In this Research Note, we examine the Smart Buildings business of Schneider Electric, based on their 2023 Full Year Results, presentations, Q3 and Q4 earnings calls. Significant partnerships, acquisitions and divestments in the smart buildings space are also highlighted throughout 2023.

Schneider Electric Energy Management Division

The Buildings end market of Schneider Electric is addressed by a portfolio of products, systems, software and services offered by the Energy Management (EM) division, including:

- Medium and low voltage products – eg. wiring devices, circuit breakers, busways.

- Building Automation – EcoStruxure Building IoT platform, building control products, home automation products and solutions.

- Grid Automation – DERMS, Microgrid software.

- Critical Power Distribution – Power metering and monitoring equipment.

- Lifecycle software from design and build to operate and maintain.

- Energy and Sustainability services.

2023 Financials: Takeaways for Smart Buildings

The Energy Management division reported €28.2 billion in revenues for 2023, a 14% organic growth versus prior year. While Schneider Electric does not report the revenue mix for its EM division, Memoori estimates that electrical and power distribution products and systems account for a significant portion of revenues in this division.

The majority of the Group’s exposure in the Buildings end-market is towards non-residential technical buildings where demand remains strong both year-on-year and sequentially. There was strength across many geographies supported by the completeness of the Group’s offer from design to execution, including services.

In Q4, there was double-digit demand growth in Hotels and Retail, while there was continued good demand in Healthcare. In Residential buildings, both demand and sales growth showed stabilization with some variation by geography.

Memoori estimates that the Global Sustainability services business made a strong contribution to the 2023 results. The company noted that its sustainability business in Q4 delivered double-digit sales growth against a base of comparison in excess of 20%, with strong growth from its EcoStruxure Resource Advisor. Sustainability and energy efficiency are continued focus areas that are particularly important in the retrofit of existing buildings.

While interest rates and back-to-work trends adversely impacted the construction of new office buildings in a number of markets, the company’s diverse footprint across technical building sectors like education, hotels and health care, along with its emphasis on renovation projects, “positions Schneider well for areas of strength in this market,” Schneider Electric CFO Hilary Barbara Maxson said in a Q3-2023 earnings call.

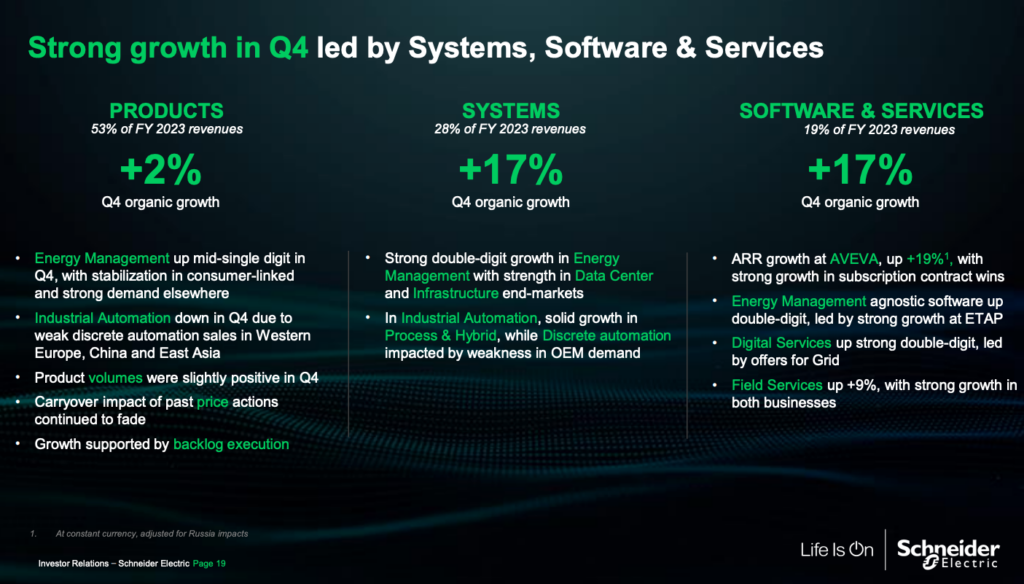

Software and Digital Services was reported as €3.0 billion, 19% of FY2023 group revenues, with Digital Services up double-digit.

Strategic Partnerships

In January 2023, Bain & Company announced a worldwide strategic partnership with Schneider Electric to accelerate corporate decarbonization ambitions. The new partnership will harness the company's growing portfolio of digital decarbonization solutions and its network of more than 2,500 experts in over 100 countries in the areas of energy and carbon management, renewable energy procurement, ESG, and efficiency.

In January 2023, Schneider Electric and BitSight announced a strategic partnership to develop a first-of-its-kind global Operational Technology (OT) Risk Identification and Threat Intelligence capability. Through a joint effort, Schneider Electric will fuse its knowledge of OT protocols and systems with BitSight’s exposure detection and management capabilities in order to generate the critical insights necessary for proactive security monitoring of externally observable risks.

In June 2023 at Cisco Live Las Vegas, Schneider Electric and Cisco, their long-time alliance partner, launched a joint IT/OT solution to accelerate building decarbonization. The solution integrates Cisco Spaces, a cloud-based software that leverages Cisco network infrastructure and collaboration devices, with Schneider Electric’s EcoStruxure Building Operation building management platform.

Acquisitions

In November 2023, Schneider Electric announced that it had finalized the acquisition of EcoAct SAS, an international climate consulting and net zero solutions company headquartered in Paris, France.

EcoAct generated around 70 million euros ($76.4 million) in its 2022 fiscal year and employs about 400 people. In the Q4 earnings call, EcoAct was described, as “a pivotal addition to the portfolio of the Sustainability Business.”

Divestments

On December 14, 2023, the Group entered into an agreement with Uplight Inc. (in which Schneider Electric holds a strategic minority investment) to sell AutoGrid to Uplight. This transaction represents a reorganization among Schneider Electric-owned or affiliated businesses aimed at Prosumers, to better align their capabilities, as we outlined in our analysis. The transaction closed on February 8, 2024.

Schneider Electric is one of the leading investors and partners in the smart buildings space. The business has committed considerable resources to open collaboration and co-innovation through alliances, strategic investments and venture capital funding.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.