The announcement last month that Canon will buy Axis Communications has created much comment about the significance of the deal and how it may change the competitive landscape; setting off a new wave of consolidation in the Security industry.

To establish the importance of this deal you need to go back over at least the last 5 years and look at the trends that have taken place in acquisitions and mergers in the business. Memoori’s report focused on this business is a good starting point.

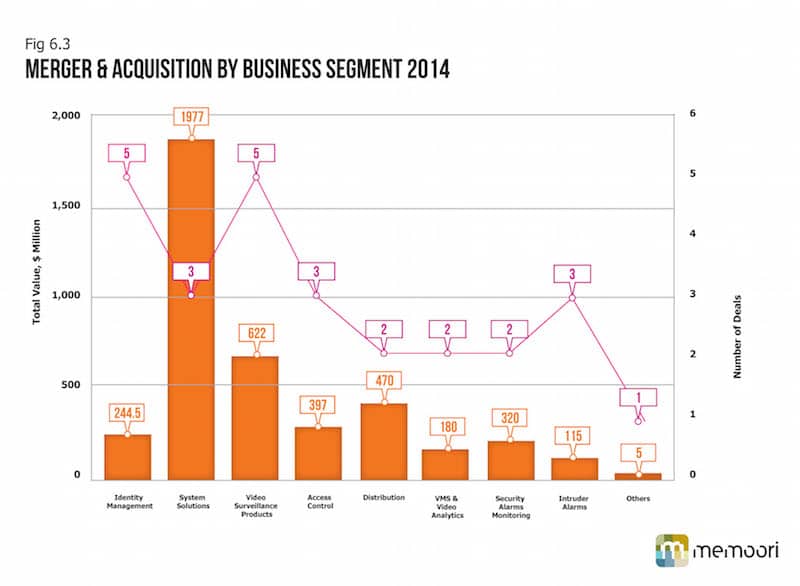

In 2014 the value of deals declined by 14% following a three year trend from its peak in 2011. This was a moderate year for activity. We identified 26 deals compared with 34 in 2013, and 82 in 2011. Whilst the number of deals and total value of acquisitions has fallen the average value of a deal has increased from $120m in 2011 to $166 million in 2014.

This arguably shows that the rate of consolidation declined but suggests that with time the impact on changing the competitive environment increased.

So why has the love for growth through acquisition cooled off in the last 3 years?

There are 2 main reasons for this. The first is the lack of confidence and/or interest by the major conglomerates to commit more investment to the industry. The second reason is that there has been a lack of buyers from outside the business, particularly Defense and IT.

The good news is that acquisition activity in the middle market, mainly populated by specialist focused security companies has significantly increased in the last 2 years.

Bringing about Structural Change

The reason that this is good is that it is changing the structure of the market and creating a much stronger based product business spread over a wider number of companies that are prepared to spend on developing new products. Despite the volatility in the M&A market over the last 15 years the trend shows a very significant CAGR of 5.5% over this period, whilst at the same time world sales of physical security products have grown at a CAGR of 5%. If we focus down further to the Video Surveillance market then it secured some 20% of the Physical Security business showing no change on 2013.

Forecasting M& A over the next five years

The first 2 months of this year shows a significant increase in acquisition activity on the same period for the last 2 years. We forecast that in 2015 the value of deals will increase by approximately 15% and that over the next 5 years to 2018 by a CAGR of 10%. This assumes that the European debt crisis will find a longterm solution and at least stabilize the European Union economy, whist the US will grow at around 2% and emerging markets will maintain their 2014 performance.

We expect that trading conditions across the world will marginally improve in 2015 and the availability of finance should not restrict acquisition activity. There is no sign yet that the major conglomerates are interested in extending their products business. On the contrary Siemens have just sold off their security products business and this trend may well extend to the other majors. This will provide a great opportunity for the specialist manufacturers to increase their share of the market.

Conclusions & Implications

At the end of last year we forecast a 15% increase in the volume of acquisition deals in 2015 based on the fact that 2014 looked to be its nadir and all other factors pointed to a recovery.

The Axis deal at $2.8Bn will go some way to help ensure this prediction is realized and there is good reason to believe that the competition will be looking hard to establish if growth through strategic acquisition should not be put back on the agenda.

The IoT will have a major impact on the Physical Security Industry probably more for the System Integrators than Manufacturers and we believe its inevitable that it will drive alliance and acquisition to new heights over the next 10 years.