In this Research Note, we examine Synectics plc, the listed UK provider of large-scale electronic security systems for critical and regulated environments. This article is based on their 2022 Annual Results, Investor presentation, 2022 Annual Report and press releases throughout the year.

Based in Sheffield, UK, the company’s expertise is in providing solutions for specific markets where security and surveillance are critical to operations. These include Gaming, Oil & Gas, Public Space, Transport, and Critical Infrastructure. During 2022, the company continued to progress the development of its fourth-generation Synergy platform and COEX camera station range.

Total revenue for the year increased by 6.8% from £36.6 million to £39.1 million resulting in underlying operating profit of £1.2 million compared to a loss of £0.5 million in 2021.

In November 2022, Synectics completed the sale of the non-core SSS business, which provides monitoring and managed services, principally to multi-site retailers in the UK. The disposal to Parfas Limited generated a net non-underlying profit before tax of £776,000. The company operates via two divisions, providing specialist electronic surveillance systems and integration capabilities.

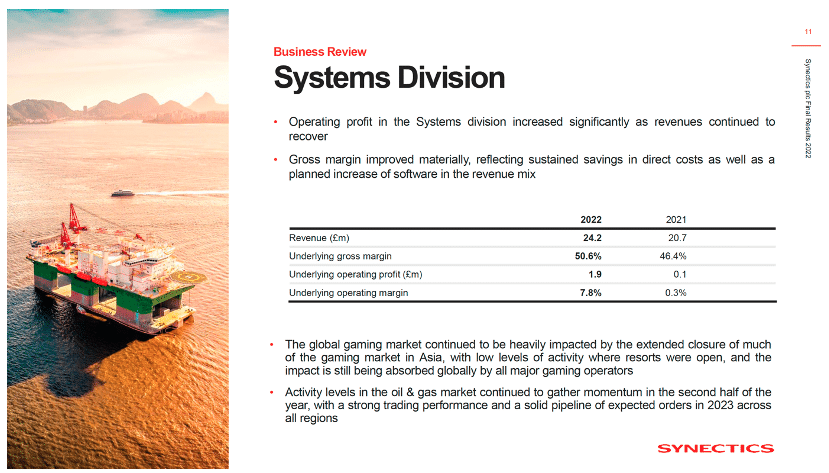

Synectics Systems Division

Synectics Systems division provides specialist electronic surveillance systems, based on its own proprietary technology, to global end customers with large-scale highly complex security requirements, particularly for gaming, transport, critical infrastructure, public space, and oil & gas applications.

Operating profit increased significantly in the year as revenues continued to recover. The gross margin also improved materially, reflecting sustained savings in direct costs as well as a planned increase of software in the revenue mix. The progressive increase of software as a proportion of the division’s revenue means that gross margin should remain strong going forward.

The global gaming market continued to be heavily impacted by the extended closure of much of the gaming market in Asia, with low levels of activity where resorts were open, and the impact is still being absorbed globally by all of the major gaming operators.

Activity levels in the oil & gas market continued to gather momentum in the second half of the year, with a strong trading performance and a solid pipeline of expected orders in 2023 across all regions.

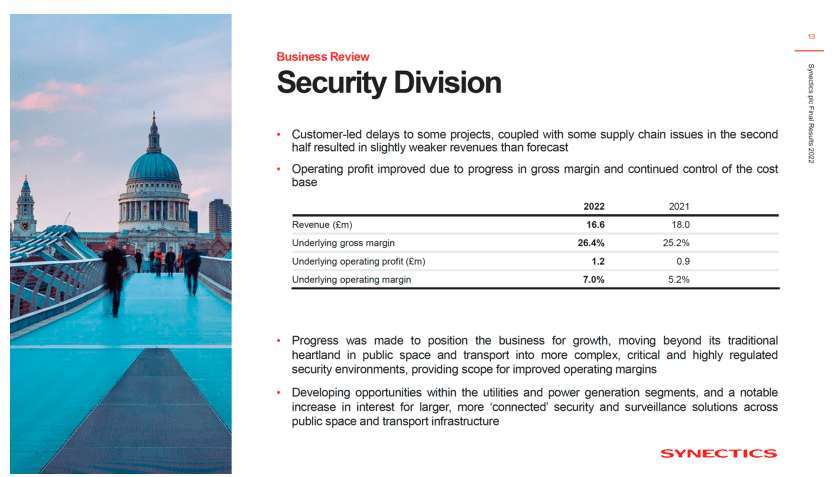

Synectics Security Division

Synectics Security is a UK-focused provider of large-scale electronic security systems for critical and regulated environments. Its main markets are in public space, transport, high security, and infrastructure projects.

Its capabilities include UK Government security-cleared personnel and facilities, with nationwide project delivery, service and support.

Synectics Security delivers products and technology both from Synectics’ Systems division, and other partners.

The division experienced several customer-led delays to major projects during the year which, coupled with some supply chain issues in the second half resulted in slightly weaker revenues, although operating profit was improved due to progress in gross margin and continued control of the cost base.

Nevertheless, significant progress was made to position the division for growth, moving beyond its traditional heartland in public space and transport into more complex, critical and highly regulated security environments, providing scope for improved operating margins.

The division has entered 2023 with developing opportunities within the utilities, power generation and nuclear segments and a notable increase in interest for larger, more ‘connected’ security and surveillance solutions across public space and transport infrastructure.

These broad scale, integrated security and surveillance solutions provide opportunities for sales growth, in co-operation with the Group’s Systems division and other technology partners.

Synectics business model, based on targeting a limited number of vertical markets where security and surveillance needs are acute and where customers value sector-specific capability, differentiates the company from other mainstream suppliers.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.