In this Research Note, we examine NAPCO Security Technologies, Inc., a building security products manufacturer of alarms & connectivity, locking and access control solutions. This article focuses on NAPCO’s competitive strengths, fiscal 2023 financials, recurring service revenues and their long-term goals.

The company has a significant security presence in commercial settings, with around 80% of its $170 million revenues installed in commercial, industrial, institutional and government markets.

Founded in 1969 and headquartered in Amityville, New York, the company consists of four Divisions: NAPCO, plus three wholly owned subsidiaries: Alarm Lock, Continental Instruments, and Marks USA. Over 1,000 employees work in partnership with a long-established network of 200+ distributors, 10,000+ independent dealers and locksmiths and 2,000+ systems integrators.

NAPCO Competitive Strengths

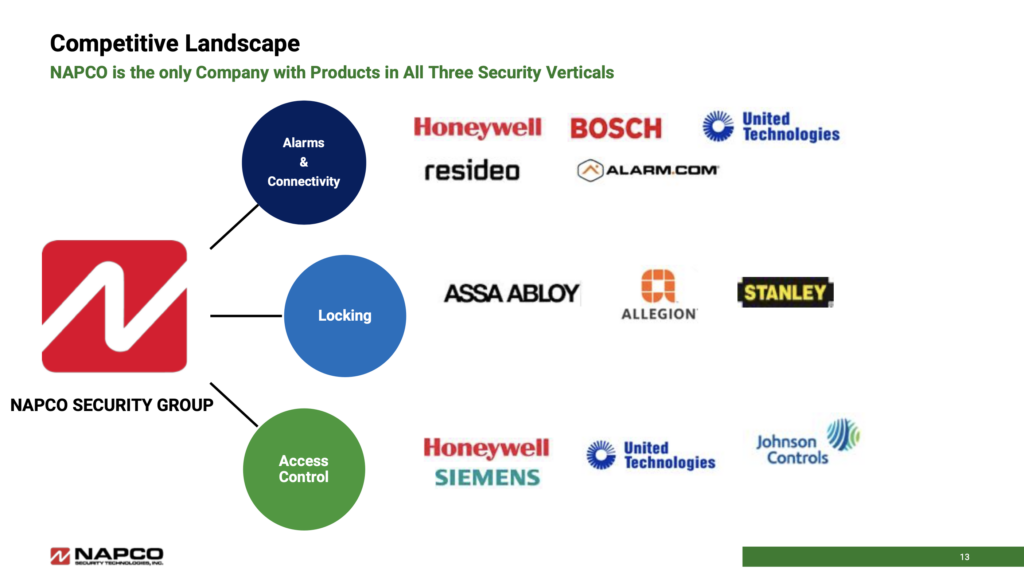

NAPCO’s differentiation relies on their claim that they are the only company with products in all three security verticals – Alarms & Connectivity, Locking and Access Control. See chart below for the company view on the competitive landscape.

According to their latest 10-K Report, the security products industry is highly competitive. The company's primary competitors are comprised of approximately 12 other companies that manufacture and market security equipment to distributors, dealers, central stations and original equipment manufacturers.

The company believes that none of these competitors is dominant in the industry. Most of these companies have substantially greater financial and other resources than the company. However, NAPCO believes that none of these competitors manufactures all key building security products: Intrusion Alarms and Access Control, Connectivity, and Locking devices.

As more security installations include multiple security-related systems, which can include, intrusion, fire, access control, door-locking and connectivity, there is more demand for the various systems to communicate with each other. By having everything manufactured under one roof, they can offer customers one integrated platform solution without the risk of incompatible equipment from multiple vendors to “talk” to each other.

NAPCO FY 2023 Financials

Fiscal 2023, year ending 30 June, was highlighted by record revenues and profitability, largely the result of a significant rise in hardware-enabled solutions that deliver recurring service revenue as well as the strength of their locking businesses.

Net sales increased 18% to $170 million as compared to $143.6 million in 2022. Net income increased 38% to a record $27.1 million. Earnings per share (diluted) increased 38% to $0.73 in FY2023 or 16% of net sales. Adjusted EBITDA increased 52% to a record $34.3 million or $0.93 per diluted share during FY2023, which equates to an Adjusted EBITDA margin of 20%.

Recurring Service Revenues (RSR)

The company has experienced significant growth in recent years, primarily driven by fast-growing recurring service revenues generated from wireless communication services for intrusion and fire alarm systems, as well as their school security products that are designed to meet the increasing needs to enhance school security, as a result of on-campus shooting and violence in the U.S.

RSR for FY2023 increased 30% to $59.9 million, reaching an annual run rate of $67 million based on July 2023 revenues. The gross margin for RSR was 89% for the fiscal year. The growth driver for RSR has been the StarLink line of cellular radios that deliver cloud-based connectivity to commercial customers.

Long Term Goals

NAPCO believes that there is significant opportunity for growth across all four of their product brands: NAPCO; Alarm Lock; Marks; and Continental Access.

Their long-term goal is to reach $150 million in annual revenue from monthly monitoring services along with another $150 million in annual revenue from equipment sales with RSR potential.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.