Underlining the growing importance of the workplace within building automation, smart buildings giant Johnson Controls acquired workplace management technology firm FM:Systems last week for an initial price of $455 million.

This adds to a growing trend by major players in the building automation market who are seeking to increase the level of integration between integrated workplace management systems (IWMS), workplace experience software, and building operations and maintenance systems, in line with our latest research on the sector.

Schneider Electric has so far opted for strategic partnerships and investments to develop its workplace experience capabilities. In December 2020, Schneider Electric made a 113 million euro strategic investment through a 25% minority stake in Planon Beheer BV., an integrated workplace management systems provider. The combined aim of the partners was to digitize the operations and maintenance activities in the building lifecycle through the integration of both Schneider’s EcoStruxure platform and Planon’s enterprise-scale solutions.

“While not an acquisition, for completeness we also highlight that Schneider Electric forged a strategic partnership with Modo Labs in 2022. Schneider Electric not only uses the low-code Modo platform for its own app development, the company also offers its own Modo-powered workplace app, EcoStruxure Engage, to Schneider Electric clients to help keep building occupants productive and engaged,” our new research explains. “The app integrates smart building data like density and air quality, to create a unified digital experience that not only provides health and safety information employees require, but also connects and engages them across global locations.”

In December 2020, Honeywell acquired Sine Group, an Australia-based provider of intelligent visitor and contractor registration software with more than 1,000 customers across commercial real estate, pharma, education, industrial, logistics, construction and other markets. Sine’s technologies has supported a cloud-based mobile platform for Honeywell Forge, Honeywell’s enterprise performance management offering, where Sine’s software augments Honeywell’s Connected Buildings offerings with expanded safety, security and compliance capabilities.

In April 2021, Siemens Infrastructure merged its two acquired subsidiaries, Comfy App and Enlighted, into one entity under the leadership of the current CEO of Enlighted, Stefan Schwab. The two subsidiaries have increasingly integrated their technologies by combining their respective data for enhanced analytics and more actionable intelligence that enables a progressive and flexible workplace environment for the emerging hybrid work era.

“Understanding employee behaviors, preferences and trends will be key to unlocking dynamic and positive work experiences. Every time an employee engages around their work environment through the Comfy app, data is captured through an opt-in process, revealing both intent and actions.”

“Additionally, the information captured around movement from Enlighted sensors provides an objective view of space utilization and movement,” explains Schwab. “Combined, they paint a powerful and useful picture of space usage that can be leveraged for space administration, design and portfolio planning.”

Last week’s $455 million acquisition of workplace management technology provider, FM:Systems, by building automation stalwart JCI is yet another example of the growing trend highlighted in our report. FM:Systems is an established vendor in the digital workplace solutions space, demonstrating double-digit revenue growth with strong operating margins in recent years that were no doubt attractive to JCI. However, like other major building automation players, JCI will be looking to integrate its new acquisition to enhance the workplace capabilities of its own smart buildings platform, OpenBlue.

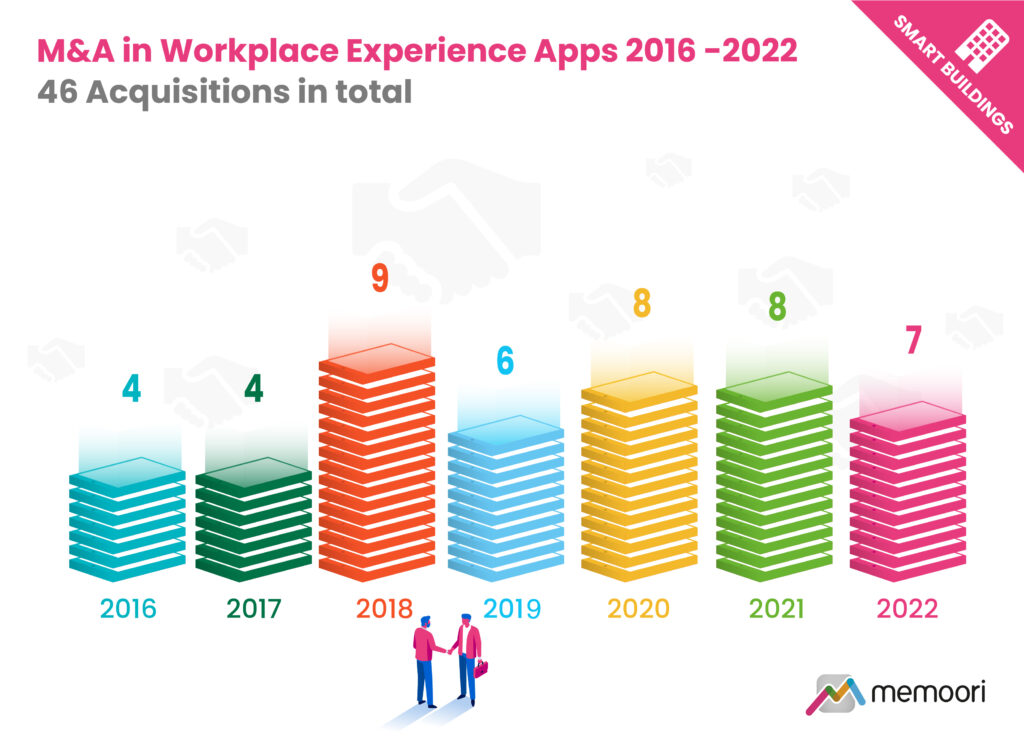

Johnson Controls have significantly expanded their OpenBlue suite of digital services and offerings with nine acquisitions and a range of partnerships in recent years, as shown in our 2-part series mapping their strategic direction. Eight years after divesting its own workplace division in a deal with CBRE, this month’s acquisition of FM:systems is now expected to strengthen the OpenBlue suite of software for commercial real estate, namely workplaces, and accelerate its net zero building automation solutions. The acquisition is another example of the rising trend outlined in our latest study, which is likely to continue alongside the marked growth of the workplace experience market.

Interested in Understand more about Building Automation Players Investments in Workplace Experience Software?

“The Global Workplace Experience Apps market in the commercial office space is estimated at $0.8 Billion in 2022, rising to $1.73 Billion by 2028, a CAGR of 13.8%. Workplace technology deals account for a significant proportion of transactions in the smart buildings space in 2021 and 2022, indicating a buoyant workplace market accelerated by the changing needs of landlords and tenants in a return to the office” states our new market report. “As the digital workplace takes shape in businesses worldwide with a revised set of working styles, whether it be remote working, hybrid working or flexible working, this change will necessitate an enhanced toolset which includes a mobile app.”