Investment is the bedrock of startups and ambitious corporations alike. Investment is not evenly spread, however, and the firms that receive a larger share of the investment pie do so because they have sold a good idea and their ability to develop that idea. Because of greater investment, those firms are also more likely to develop their ideas, disrupt their market, and play a part in shaping our society. Where investors put their money makes a real impact on the future, but who are these organizations gambling on what they think the future will be?

In the Smart Building industry, investment is rampant. A maturing consumer market and significant M&A activity are fueling confidence in the investment community. Given this backing, a multitude of startups are pursuing ambitious strategies to emulate the growing number of success stories in the wider technology space.

“2018 has proved to be a record year for investment in the global smart buildings sector, with over $2.4 billion invested in startups, showing increased confidence by investors in the sector and indicating the positive response companies are receiving for their products and services in the market,” states our latest report StartUps and their Impact on Smart Buildings 2019.

The importance of investors in the development of technologies and applications for smart buildings is undeniable. Leading players in the built environment account for 6 of the top 12 investor companies in the smart buildings space and have been launching new venture funds which confirm the increased impetus to interact with startups at an early stage, in order to explore disruptive technologies and new business models.

That’s according to our report, whose analysis of investments made in smart building startups since 2012 by venture capital companies, private equity firms, and corporate investors, has brought up some fascinating results.

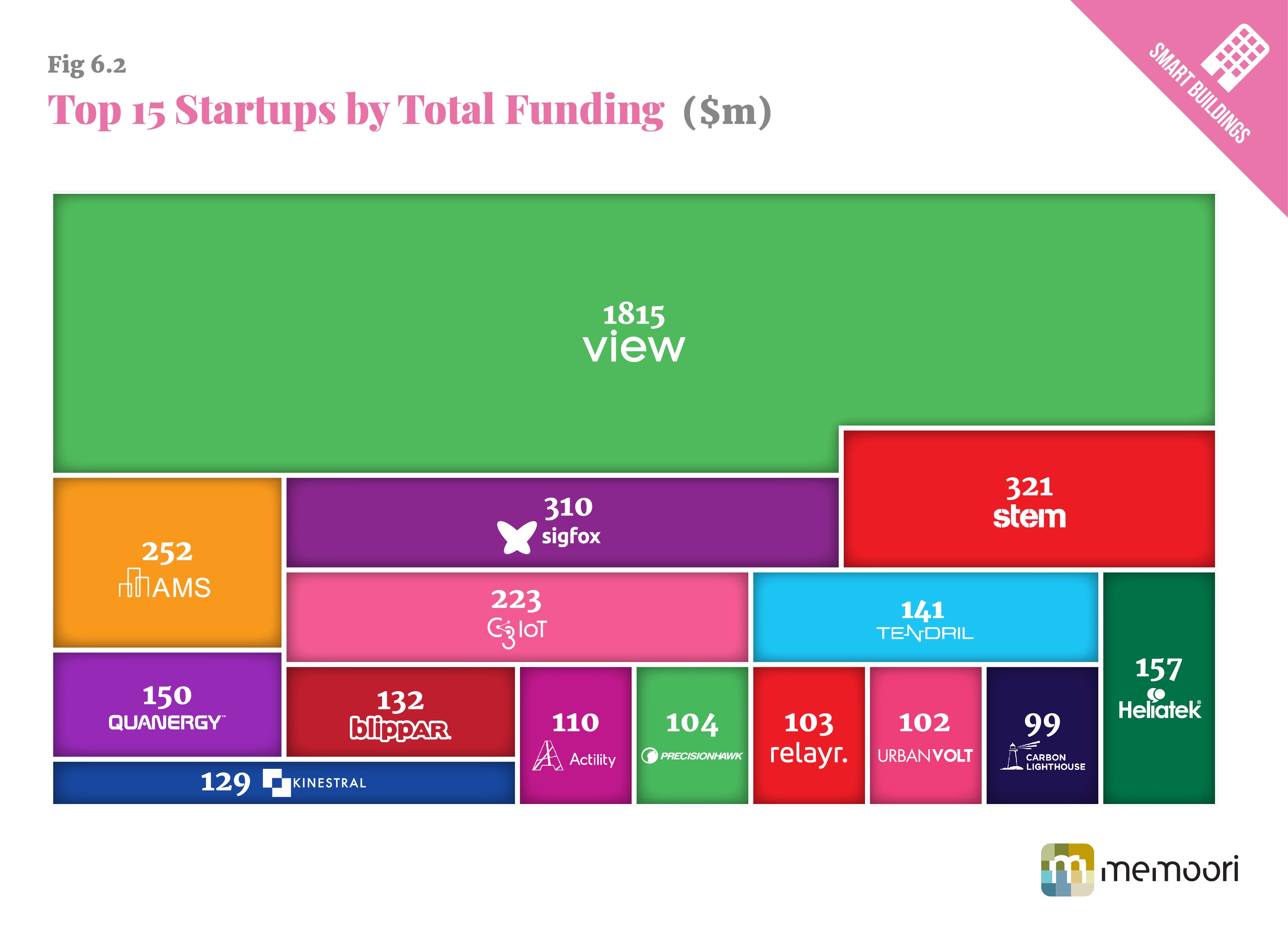

Smart glass startup, View, represents the lion’s share of total funding in the smart building startup space, the fact that more than half the investment is directed by one enigmatic man is intriguing. Masayoshi Son, Chairman & CEO of SoftBank Group Corp., is known for big and bold investments that often work out well. His $20 million dollar investment made into a young marketplace platform called Alibaba is now worth $140bn, for example, and it is still a bit early to judge his undoubtedly bold $4.4bn investment in office-space-rental company WeWork in 2017.

Son’s $1.1bn investment in View in November 2018 means the startup has raised around $1.8bn. However, even discounting the View investment, 2018 saw record funding of over $1.3 billion in the commercial and industrial buildings space continuing an upward trend. The capital invested in the global smart buildings sector has actually increased more than 6 times since 2012 with the sector attracting around $6.8 billion during this period.

Stem, Sigfox, and AMS, lead the chasing pack in the startup funding race, each raising over $250 million. Through its analysis of investment data, our report identifies 3 key characteristics that startups with the greatest levels of funding all possess. A recipe for success that will attract the attention of the most prolific investors, and in the smart building industry investment is undoubtedly dominated by corporations, hungry for the innovative power that young companies offer.

“The importance of corporate investors in the development of technologies and applications for smart buildings is evident over the years we have been tracking venture capital funding in this sector. They have filled the gap caused by venture capital firms withdrawing from clean technology investments,” explains our report. “50% of the leading venture capital backers in the smart buildings space over the last ten years are corporate investors.”

GE Ventures tops the list for the sheer number of investments. Its funding recipients including well-known names such as; IoTium, Foghorn, AMS, Stem, and Sensity systems among others. Next47 / Siemens Venture Capital, Navitas Capital, Intel Capital, and Aster Capital / Schneider Electric, make-up the top 5 groups by number of investments, each with funding recipients in double figures. There is also a strong investment presence from corporations from the built environment space. Honeywell, Schneider Electric, Siemens, and JLL Spark accounting for over $1.5bn over the last three years.

Insurance firms and utility companies, in addition to accelerators and incubators, also play a significant role in the smart building investment landscape, demonstrated by the data gathered by Memoori during the last 7 years. During that period, we tracked a total of 824 venture funding investments relating to startup companies in the smart buildings space, ranging from seed and angel investments to debt financing and Series A to Series E announcements. Looking forward, the latest edition of our Startups report predicts this strong investment trend to continue in the years to come.

“While startups continue to generate value for corporate organizations, investments in the startup ecosystem, whether through venture capital, partnerships or corporate accelerator programs are not likely to diminish in the foreseeable future,” our insightful new report predicts.