Our new report takes an in-depth look at the market for IoT technologies in commercial buildings (BIoT), at a time when the ‘digital divide’ in real estate has never been so distinct. The global pandemic demonstrated the value of technology to deliver more resilient and efficient business operations. For example, the digital ‘have nots’ faced situations where building occupancy dropped to near zero, yet energy use only fell by 10-15%! Whereas the digital ‘haves’ could remotely access building systems and monitor and configure performance.

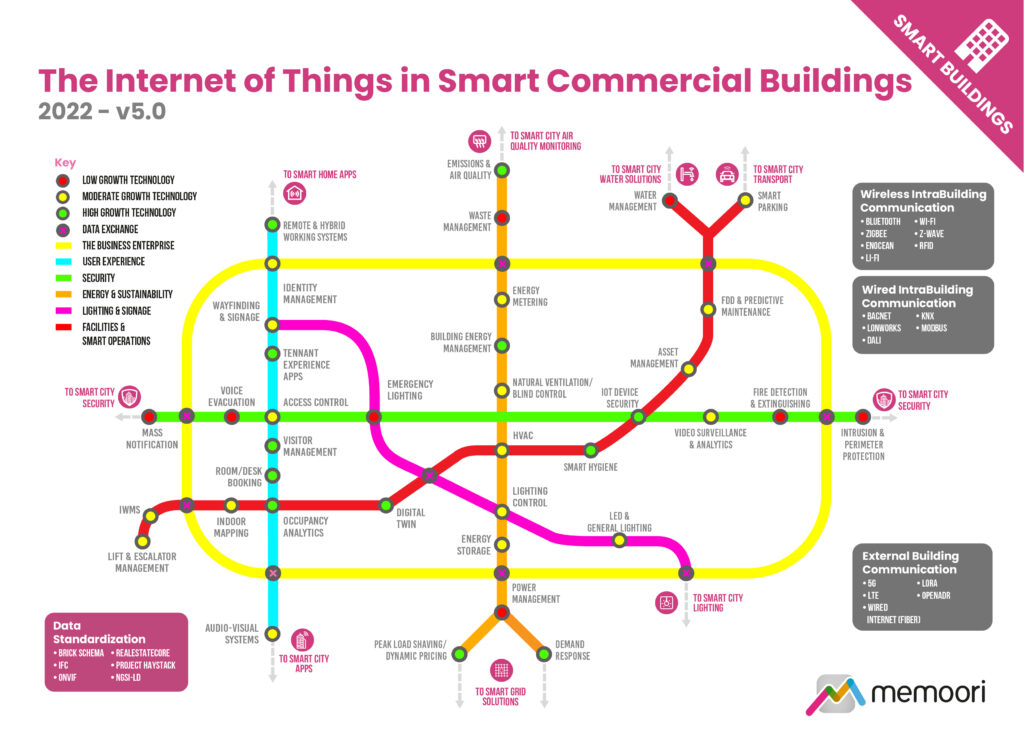

Our report also looks at the increasing industry push towards improving the value of data generated by buildings through better systems interoperability. A layered horizontal systems architecture is increasingly being advocated for, which is technology agnostic, uses open standards, open protocols, and non-proprietary solutions.

BIoT Market recovery through 2021 was healthy, growing 21% to rise above the 2019 market total, at just over $47 billion. We forecast that the market will continue to grow at a healthy 12% CAGR, rising to $92.88 billion by 2027.

The number of connected IoT devices installed in commercial smart buildings will also grow at over 11% CAGR for the forecast period, rising from an estimated 1.26 billion in 2021 to over 2.5 billion by 2027.

We are now seeing a greater degree of collaboration between the IT and OT worlds. A growing number of vendors are coalescing around cloud solutions provided by major IT companies such as Amazon and Microsoft. This should facilitate the development of “platform ecosystems”, where data exchange, innovation and supply chain partnering are simplified by common software tools.

The competitive landscape for BIoT remains incredibly complex and varied. The level of fragmentation we continue to observe in the market can act as a source of confusion and frustration for buyers, with many vendors of point solutions and platforms vying for attention.

Leading platform solution providers are beginning to emerge, however, and the user base seems likely to form around a more limited number of platform providers, with those unable to maintain a sustainable user base being forced to merge or withdraw from the market.

Now in its 5th Edition and with 279 pages and 47 charts, this brand new 2022 report provides valuable information to companies so they can improve their strategic planning exercises and look at the potential for developing their business by understanding exactly how the IoT is impacting commercial real estate.

New for 2022, the report now includes at no extra cost, a spreadsheet containing the data from the report and a graphics pack with high-resolution charts.

For more information, visit; https://memoori.com/portfolio/the-internet-of-things-in-smart-commercial-buildings-2022-to-2027/