2021 was the "Year of the #SmartBuilding SPAC" when 9 companies completed a business combination. So what does that make 2022?

We have analysed 17 companies, that fit our definition of a PropTech business, to determine what their financial performance looked like in 2022 and what we might expect to happen in 2023 and beyond.

Our analysis consists of 11 companies that completed their SPAC business combination in the last 2 years (including one that has now filed for protection under chapter 11 in the US), 3 companies that failed to complete their business combination in 2022 and a further 3 that have one planned for 2023.

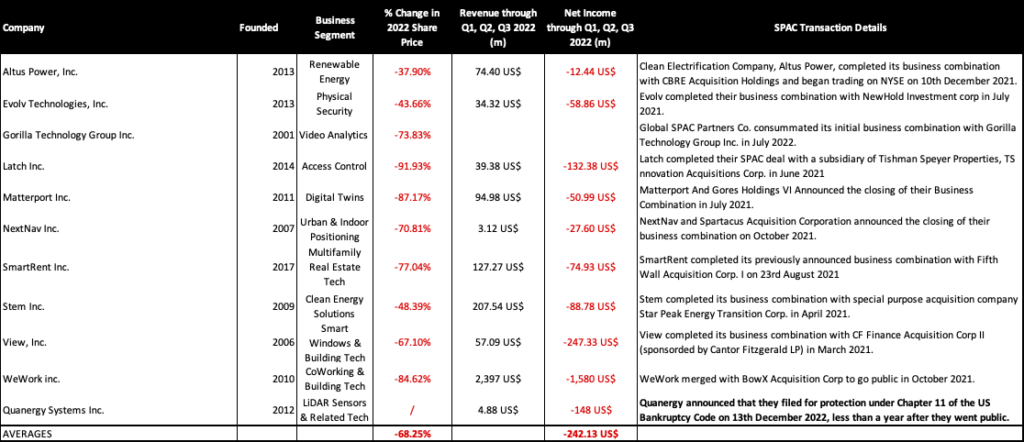

The table below compares 3 financial metrics across these 11 public companies. The percentage change in their share price since the beginning of 2022, revenue through the first 3 quarters of 2022 and net profit in the same period. For fairness, we discluded Quanergy from the share price metric, since they recently declared bankruptcy and we discluded Gorilla Technologies from the net profit metric, as they only started publicly trading in July 2022.

There were also 3 proposed SPACs in 2022 that did not complete their business combination. Access Control as a Service company, Brivo was due to merge with Crown PropTech Acquisitions in 2022, but the agreement was terminated in August. Tado, a German smart thermostat provider terminated their deal in October. And also in August, Voltus, a distributed energy resources company, had its SPACs merger with Broadside Acquisition cancelled.

Based on our analysis we have identified 3 key learnings from SPACs in 2022 and beyond.

1. Average Decrease of 68% in SPACs Share Price During 2022

Our analysis showed that the share price of these companies declined by an average of over 68% in 2022 (as of 19th December 2022). To put this in context, it has been a historically bad year for tech stocks in general. The Nasdaq is down 33% YTD, Microsoft is down over 27% YTD and Alphabet is down nearly 39% YTD. The Dow Jones Industrial Average is down 10% YTD.

But even in this extremely tough time for tech stocks, there are those in our cohort who really stand out. Latch has seen its share price drop over 90% YTD and has had a torrid time over the year with multiple rounds of staff layoffs. With their stock trading at around $0.66, there is open speculation that their liquidation value would be more.

Despite reporting strong revenue in Q3, Matterport stock is now trading down 87% YTD. One of the issues is that operating expenses have increased significantly and they are burning through cash. More on this...

2. SPACs are Buring Through Cash

Among some of the worst performers in our cohort, WeWork stock is currently trading around 84% down YTD. When measured by revenue, they are by far the biggest company in our analysis, but one thing they have in common with others is that they are burning through cash like a drunk sailor.

Talk of a looming global recession, inflation and particularly, higher interest rates, are all making life difficult for our Smart Building SPACs cohort. Loss-making companies will find debt harder to come by and more expensive.

In the specific case of WeWork, they have historically managed to cover their losses by going to their biggest backer, Softbank. But the company has said they expect to end 2022 with $300m in cash, less than 1/3 of what they had at the end of 2021.

Average losses for the 1st 3 quarters of 2022 for the companies in our analysis were $93m if we are fair and exclude those of WeWork. These companies, like the rest of the tech industry, are not immune to the likely worsening macroeconomic conditions coming in 2023. Investors will likely want to see steps taken, like cost-cutting exercises, to reduce losses.

3. More to come in 2023!

Our analysis identified 3 companies planning SPACs in 2023. Workplace Experience platform CXapp is planning a business combination with KINS Technology Group Inc, but this has recently been pushed back to June 2023. EnOcean has an agreement with Parabellum Acquisition Corp. for a business combination in the 1st half of 2023. And Learnd has entered into a definitive business combination agreement with GFJ ESG Acquisition I SE.

We expect 2023 to look not dissimilar to 2022, some agreements will be completed, and business will be tough as debt to fund losses will continue to be hard to find.

For now, at least, SPACs business combinations remain an alluring prospect for companies in the smart building and proptech space.