This article was written by Daphne Tomlinson of Tomlinson Business Research.

Partnerships and investments can play an increasingly important role in implementing strategic goals, particularly in providing access to the range of innovative technologies being developed for the smart buildings marketplace.

While acquisitions are also being regularly undertaken by the building technology players as an alternative vehicle for strategic growth, partnerships are cooperative, negotiated, less risky and not so competitive. They are an attractive option for mainstream suppliers for diverse reasons including:

- To offer a more integrated solution for commercial and industrial building owners and operators

- To capitalize on collaborating with IT players

- To benefit from the innovative software or hardware offered by a technology startup

- To augment a solution for a specific vertical market or region

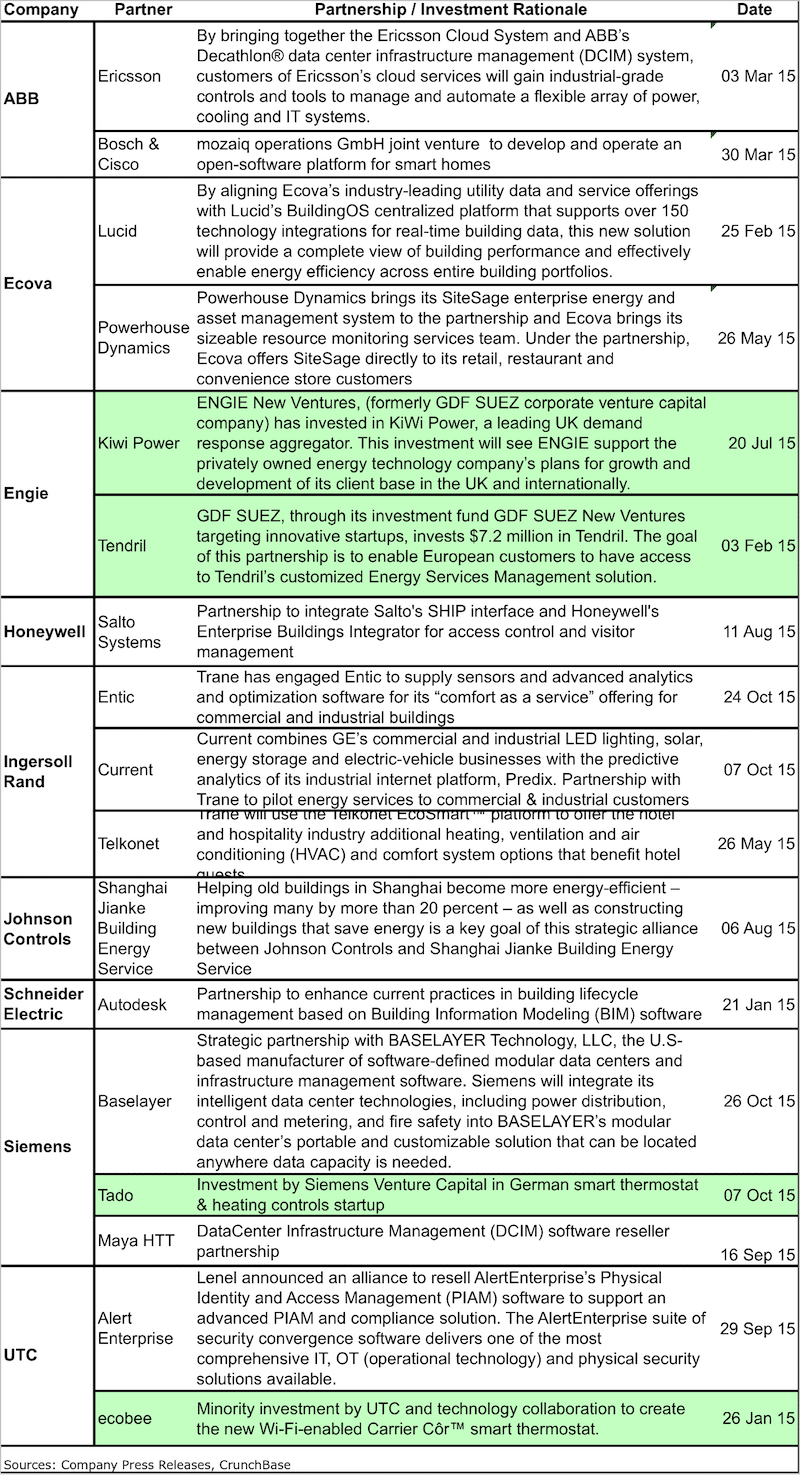

Recent alliances by the leading suppliers of building automation systems, HVAC equipment and energy services for commercial buildings and homes were analyzed. The table includes those partnerships identified during 2015 to date by:

- The top four global building management system vendors, Honeywell, Siemens, Johnson Controls and Schneider Electric

- Second-tier players in the building automation sector : ABB, Ingersoll Rand and United Technologies Corporation (UTC)

- The leading energy services player in Europe: Engie, formerly GDF-Suez, parent company of Cofely and Ecova

While partnerships are commonplace as companies set up distribution channels, system integrator or ecosystem networks, the following table summarizes only those which are described as strategic or where funding was provided. It should also be borne in mind that not all such partnerships are announced in the public domain. It is therefore not a comprehensive listing. Strategic investments are highlighted in green.

Several trends can be seen:

- Many of the technology partnerships and investments are with small startup companies.

- Building energy management solutions are predominant. The desire to increase capability in integrated solutions for buildings across all disciplines is also evident.

- Alliances are sometimes accompanied by strategic investments in the partner: Schneider Electric has created joint ventures directly, eg. with Lucibel to offer smart high-end LED lighting and sensors/controllers to retail industry clients as a managed service. The company has also been active in recent years through Aster Capital, a joint funding company backed by Alstom, Solvay and Schneider Electric. Siemens and Engie also have their own in-house venture capital funding units.

- Partnerships are being undertaken in order to enhance capabilities in specific vertical markets, e.g. Siemens partnerships in data centre solutions. Ecova alliances for the multisite retail, restaurant and convenience store sector

- Honeywell and Johnson Controls have announced fewer partnerships than their major competitors in recent years; Honeywell has regarded acquisitions as its primary vehicle for growth and entry into adjacent markets while Johnson Controls has been concentrating this year on portfolio divestments and completing a 60% stake in its joint venture with Hitachi Appliances.

It is clear that closer collaboration will continue as mainstream suppliers defend their market position and emerging startups and IT vendors try to gain a foothold in the smart buildings arena.