitions, which extend the group’s video security product portfolio through entry into adjacent mass notification and sensing device markets.

Motorola Solutions Video Surveillance & Access Control Business

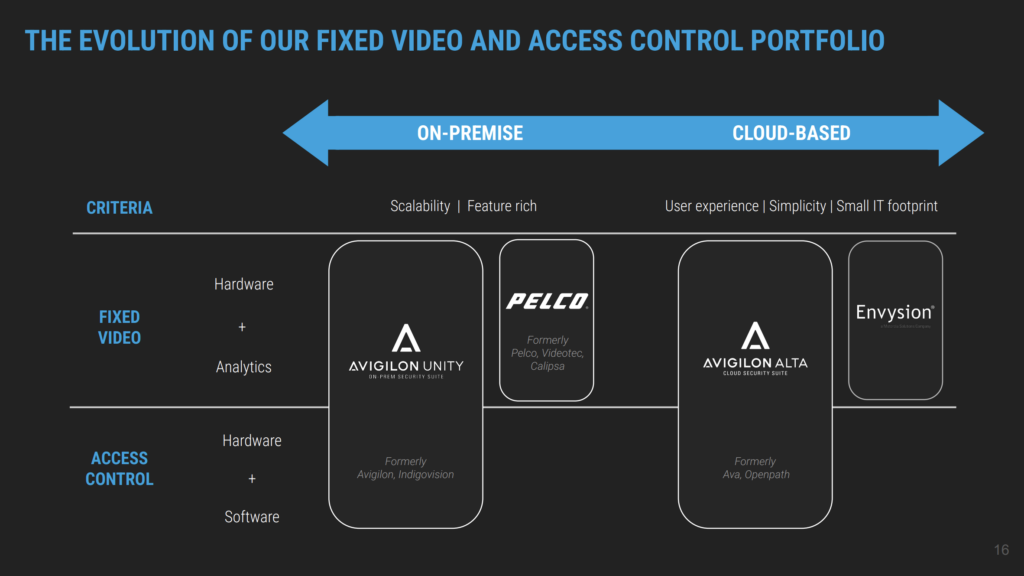

The Avigilon acquisition in 2018 was the starting point for Motorola Solutions’ Video Security & Access Control business, which has largely grown through strategic acquisitions over the past five years.

Indigovision and Pelco were acquired in 2020, Openpath and Envysion in 2021 and Ava Security, Videotec and Calipsa in 2022 to augment its Avigilon leadership position in the video security hardware and software market.

The video security and access control business has deployed over 5 million fixed video cameras across over 300,000 sites. Revenues are growing double digits within the global video surveillance market worth $30.4Bn in 2022.

The group has a broad fixed video portfolio with global go-to-market reach combined with mobile video which is gaining share by utilizing existing relationships in the Land Mobile Radio Communications business.

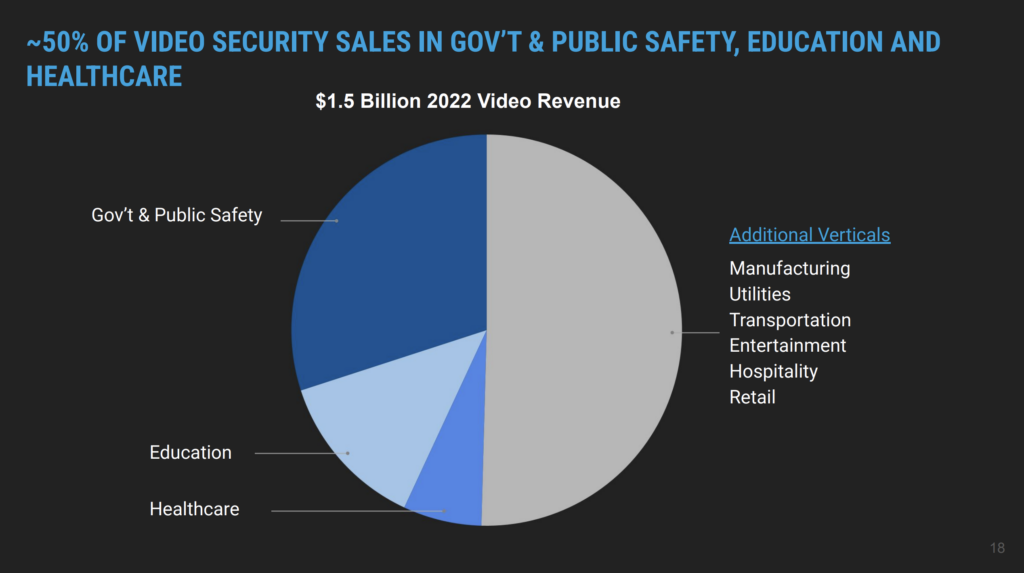

50% of the $1.5 billion 2022 video and access control revenues are to government and public safety organizations, education and healthcare vertical markets.

2023 revenues for the video security and access control business increased 13% from the $1.5 billion business in 2022.

In March 2023, Motorola announced the new Avigilon physical security suite that provides secure, scalable and flexible video security and access control to organizations of all sizes around the world. The Avigilon security suite includes the cloud-native Avigilon Alta and on-premise Avigilon Unity solutions.

Motorola Solutions 2023 Financials

Full-year sales were $10.0 billion, up 10% driven by growth in North America and International regions. The Products and Systems Integration segment grew 9% driven by higher sales of LMR and Video.

The Software and Services segment grew 10% driven by growth in LMR services, Command Center and Video, partially offset by the revenue reduction for Airwave.

Rave Mobile Safety Acquisition

In December 2022, Motorola Solutions announced the acquisition of Rave Mobile Safety. Based in Framingham, Massachusetts, the company is a provider of mass notification and incident management solutions that help organizations and public safety agencies communicate and collaborate during emergencies. Rave was founded in 2004 and has about 220 employees.

State and local governments and enterprises, including hospitals, rely on Rave's cloud-native, customizable platform to support emergency coordination. Users can effectively communicate operational updates and alerts, such as health emergencies, lockdowns and evacuations, so people are better informed to take appropriate action.

The platform is also used by thousands of K-12 schools and higher education institutions across the U.S. Rave’s panic button solution can immediately provide real-time incident details and essential data like location to 9-1-1 call takers and first responders, and its incident management solution helps to coordinate the emergency response across school safety personnel, administrators and first responders.

"Motorola Solutions’ technologies strengthen the critical intersection of public safety and personal security," said Greg Brown, chairman and CEO, Motorola Solutions. "Our acquisition of Rave complements our portfolio with a platform specifically designed to help individuals, businesses and public safety agencies work together in more powerful ways.”

IPVideo Acquisition

In December 2023, Motorola Solutions acquired IPVideo, the creator of the HALO Smart Sensor, an all-in-one intelligent sensor that detects real-time health and safety threats. The acquisition was closed for $170 million in cash. Founded in 1996, the company is based in Bay Shore, New York.

The HALO Smart Sensor is a multifunctional safety and security device with built-in vape detection and air quality monitoring, gunshot detection, abnormal noise and motion detection and emergency keyword detection.

The acquisition is notable as a non-video solution for areas where cameras and video security solutions are not suitable, such as restrooms, classrooms, hospital rooms and hotel rooms. The HALO Smart sensor acquisition in this adjacent market extends the perimeter of security while protecting privacy.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.