In this Research Note, we examine the 2023 business and financials of Trane Technologies, based on their full-year results announced on 1st February 2024, their 2023 10K Report and other announcements.

Acquisitions, strategic investments and partnerships in the last 12 months are also highlighted.

Since becoming a public company in 2020, Trane Technologies has positioned itself as a pure-play climate innovator, with an increased focus on energy efficiency, sustainability and decarbonization of buildings.

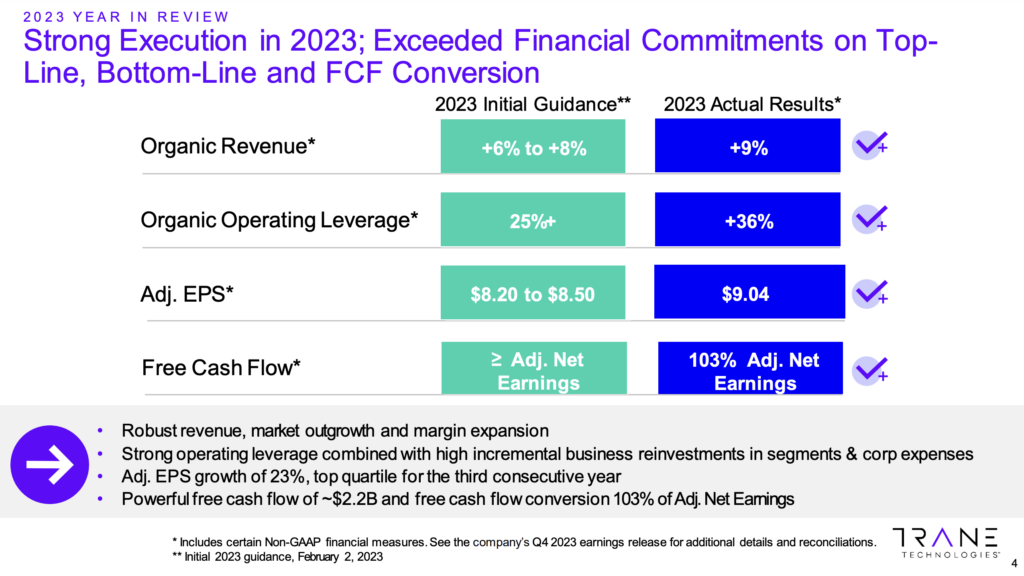

2023 Trane Financial Highlights

- Trane Technologies reported revenues of $17.7 billion, up 11%; organic revenues up 9%.

- GAAP operating margin up 130 bps; adjusted operating margin up 140 bps.

- Adjusted EBITDA margin of 18% up 120 bps.

- A strong backlog of $6.9 billion is dominated by commercial HVAC projects.

- Trane Technologies plans to invest $2.5 billion in capital in 2024, with a focus on innovation and market expansion.

- The company aims to deliver top-quartile financial performance through its sustainability-focused strategy.

Acquisitions

In a move which emulates that of the company's building controls peers, Trane acquired Nuvolo, a US provider of integrated workplace management systems (IWMS). See our previous coverage in October 2023.

The purchase price for Nuvolo was $442.9 million. In its Q4 2023 investor call, Trane Technologies reported that they expected a negative impact of $30 million to operating income for the full year, primarily related to their technology acquisition of Nuvolo. They expect this acquisition to be EPS accretive by year three.

Two further acquisitions were completed in 2023. MTA Spa, an Italian chiller manufacturer was acquired for $224.4 million. The company has nearly 500 employees and turnover is around €90 million. Their range of industrial refrigeration and air conditioning equipment and services business is intended to strengthen Trane’s Commercial HVAC capabilities in key markets.

Helmer Scientific, a U.S. precision cooling equipment manufacturer was acquired in May 2023 for $266.4 million. The acquisition broadens Trane Technologies' capabilities in precision temperature control and its existing portfolio of life science solutions under the FARRAR™ brand.

Strategic Investments and Partnerships

In a move to invest in innovative technology for its data center customers, Trane Technologies backed LiquidStack’s Series B funding in March 2023. Founded in 2012, the Boston, MI-based startup is scaling liquid immersion cooling as a data center sustainability standard.

The investment will help further support the adoption of LiquidStack’s solutions and significantly reduce data center carbon footprint, water consumption, e-waste and environmental impact. Trane and LiquidStack customers will have access to broader end-to-end solutions and services, including immersion cooling coupled with Trane’s chillers, fluid coolers and heat recovery systems.

Trane Technologies has also accelerated its efforts to transform itself into a software company with a strategic partnership with Brainbox AI announced in September 2023.

Trane Autonomous Control powered by Brainbox AI enhances existing connected Tracer® SC+ building control systems– incorporating variables like predictive weather data and occupancy trends for improved building performance and sustainability.

With software becoming a significant differentiator in the building and workplace management sector, Trane has followed the path of its major competitors who have been actively augmenting their hardware business with software acquisitions and investments.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.