Since 2019 the business world has been inundated with high-profile SPAC deals. And while we have certainly seen a slowdown in SPAC deals in recent months, the SPAC trend is by no means over. In the smart building industry, a new SPAC was completed this month, as workplace experience platform provider CXApp completed a business combination with KINS Technology Group. In this research note we discuss the deal, based on the CXApp Investor Deck, KINS 10-K document and the ongoing SPAC trend.

“For anyone looking to evaporate a large pile of money, the past year has presented abundant options. Of those, one of the faster and more effective methods involved investing in tech companies going public via SPAC,” reads a December 2022 CrunchBase study. “Out of a selected set of 50 completed SPAC deals, 24 were trading below $1 per share, that means they’re down 90%. No company on our list even has shares trading above the $10 break-even threshold for SPAC deals.”

No two SPAC deals are the same, which may be why each one thinks their result will be different, and the CXApp deal certainly has its unique factors. In 2021, smart building firm Inpixon acquired Design Reactor Inc., CXApp’s operating subsidiary, and integrated much of the company into its internal departments. Then, in September 2022, Legacy CXApp was incorporated under the laws of the State of Delaware with the specific purpose of separation as a wholly-owned subsidiary of Inpixon.

Legacy CXApp had not carried out any activities since it was incorporated, until March 14th 2023 when a business combination was effectuated with KINS Technology Group Inc, a special purpose acquisition corporation sponsored by KINS Capital LLC. The company name was subsequently changed to CXApp, and shares of CXApp Class A common stock began trading on the Nasdaq on March 15th 2023, under the ticker symbols “CXAI” and “CXAIW” —which the firm says represents enhanced employee experiences (“CX”) with connected intelligence (“AI”).

The CXApp platform itself, as presented by Inpixon since 2021, offers a suite of workplace experience solutions including enterprise and employee applications, indoor mapping, on-device positioning, and augmented reality technologies. According to the company, the AI-based analytics platform will be targeted at the emerging hybrid workplace market to provide “enhanced experiences across people, places, and things”. A partnership was also announced between Inpixon’s CXApp and tech giant Cisco alongside the SPAC announcement, driving some positivity around the SPAC deal.

“This is a fresh start for CXApp with the innovative combination of leading-edge technology assets with a seasoned leadership team to create the only publicly-held asset in the exciting new workplace experience category,” said Khurram Sheikh, Founder, Chairman, and CEO of KINS, now serving as the Chairman and CEO of the combined company. “CXApp is a “category-maker” company that has developed the most engaging application for the hybrid workplace market. We believe that through our merger it has the potential to create significant value for stockholders over time.”

Shares were listed at $10 on Nasdaq after a bell ringing ceremony on March 14th, then dropped 59% on their first day to $4.10, and continued to decline over the past two weeks, closing at $1.82 yesterday (March 27th) an 82% decline. While two weeks is far too quick to judge an IPO, the poor record of SPACs in the last 4 years does not inspire much confidence for the future of CXApp. We can talk about the platform itself, which appears to be very capable, the obviously close relationship with Inpixon, and the track record of KINZ, but it was the same with many smart building industry SPACs.

Tado and Ecobee had strong customer bases in the smart thermostat market. Video solution’s firm Gorilla Technology has partnered with Softbank, Intel, and Dell. Smart lock firm Latch was becoming a household name. Smart window company View became a unicorn, with a valuation over $1 billion. All these companies and many more in the smart buildings sector have attempted or completed a SPAC, and all have struggled in one way or another.

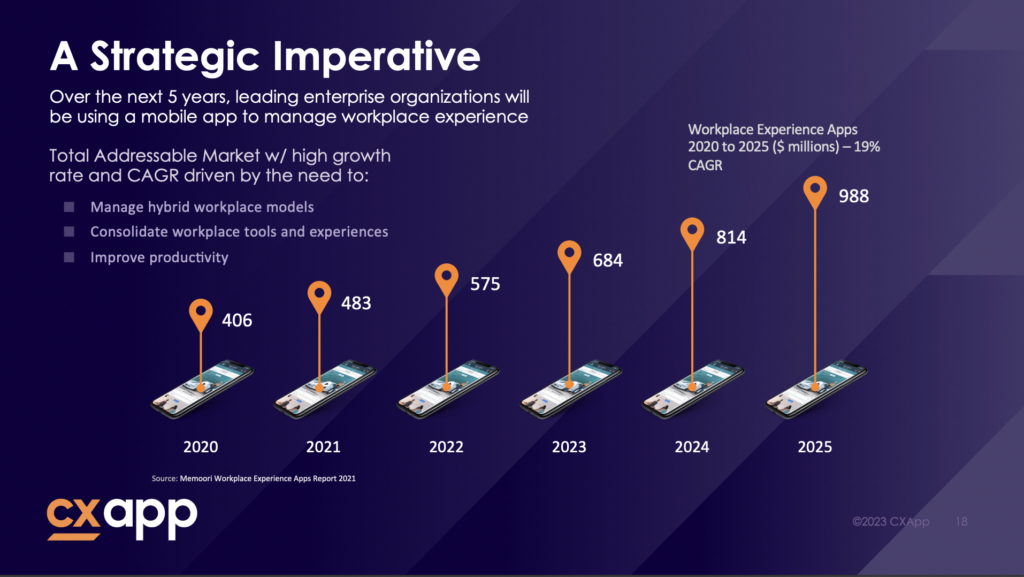

CXApp is also different, and playing into a strong trend in the rapidly evolving workplace market. Our market study estimates the global digital workplace market at $3.70 Billion in 2021, rising to $9.21 Billion by 2026, growing at a rate of 20% CAGR. The research showed the number of companies in the digital workplace sector grew 30%, having seen considerable activity as a result of COVID-19, “companies need new ways to deliver an environment in the post-pandemic era that the modern workforce demands,” the report reads.

Those holding on to hope that, despite slow starts, SPACs can offer long-term growth for investors will be clutching for examples of success as the trend matures. While CXApp and its unique factors could be the SPAC that bucks the trend, we can only assume those pursuing SPAC deals in 2023 have found their confidence with awareness of the highly-publicized risk. Until regulations prevent it, SPACs will continue to offer an alternative route to IPO, either new SPACs learn from those struggling to find a winning method or investors will eventually realize that SPACs are bad business.