Human-Centric Lighting (HCL) is a rapidly emerging technology in the lighting space. Our latest report estimates the global HCL market to be worth $849 million in 2019, growing to $3.5 billion in 2024. North America and Europe are generally comparable when investigating the development of general lighting and wider building system related analyses. However, the situation is different with HCL due to a number of factors outlined in the report.

European companies have stolen a march on the rest of the world with an estimated 46% of global HCL revenue, our report found, North America lags behind with $238.3 million in HCL revenue or 28% of the global market. As discussed in our recent article, Europe’s weather, latitude, and older building stock offers some explanation for European HCL dominance, but North America’s must also reflect on some issues affecting its own HCL market development too.

Like Europe, the US is home to many older, established lighting firms such as GE or Eaton and many innovative startups that have made North America a strong lighting market. In fact, the US is seen to have a much more startup-friendly business environment than Europe and other parts of the world. Another 2019 Memoori study found that 56% of new smart building market entrants were based in North America. EMEA accounted for 37% of startups and Asia & Australasia around 7%. Yet HCL development still lags behind Europe.

“North America, namely the US, has the lighting pedigree and business environment to rival Europe in HCL. The latent potential in the region is growing, but the sector is being held back by delays and uncertainty on political and regulatory levels,” explains the report: The Human Centric Lighting Market 2019 to 2024.

“Inflexible regulation and slow approval processes have created a barrier for HCL firms in the US. Amid criticism of not keeping up with the development in the lighting sector, US authorities are under increasing pressure to facilitate the market development of new technologies like HCL better,” our comprehensive new report continued.

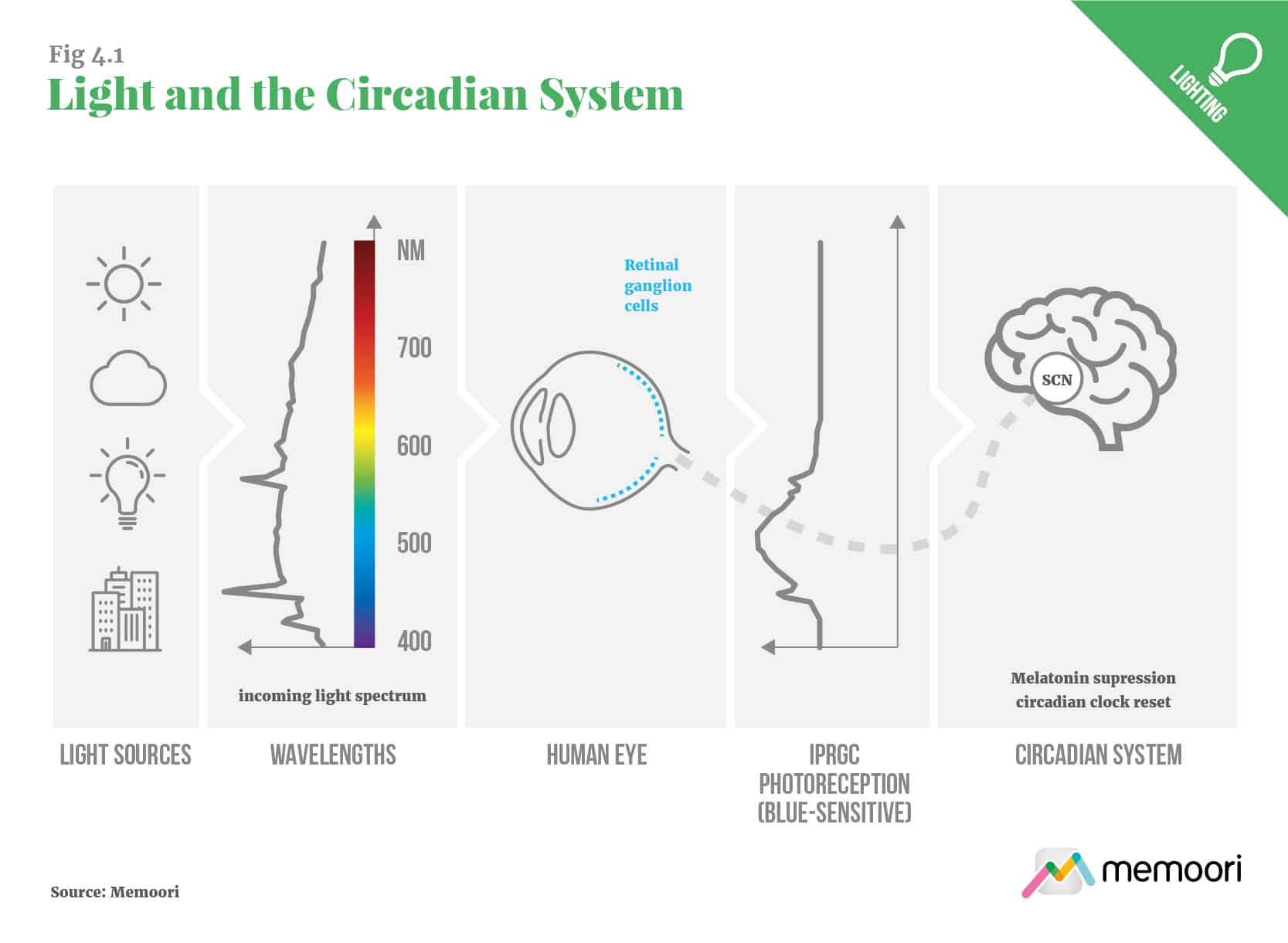

Perhaps the most obvious examples of this slow regulatory development are energy codes like ASHRAE or California’s Title 24 in the US. Those codes do not allow enough wattage for sufficient light to affect the non-visual (or biologic) portion of the visual system - which is part of what HCL is designed to do. A significant barrier that companies operating in the European market would not contend with.

“In California, even if lights are brighter for only a short time in the morning to help suppress melatonin production, all of the extra wattage is included in the lighting power density calculation - although that wattage is not used during typical afternoon peak demand,” says Stan Walerczyk, principal of Lighting Wizards and chair of the Human Centric Lighting Society. “What is the sense of saving every watt if worker productivity, student learning, and general wellbeing are decreased?” he asks.

The issues for US HCL development do not stop there either. The Design Lights Consortium (DLC), for the approval of lighting products and solutions in the US, does not currently approve interior LED lighting (except for interior high bays) at CCTs above 5000K, even in the case of tunable lighting products only being used below 5000K. While the Illuminating Engineering Society (IES), a cornerstone of lighting industry success in the US, is stuck in the past according to many in the industry.

“Although the IES is an excellent organization and has done a lot of good work, it can be considered to move quite slowly regarding HCL. I am amazed how many North American lighting professionals still cling to the notion that the incandescent bulb is the holy grail of CCT and CRI, and that the Kruithof Effect is valid,” says Walerczyk. “The lack of IES relevance in Europe may be another reason that region is more advanced regarding HCL,” he adds.

Our report also goes into detail on the US-China trade wars, which are raising LED and lighting control component costs, as well as a raft of presidentially-driven budget cuts that are filtering through the system to the determent of HCL and, undoubtedly, a number of other progressive technological solutions. Cuts at the US Department of Energy (DOE), for example, led to the elimination of ‘Lighting Facts’ a fundamental building block of the US SSL transition, which in turn forces the DLC to take on the new role as gatekeeper for many utility rebates.

“North American HCL expectations have primarily been based on general LED industry growth in comparison to other industries, but the introduction of LEDs was well supported by DOE and other key lighting organizations,” explains the brand new report. “The cancellation of the Lighting Facts program and the subsequent environment of temporary uncertainty has also played its part in what many see and an ‘underperforming’ North American HCL market.”