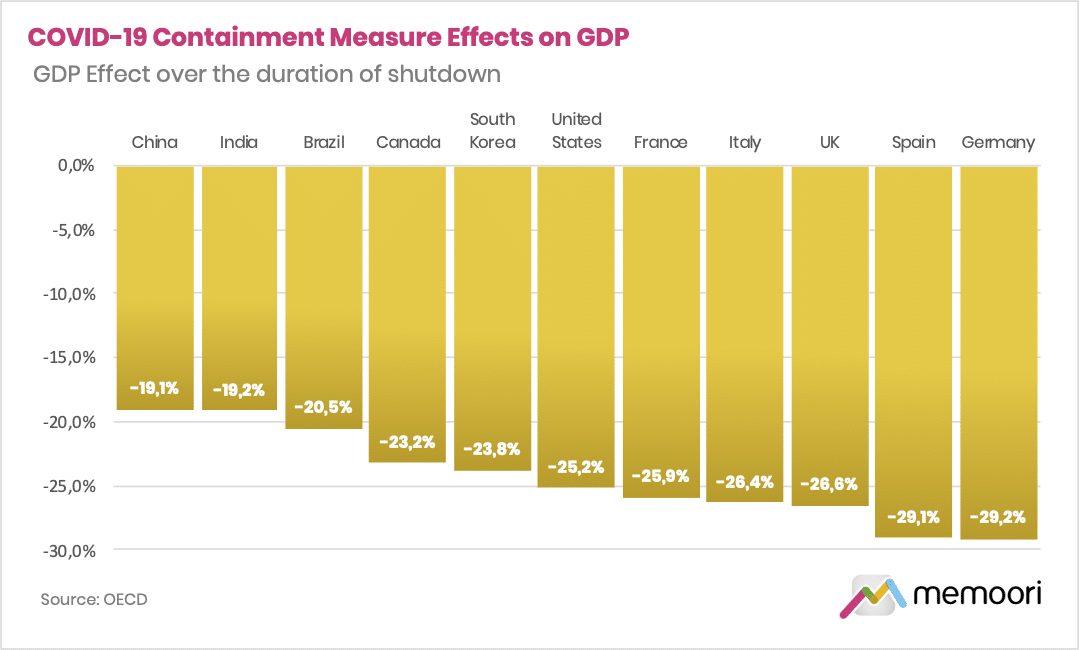

“The lockdown will directly affect sectors amounting to up to one-third of GDP in the major economies. For each month of containment, there will be a loss of 2 percentage points in annual GDP growth,” explained Angel Gurría, Secretary-General of the Organisation for Economic Co-operation and Development (OECD). The OECD estimate that the direct hit to the level of GDP by the average lockdown is between 20-25% in many major advanced economies. The impact is not evenly distributed, however.

“The steepest deterioration was seen in the services sector, where businesses such as airlines, restaurants, hotels, cinemas and other leisure activities were hit especially hard by containment measures,” states our latest report, which focuses on the Building Internet of Things (BIoT) market. “Shutting down large parts of society is not sustainable in the long-term, but governments are currently being understandably cautious in relaxing societal restrictions on people movement and non-essential work, deferring widely to scientific advisors.”

According to the new report — The Internet of Things in Smart Commercial Buildings 2020 to 2025 — Q2 is going to be painful for building operators in all areas. The full picture is still evolving and will be for some time, but the economic indicators from March as well as initial Q1 earnings reports paint a dismal picture of activity around real estate in general. Figure 5.3 of the report (shown below) demonstrates the scale of the problem, with the impact of lockdowns on national GDPs over the duration of the lockdown ranging between -19% and -30% in the worlds major economies:

The impact of COVID and the subsequent lockdowns on real estate is not purely in economic terms, however. The crisis will also change the way we use our buildings and spaces, creating unprecedented challenges in the post-COVID era. The earliest indicators of what a post-lockdown working world might look like are slowly emerging as France, Italy and others begin to tentatively ease their lockdown measures. This “new normal” that we hear so much about, looks very different, especially when it comes to commercial real estate.

Last week, Twitter announced that it would allow employees the option to work-from-home, forever. This was later extended to Square Inc. and other major firms are expected to follow suit, presenting a very different “new normal” that would no doubt lead to tremendous contraction of the commercial real estate market. Microsoft extended the work-from-home deadline through October 2020, while Google, Facebook, and Apple have moved their return-to-the-office dates to the end of the year. These tech-giants are also significant property owners and will no doubt be monitoring the accelerated evolution of remote and flexible work trends as they make long-term decisions.

To combat this reaction to the pandemic, the BIoT have stepped up with occupancy analytics to show how we might maintain a social distance in buildings by tracking the movement of people. Smartphone control and hands-free interfaces, such as voice, will also see a boost in sales as buildings strive to reduce human contact with surfaces. HVAC systems are ensuring good air quality and trying to quickly understand the role of airflow in the spread of infection. And, where possible, all these building systems will be monitored and operated remotely to reduce building occupancy. Buildings have been set back, but technology can provide a solution if we can provide the technology.

“The outbreak of COVID-19 put substantial stress on global supply chains. Transportation disruption, increased border restrictions and company closures have all contributed to one of the steep increases in vendor lead times for many goods,” states the comprehensive new report. “The supply of IoT technologies will doubtless be adversely affected by both declines in relevant manufacturing output and supply chain disruption, but the extent to which this disruption will ultimately affect revenues will depend on the scale of the demand-side shock.”

The world is disrupted and commercial real estate is in the eye of the storm — the silence of empty offices signalling that the winds of change are on their way. Rates of recovery will vary significantly depending on location, due to local COVID impact and government support, and by industry vertical, where hospitality and aviation are the hardest hit, for example. For the proptech sector, there is light at the end of the tunnel for those with the ability to adapt and innovate.

“Delivery of all BIoT products and services will initially be adversely impacted by the effects of the COVID-19 pandemic, as access to many commercial buildings remains restricted. However, IoT technologies are already being leveraged to develop effective solutions that help mitigate the negative impacts of COVID-19,” explains our report.

“Some of these technologies were niche before the emergence of the virus, but now represent significant growth opportunities, others are more established but will need to be adapted to face the challenges posed by the virus,” continues the report. “We are likely to see a prolonged period of innovation in the sector, with new technologies to educate, inform and provide assurance to building users, as well as limit the spread of the infection.”