Our new report investigates the rapidly evolving digital workplace market, at a time when ‘new’ working practices, including remote working, hybrid working and flexible working, are demanding accurate data for making effective decisions about the use of commercial office space.

The digital workplace market is in the early stages of maturity, having seen considerable activity over the last two years, accelerated by the COVID-19 pandemic. Workplace experience and occupancy analytics solutions are playing important roles in the future of ‘connected’ real estate and the workplace at large.

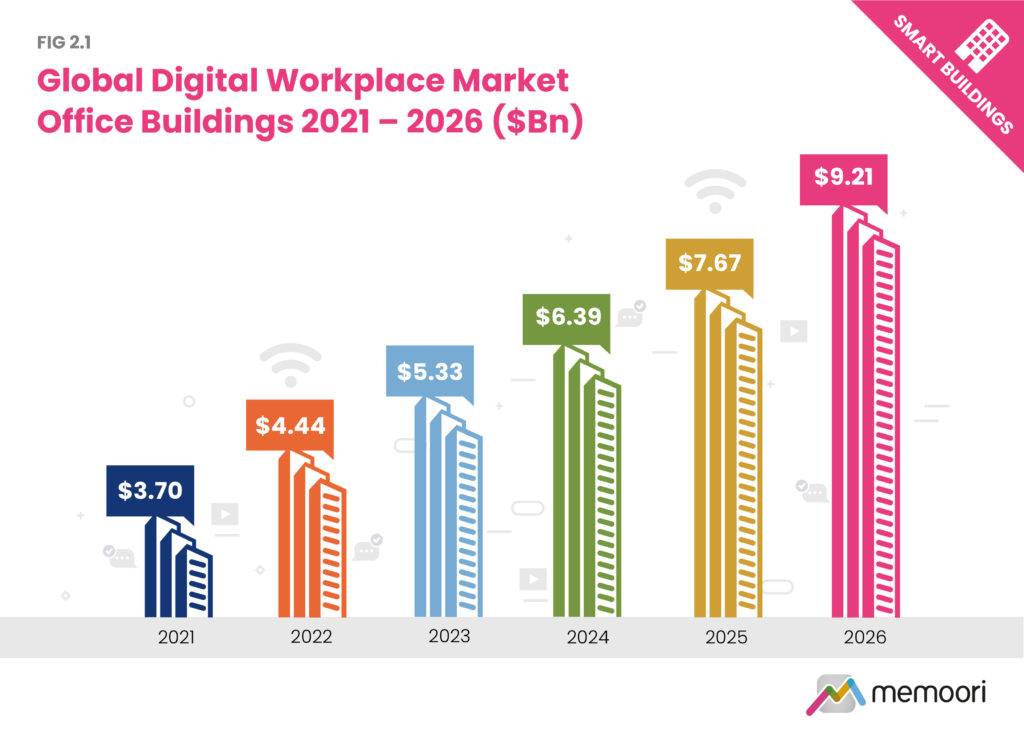

The global digital workplace market in commercial office space is estimated at $3.7 billion in 2021, and will rise to $9.2 billion by 2026, growing at a rate of 20% CAGR.

Employee expectations of the workplace have shifted with the move to hybrid working. Staff need a good reason to come into the office now that they have adjusted to working from home and are demanding healthy, human-centric spaces that support their productivity, wellbeing, and collaborative relationships. There are a growing number of landlords eager to tap into this opportunity for more digitized workplace experiences.

Company executives have also started to pay more attention to workplace experience as a driver for talent retention and business success, in the light of increasing resignation levels. Companies need new ways to deliver an environment in the post-pandemic era that the modern workforce demands.

This timely report, completed in Q1 2022, seeks to bring clarity to an innovative PropTech market where 288 vendors are vying to increase their market share and lead the disruption of commercial real estate.

Within its 171 pages and 28 charts and tables, the report presents all the key facts and draws conclusions, so anyone can understand what is shaping the future of the workplace. The report includes at no extra cost, spreadsheets listing all major vendors, deployments, acquisitions, and investments. For more information, visit; https://memoori.com/portfolio/the-global-digital-workplace-market/